An overview of regulatory measures with regard to and the impact of the Coronavirus on Banking, FinTech, Start Ups and the overall economy.

Monday’s plunge at European stock markets when shares saw the biggest falls since the 2008 financial crisis leaves no doubt. The coronavirus has reached financial services and while most markets saw some recovery, the outbreak has severe consequences for banking.

The most evident impact was the drop in share prices, but there are several other areas. Contingency plans need to be reviewed and adapted, compliance with regulatory obligations needs to be ensured, and, most critical the funding situation needs to be analysed and monitored at organisations of all sizes.

What is the impact of the Coronavirus on Banking?

The most evident impact was the drop in share prices, but elsewhere the effect will be felt, too. Regulators have rushed to issue publish statements on Covid-19 (its official name) that give an indication as to what financial institutions need to bear in mind now. A review of the steps taken by regulators gives an indication where the focus should lie.

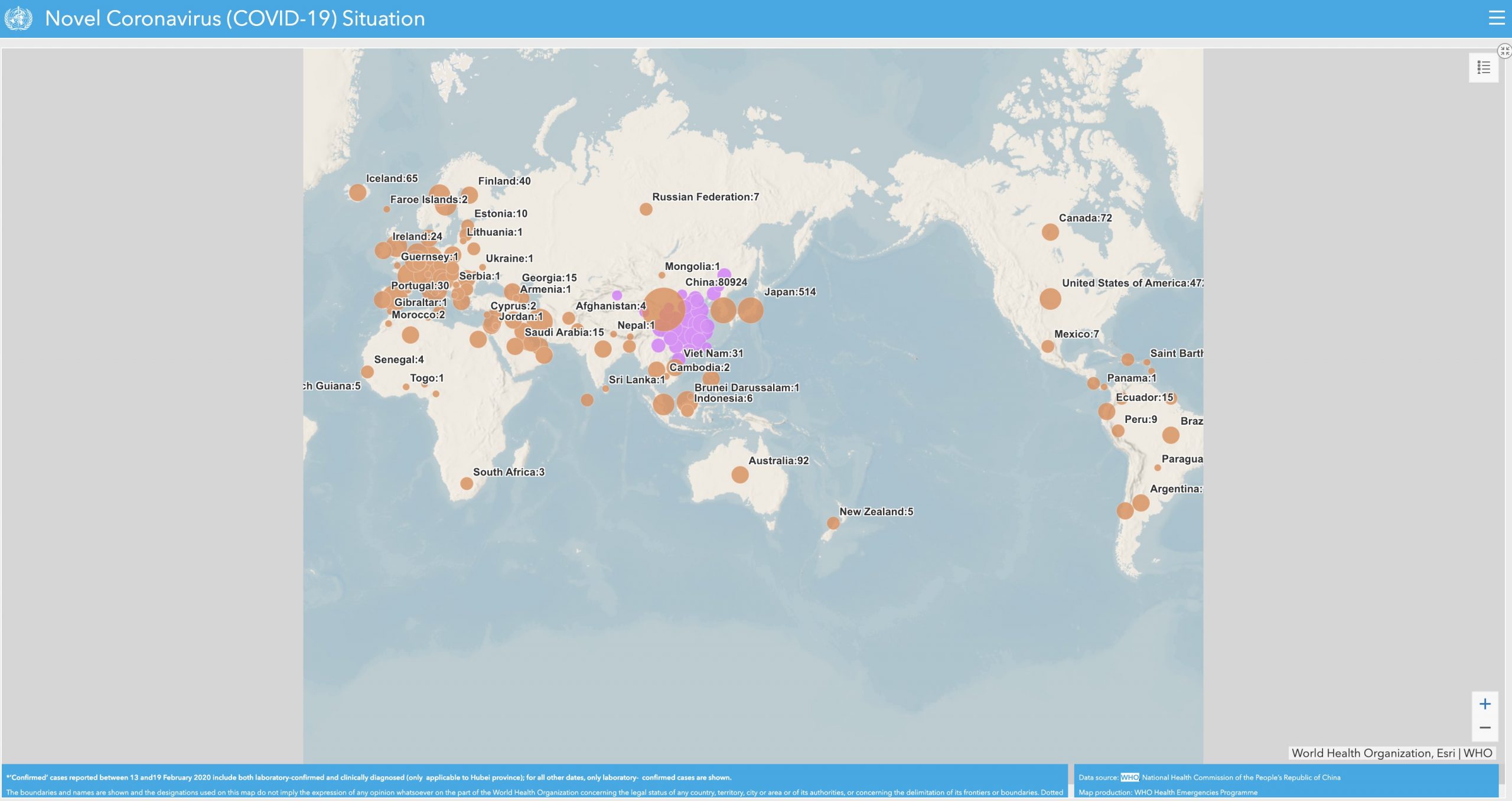

An overview of regional responses

What does the Coronavirus mean for the Chinese banking system?

China’s banking regulator was already under pressure to address a shadow banking and a rising amount of non-performing loans. The coronavirus, however, and its direct influence on the Chinese economy means that all reform plans will need to dial back to focus on the country’s banking system with hundreds of billions of dollars worth of new non-performing assets.

What does the Coronavirus for the banking system and beyond in Italy?

Italy is the country outside China that has been hit the hardest by Covid-19. Now, entirely in lockdown, it will have to deal with numerous problems that affect all aspects of society including its finance system. Already on 23 February, the Banca d’Italia, Italy’s central bank and its chief supervisory authority, advised on measures to contain the risk of coronavirus infection, suspending public events of the institution. Only a day later, it was compelled to provide guidance on the authorization to carry out manual checks on the authenticity and suitability of banknotes, an activity at the very center of a central bank.

The distribution of banknotes remains an issue (as seen as it yesterday’s confirmation by the Banca d’Italia in that regard), but with one of the highest national debt in the Eurozone that already accounts for 134.8 % of the country’s nominal GDP, the long term consequences of a country standing still is likely to be significantly worse.

What is the response in France?

Just on the other side of the border, in France the Governor of the Banque de France, sought to reassure the industry to keep a cool head. In an interview on the Banque’s website, he stated that the Banque de France was vigilant and prepared, but that it was too early to forecast the economic effect, which would depend on three considerations: the first being the trend that before the outbreak showed improvement in Europe and the United States. Secondly, the impact of the coronavirus, whose magnitude depends very much on the duration of the epidemic. And lastly, the disruption of supply chains: the longer this affects supply, the more it also would impact demand. He therefore highlighted the importance of financing especially to the country’s many small and medium enterprises that would possibly encounter difficulties ahead.

What did the regulator in Germany say?

The largest economy of the Eurozone on the other hand has so far been fairly quiet. The German regulator BaFin issued a statement last week that confirmed that it was in close contact with banks and other financial market players about possible implications and emergency plans. While BaFin was to continuously analyse further developments and possible effects on the financial industry, it seems that most conversations take place behind doors

What do UK regulators do regarding the coronavirus?

The UK’s FCA published on the same day as its German counterparts a statement that it was working closely with the financial services sector to ensure it is responding effectively to the Covid-19 outbreak together with the Bank of England and HM Treasury. The FCA, however, went further to explain that expects all financial institutions “to have contingency plans in place to deal with major events”. This highlights a priority for firms, namely the importance to guarantee the functioning of organizations despite the existing consequences and those that might occur. For this reason, the regulator together with the Bank of England will

actively review the contingency plans of a wide range of firms including “assessments of operational risks, the ability of firms to continue to operate effectively and the steps firms are taking to serve and support their customers”.

At the same time, it reminded firms to take all reasonable steps to meet their regulatory obligations, but showed some flexibility about how this would be achieved, for example, through the use of backup sites or with staff working from home.

What is the regulatory situation in the USA?

The U.S. Securities and Exchange Commission followed a similar path, but agreed to provide additional regulatory relief for certain publicly traded company filing obligations under the federal securities laws as “the impacts of the coronavirus may present challenges for certain companies that are required to provide information to trading markets, shareholders, and the SEC”. In an order it presented publicly traded companies with an additional 45 days to file certain disclosure reports that would otherwise have been due between March 1 and April 30, 2020.

At the same time, it reminded companies to “provide investors with insight regarding their assessment of, and plans for addressing, material risks to their business and operations resulting from the coronavirus to the fullest extent practicable to keep investors and markets informed of material developments” as this would be material to an investment decision. In return, it offered such firms to avail themselves of the safe harbor in Section 21E of the Exchange Act for forward-looking statements.

What is the impacts across sectors?

To summarise, but also to translate these statements into actionable insights, let us focus on the impact of the coronavirus on banking and across the different sectors and functions.

The dive of share prices means a dramatic loss in market value across the board and creates insecurity among investors, something financial markets do not appreciate at all.

However, this also impacts the balance sheets of financial institutions and potentially the liquidity situation of some organisations. For smaller firms like FinTech startups this could result in funding shortages as pointed out by the Banque de France above. It is therefore all the more important that firms of all sizes focus on these elements to avoid a squeeze that could put the entire business at risk.

Simultaneously, the financial system will also feel the pain that the hardest hit sectors like airlines, hotels, restaurants, or entertainment venues are experiencing. It is unlikely that the loss of business can be recovered and while much depends on the response of governments and central banks, a recession, for example, in the EU is not off the cards.

At the same time, regulators will accept no excuses with regard to the regulatory obligations of companies. Some explicitly showed their availability to discuss ways how to help firms in dire straits, the same is likely to be true in most cases if not all, but neither would be prepared to waive any requirements in deems necessary to protect the overall integrity of markets and consumers. For instance, the FCA made it clear that it expects firms to be able to enter orders and transactions promptly into the relevant systems, use recorded lines when trading and give staff access to the compliance support they need.

Companies are also likely to come under palpable strain as can be taken from the Italian situation, where banks require staff to work from home and are at the same time potentially facing a shortage of personal as can be seen in Chinese provinces that have suffered large numbers of infected staff members across organisations.

In any case, the impact of the outbreak will be felt in several ways and will leave a mark on the economy though how and to what extent remains to be seen.