A word of warning about RegTech Investment analytics

Before we dive into a presentation and analysis of investment activity in the RegTech sector, we need to issue a word of warning or two: the numbers below are for reference purposes only and can never be absolutely accurate. On one hand, it would go beyond the scope of this article to identify every single deal in history. It would also be impossible as information in this field is notoriously limited: many RegTechs are private companies and not everyone speaks freely about the size of their fundraising activity. Another aspect is that comparative research is somewhat flawed as every single report issued in this area seems to have a different starting point. What we mean by this is that research in most cases is based on different data sets, different definitions of what constitutes a RegTech and, again, limited information.

With that in mind, the purpose of this exercise is to present you with our view of RegTech investments and parameters we have chosen, just like every other document of this kind. Just so you know… But now let’s go on a little tour of four years of RegTech investment research courtesy of Planet Compliance.

The Why

First, let’s summarise why RegTech is so popular: According to BBVA research, an estimate for financial institutions is now around 10-15% of total workforce dedicated to governance, risk management and compliance. Estimates from 2017 suggested that tier one banks are spending well in excess of $1 billion a year on compliance-related costs, or some $270 billion a year for the industry as a whole.

Data from Fenergo detailing the global fines activity of regional and in-country regulators over the past 10 years shows that $26 billion in fines has been imposed for non-compliance with Anti-Money Laundering (AML), Know Your Customer (KYC) and sanctions regulations. And that is just part of the story: A research report published in 2017 claimed that regulators in the United States and Europe have imposed $342 billion of fines on banks since 2009 for misconduct and that this number is likely to top $400 billion by 2020.

One research report predicts that the global RegTech market will grow from $4.3 billion in 2018 to $12.3 billion by 2023, while another report predicted that the spending on RegTech would reach $76bn by 2022.

With these numbers in mind, it is clear why venture capitalists have increased their investments in RegTech firms that promise to solve billion dollar issues.

Early numbers and Future Predictions

That hasn’t always been the case though and investment activity has picked up only recently. While several smart investors have been the proverbial early bird that catches the worm, the move into mainstream investment has been slow.

Early days

When we first published the PlanetCompliance RegTech Directory in 2016, we examined 167 RegTechs in detail and analysed the data. Though early days for the new RegTech, it produced some interesting results. In terms of numbers, these firm shad until the end of 2016 raised $1.2 billion. Furthermore, the companies in scope had received fundraising of approximately $5.15 million on average. The actual numbers were likely to be significantly higher though.

Generally, many firms do not disclose the amount they have raised or the funding rounds at all as they are predominantly privately held companies, so weneed to take this number with a pinch of salt, too. An imminent observation was that it was tiny when compared to the approximately $36 billion of funding the wider FinTech universe had raised in the year of 2016 alone.

But there were other aspects, too, that we could conclude from the information we had collected: London was the centre of the RegTech world – almost half of the companies that we identified as RegTech firms (using a narrower definition as we focused on the “traditional” RegTech categories and on RegTech for financial services – a definition that appears to have become the basis for other reports like the KPMG FinTech Pulse as well – see below) were headquartered or have an office there. Talking about categories, the classification has (and still is) one of the trickiest parts when producing such a directory as many offerings cannot be squeezed into one category, but drilling down into too many different ones would make it difficult to compare solutions and companies. Still, it was clear that client and counterparty identification, mostly in the form of KYC and AML services, and Monitoring were early favourites. We also found that the average RegTech firm was a small enterprise with more than two-thirds having less than 30 employees on their books. Given that we concentrated on pure RegTech firms (as opposed to large consultancies or big IT firms producing some form of solution that can be used for RegTech purposes), it wasn’t entirely surprising though.

The breakthrough year

The following year marked a quantum leap for RegTech as it made its way into the limelight. More and more investors discovered the value and investment opportunities in this sector and when we repeated the exercise in 2017, our figures now based on the over 300 RegTech firms listed then in the Directory were closer to $2 billion in total fundraising.

The Pulse

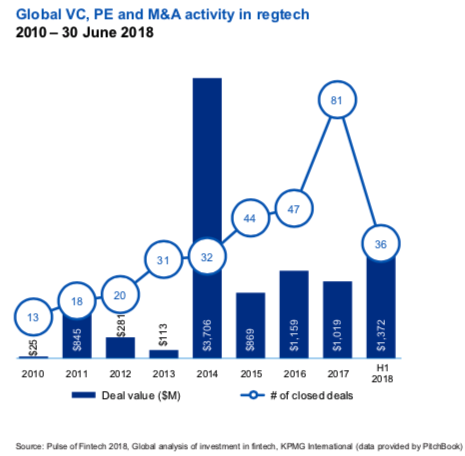

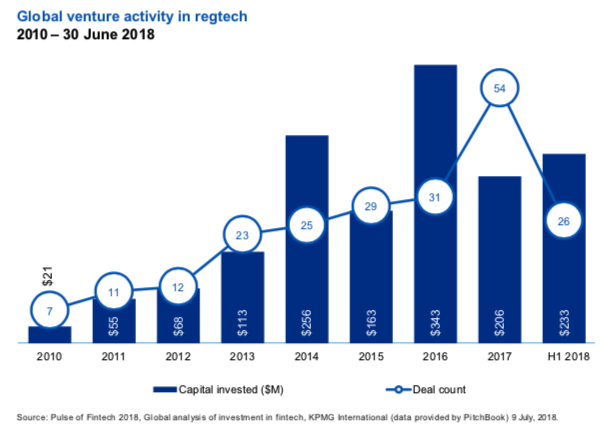

And things only got better from an investment point. The KPMG Pulse of FinTech Report stated that RegTech investment had reached $1.37 billion in the first half of 2018 alone, already surpassing 2017 annual totals.

However, this report, too, as all others of its kind, needs to be put into context: The authors themselves state that as opposed to previous editions this one uses a narrower definition, i.e. RegTech according to KPMG consists of “Companies who provide a technology-driven service to facilitate and streamline compliance with regulations and reporting as well as protect from employee and customer fraud”. This is a differentiation that partly is in line with our definition as it excludes a large number of institutions and even though it does not specifically mention its focus on financial services compliance, it does not seem to include companies in other sectors such as healthcare, insurance or telecom. After all, we need to remind ourselves that an important element of RegTech is that its potential goes beyond financial services.

Neither does the report list all of the 36 deals that account for the $1.37 billion in deal value in 2018H1, but only cites some examples: the $25 million raise by UK-based CloudPay; the $38 million raised across two funding rounds by US-based Harbor; and a $10 million raise by CloudMargin (for sake of completeness, the report also refers to the $30 million Series C round of Tipalti, which predominantly focuses on accounting software and international money transfer – another example for the difficulties of defining the scope of such reports). However, listing all deals that have been considered for the entire report (including FinTech deals) was probably not the objective of KPMG and its data provider PitchBook.

Nevertheless, as we cannot say with certainty which are the other 32 deals that KPMG counted, we can at least try to close the gaps with a selection of other significant deals in the first half of 2018:

- On 8 January 2018, Collibra announced it had closed $58 million in Series D financing. This round was led by existing Collibra investors ICONIQ Capital and Battery Ventures, with participation from early Collibra investors Dawn Capital, Index Ventures and Newion Investments, bringing the total funding for Collibra to over $133 million.

- XebiaLabs, on 12 February announced that it had secured a Series B growth investment of over $100M from investors, including Susquehanna Growth Equity and Accel, along with many existing shareholders.

- Alsop Louie Partners led Ascent Technologies’Series A round for a total of $6million in March.

- On 21 March, Sift Science announced that it had raised a $53m Series D round, which was led by Stripes Group.

- Checkr announced on 12 April $100 million in Series C funding led by T. Rowe Price, which was joined by earlier backers Accel and Y Combinator.

- On 13 April, Onapsis announced a $31 million Series C minority funding round led by new investor LLR Partners, with participation from existing institutional investors 406 Ventures, Evolution Equity Partners and Arsenal Venture Partners. This marks the largest single round of funding in the company’s history, bringing the total investment in Onapsis to $62 million.

- ClauseMatch in April closed a $5m Series A funding round, led by Index Ventures.

- On 29 May, Signifyd announced it had secured $100 million in a Series D round led by Premji Invest, with participation from existing investors Bain Capital Ventures, Menlo Ventures, American Express Ventures, IA Ventures, Allegis Cyber and Resolute Ventures.

- Auth0 operates a cloud based identity platform for developers and announced on 15 May a series D round for $55m.

- And on 25 June, BigID Inc. announced that it had raised $30 million in Series B funding, less than five months after completing its $14 million Series A round. Led by new investor Scale Venture Partners with participation from previous investors ClearSky Security, Comcast Ventures, BOLDstart Ventures, Information Venture Partners and the SAP.iO Fund, the round brought BigID’s total funding to $46.1 million.

These 11 deals amount for $552 and narrows the gap, but still leaves plenty of questions as to the deals that took place according to the report.

Still, there are plenty of interesting insights in the KPMG report: The US and UK attracted the majority of this funding, which cements our earlier statement of London still being one of, if not the most important RegTech hubs, though other EU-jurisdictions have been busy, too, thanks to the various EU regulatory initiatives that make the European Union an attractive playground.

With regard to Asia the report sees continued slow traction and mostly so in Australia and Singapore, where “regulators have been strongly supportive of fintech innovation”. It also states that “much of the regtech focus in Asia has been around KYC and fraud prevention”, which confirms the statement we made in our first publication, i.e. KYC as an activity that seems to be the most apparent in need of innovative solution and at the same time offers large and quick rewards for startups. The report concludes its RegTech section with an outlook for the next 12 to 24 months: “we expect to see investment in regtech to grow rapidly — particularly in areas like AI, Know your Customer (KYC) and Know your Data (KYD)”.

The Second Half

This brings us to the question about what happened in the second half of 2018? Did RegTech continue on its trajectory to record highs in terms of deal value?

Well, again all depends on where we draw the line. If we take into account the two deals involving SenseTime, the Chinese facial recognition and identification solution provider, the record first half is already matched by the $1.2billion raised in two transactions from investors including Alibaba and Tiger Global Management.

But there were also a number of smaller deals (again in chronological order) such as:

- Israel’s ThetaRay in July 2018 completed a fundraising round of over $30 million, bringing the total amount raised to date to more than $60 million.

- In September, QualitAdd raised 1 million Euros with the trust of investment fund M Capital Partners.

- Humingbird Regtech conducted a Series A fundraising round in October that collected $3million and was led by Homebrew with investments from Omidyar Network, TTV, and Designer Fund.

- Customer Risk Intelligence Provider Arachnys Secures $10 Million in Series A Funding in October, too.

- And another October deal saw French RegTech Scaled Risk raise €3million in a round led by Odysee Venture.

- Cognigo, a startup that aims to use AI and machine learning to help enterprises protect their data and stay in compliance with regulations like GDPR, today announced that it has raised an $8.5 million Series A round in November.

- Also in November Aztec, the company behind the Aztec protocol, which uses cutting-edge zero-knowledge proofs to enable private transactions on the virtual currency Ethereum, raised a $2.1 million seed investment led by ConsenSys Labs and other investors such as Entrepreneur First, Samos Investments, Jeffrey Tarrant (Mov37) and Charlie Songhurst.

- French startup Woleet concluded a fundraising for €1 million in November to secure transactions with blockchain technology

- Steeleye announced the completion of a £5.7m seed fundraising led by venture capital firm Illuminate Financial on 23 November.

- Alyne announced on 27 November that it had raised €3 million from two existing investors, Alstin Capital as Lead Investor and Hannover Digital Investments GmbH. The investments brought Alyne’s total funding, since launching its next generation RegTech in early 2016, to a total of €4,2 million EUR which will be used to scale Alyne’s operations and expand its customer base in line with its high growth potential.

- The UK’s Pass Technolgy in December raised £3.25 million.

Which gives us a total of 13 transactions in the second half of 2018 and a total of approximately $1.31 billion in today’s money (just for sake of completeness, other industry observers talk about three times this number for total of almost $2 billion though the identity of the companies involved and composition of these deals is not publicly available).

And as a result, we stand at a grand total for the last year of either $2.68 billion if we add the KPMG numbers to the 2nd half or at $1.935 billion if we only count the deals listed above. In any case, truly impressive numbers.

The Bottom Line and the Road Ahead

However, RegTech remains in the shadows of the larger FinTech investments last year. While the numbers are impressive they are miniscule compared to the likes of Revolut, which raised $250 million in a Series C round that valued the company at $1.7 billion in April 2018. And that is far from being the outlier as other deals confirm:

Nubank from Brazil raised $150 million in round that was led by DST in March that values the startup at about $2 billion; Atom Bank, the British business lender and mortgage provider, collected almost 150 million pounds from BBVA, Toscafund and others, putting its worth at a valuation of £450 million; another British lender, OakNorth, raised 100 million in September; and Germany’s N26 raised $160 million in a Series C round from Tencent, Allianz X and other investors.

The KPMG report cited global investment in FinTech of $57.9 billion across 875 deals (including RegTech) in the first six months of 2018. While this refers to a much larger group of companies, it shows that RegTech is still somewhat niche compared to its big brother FinTech. Which is further emphasised by the average size of deals as just demonstrated.

But it isn’t necessarily a bad thing that the numbers of RegTech investments do not match those of FinTech, which after all is a much larger sector and consists of greater opportunities. RegTech in its industry development is at earlier stage and is also very different in terms of the nature of its investment opportunity: RegTech firms often focus on specific use case with regard to regulatory obligations and the deployment of a solution from the first contact with a client and the signing of a contract can easily range between 12-18 months. That means that these firms need stamina and therefore often have more to show for than, say, the next payments app. Not to say anything against payment apps.

In any case, it seems like we are to a good start as the New Year has already seen some significant investment activity in the form of a £25 million ($32.3 million) funding round for Featurespace, which was led by Insight Venture Partners and MissionOG with participation of existing investors including IP Group plc, Highland Europe, TTV Capital, Robert Sansom and Invoke Capital.

Stay tuned…