Artificial Intelligence aka AI is changing the Financial Industry; there is no doubt about it. While the verdict is still out on the impact AI is going to have on jobs, the technology has long found its way into financial services. While some expect that the rise of the robots could end almost half of the industry’s workforce around the world within the next two decades, others like the OECD expect this number to be rather around 10-12%. Only time will tell. But since AI is here and here to stay, it is vital to focus on how AI has already disrupted the financial services industry and what is yet to come. That is the case, of course, if you intend to stay (or enter) the industry, but be warned that others sectors are affected in similar ways.

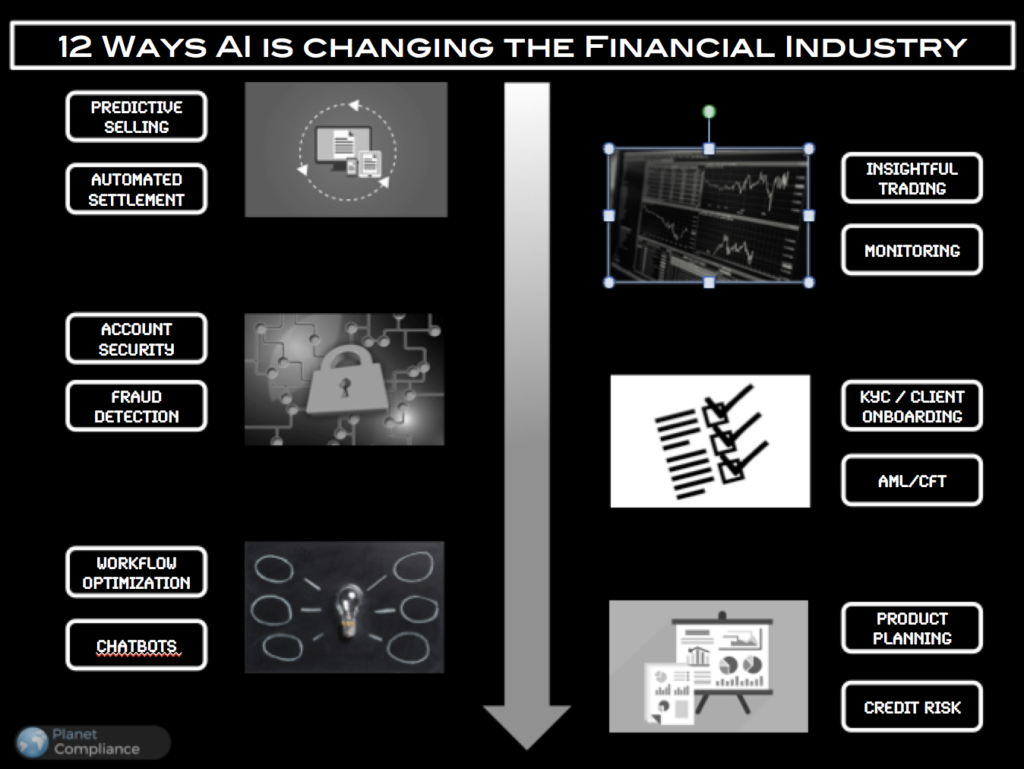

What are the 12 ways AI is changing the financial industry though? They run across all aspects of the sector, from the Front Office to the Middle Office to the Back Office functions. Current or potential future disruption through Artificial Intelligence comes in various forms.

AI in the Front Office

Let’s start at the client-facing side of things. The distribution of financial products is transformed through better insights and knowledge of customers and financial instruments alike. Firms can offer their clients services based on previous activity and customer backgrounds that before were often not feasible.

The machines learn about the clients of an institution, monitor financial and data input from different sources including social media and create a holistic service to cater to the specific needs of a client. The same holds true for the development of new products and services. Deep learning models allow computers to use all this information to propose investment if it makes sense for a sufficient group of customers.

While this is still in its infancy, the use of AI in the actual trading of financial instruments is already several steps ahead. Hedge Funds have been using big data and machine learning for many years to build predictive investment models, but only in the last decade or so, we have seen a real jump in investments across the banking industry. High Frequency Trading is already accountable for large percentages of trading in most asset classes. Algorithms not only execute buys and sells much faster than a human trader, profiting from small increments in the markets; computers also spot hidden signals and patterns that predict price changes in order to beat the market.

Equally important is the impact of AI to change and improve the customer experience at the Front Office level. ChatBots can do the job of humans at a fraction of the cost as well as reduce the waiting time for customers that do not have to spend hours in lines or on hold on their phones. Computers can also identify trends that can impact the lives of a bank’s customers (and the organisation itself). And lastly, AI is capable of spotting account activity that indicates fraud or unauthorised access providing clients with better security.

The use of AI as in any application of innovative technologies is not without risk though. If one trend has become apparent, it is that customer satisfaction has to be at the centre of FinTech innovation. Especially in the bank-client relationship the human element plays an important role that should be complemented by technical support to create the winning formula.

AI in the Middle Office

The Middle Office is probably an area that is currently undergoing the greatest wave of disruption. The future of compliance jobs in light of the digital disruption that is often summarised under the term RegTech (= Regulatory Technology) is a topic that is hotly debated. Fact is, however, that RegTech firms are transforming all aspects of the compliance function and AI plays a key role in their solutions. With the capability to go through massive amounts of data in the blink of an idea in combination with spotting the smallest of details that indicate foul play, it is an invaluable resource in the fight against money laundering and the financing of terrorism. It also empowers financial institutions to monitor the trading of its staff more efficiently and discover patterns of market abuse or rogue trading.

Client Onboarding or KYC (know-Your Customer) checks can also be conducted significantly faster and at lower costs. Thanks to machine learning, computers can go through the vast amount of client data that financial institutions already have collected, making sense of bits and bytes that otherwise result in data garbage.

AI in the Back Office

And now for the back office. AI-powered solutions help banks to better allocate credit risk as each decision can be made on better information about the client when used well. While the experience of human financial advisors can be a powerful tool when assessing the credit worthiness of clients, the combined use of dozens of data points creates a higher probability when determining whether a credit can be approved or not. It also enables to allocate capital more efficiently to cover for eventualities, a usually cost- and time-intensive process.

Talking about processes: the automation of processes and workflows is one of the main areas of transformation in all areas of a financial institution. In the back office the automation of settlement processes can save enormous amounts though. The combination of AI with another buzzword could be the key achieve this: Blockchain, or better the underlying smart contracts that administer the technology. AI improves the application of blockchain technology significantly: AI can increase the secure applications deployment and calculate a more efficient execution of blockchain transactions reducing costs and energy consumption. Just to name two aspects, but let’s not get carried away.

Even the improvement of workflows and processes on a smaller scale can reduce costs significantly though and render financial institutions that are notoriously slow to act more agile and prepare them for the future.