As more customers turn to online channels to buy goods and services, there’s a greater focus on verifying digital identity to reduce fraudulent transactions and protect sellers. Malicious actors, posing as buyers, deceive businesses for financial benefits and to gain unauthorized access to the system. Some buyers even conduct fraudulent financial transactions to exploit the retail environment to their advantage.

Here’s a look at the best identity verification software that can protect your business and help meet mandatory compliance:

- Trulioo A global identity verification service for automatic compliance and due diligence for organizations of all sizes.

- iDenfy A three-layer identity verification service that is effective against fraudulent activities.

- Jumio An automated ID verification solution to fight fraud, maintain compliance, and onboard online users.

- Veriff An AI-powered identity verification platform that prevents fraud, safeguards your customers and builds trust.

- Onfido A digital identity verification platform that uses AI algorithms to verify users based on a photo identity.

- Ondato A SaaS platform offering KYC-compliant verification services for easy client onboarding.

To protect themselves from such frauds, businesses must take additional measures to verify the buyer’s digital identity to assess and mitigate the associated risks. Additionally, to help businesses, governments around the world have also implemented stringent laws for identity verification. One such mandatory fraud prevention mechanism for regulated businesses like those in healthcare or finance, is Anti Money Laundering (AML). It includes a series of steps called Know Your Customer (KYC) that requires user identity verification for further use of an organization’s products and services. With such a concerted approach, AML aims to prevent illegal money from entering the legitimate financial system.

In this article, we will talk more about digital identity, KYC, AML, and the tools that can take care of these processes for you. We will end with a review of the top tools that can seamlessly verify your buyers’ identity.

Importance of Verifying Digital Identity

Digital identity verification has become the cornerstone of today’s online world, and for good reason too. Below are some reasons why it must be an essential part of your business.

Protection from Frauds

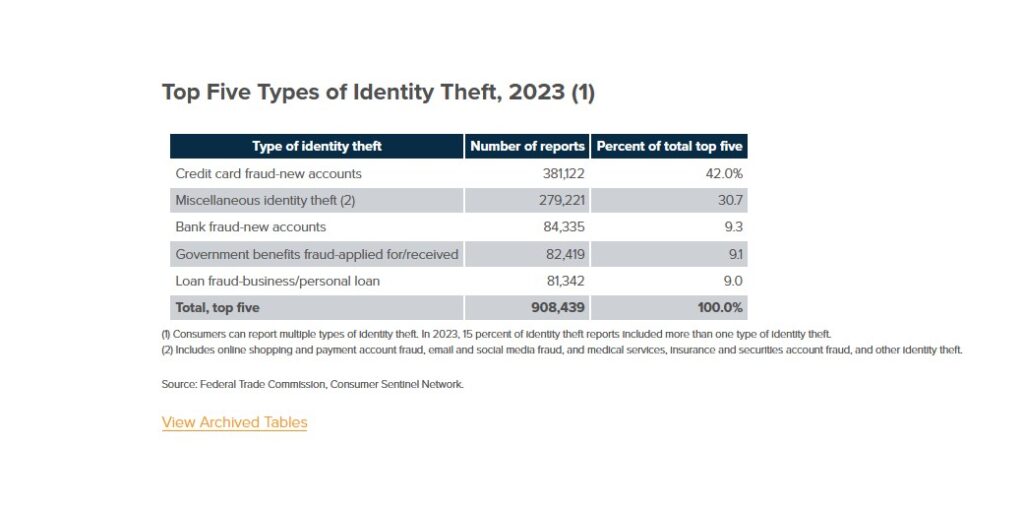

Cyberattacks are ever-increasing. The Insurance Information Institute lists five top identity thefts that can have a profound impact on your business.

Source: iii.org

Digital verification processes can protect your business from these identity thefts and frauds.

Meet Compliance

The growing online transactions and the ensuing frauds have led global consortiums, governments of member countries, and even organizations like the United Nations to come up with frameworks like AML, CFT, and KYC to prevent fraud and safeguard businesses. AML is mandatory for some organizations and if your business falls on this list, a robust identity verification process can help with compliance.

Build Trust

Data breaches and identity thefts cause financial and reputational loss for your business. Using these identity verification mechanisms can help build trust among your customers, investors, and other stakeholders. Also, these verification mechanisms provide the confidence to explore new business revenue opportunities.

Due to these benefits, many organizations voluntarily take up identity verification.

How to Verify Digital Identity?

Every business is unique. While some businesses are local, others have operations worldwide. Due to these variations, all businesses can’t use the same verification processes. But in general, your process must answer three questions:

- Is the identity of the buyer a real one?

- Does the identity belong to the person who is claiming it?

- Is this identity flagged as high risk?

Many processes can effectively answer these questions for you. Here are some processes that can verify a buyer’s identity.

- Check an individual’s Personally Identifiable Information (PII) against national IDs and credit card details to ensure the individual is who he or she claims to be.

- Analyze official identity documents like driver’s license, passport, etc.

- Confirm the existence of a bank account.

- Use biometrics to establish the true owner of an identity.

- Send a text message to verify the device of the user.

- Screen risk behavior by analyzing a user’s identity against global risk data sources like sanction lists.

If you’re an unregulated business, you can choose from one or more of the above processes to safeguard your business. On the other hand, if you’re a regulated business, you will have to follow the KYC and AML provisions mandated by law.

What are KYC and AML?

KYC is a part of AML and is mandatory for businesses in banking and healthcare. Besides KYC, AML also includes processes like Combating the Financing of Terrorism (CFT). Every country mandates AML regulations to prevent money laundering and includes the following provisions.

- Identity verification

- Determining risk levels. This process includes screening Politically Exposed Persons (PEPs).

- Continuous monitoring of users in the system to identify any behavioral changes.

- Reporting of suspicious activities and fraudulent transactions.

- Maintenance of internal records and audit trails.

- Regular training and internal policies to ensure compliance with AML provisions.

Given the complex nature of identity verification, it’s not possible to do them manually. This is why companies turn to digital tools and software for verification. In recent years, these verification tools have become highly sophisticated, as there are automated actions supported by artificial action and machine learning. Hence, it makes sense to opt for identity verification software that is comprehensive and meets all your compliance and business requirements.

Next, let’s look at some of the best software in this space and the criteria we used for selecting them.

Our Methodology

Here are the factors we considered while selecting the best identity verification software:

- A wide variety of identity verification techniques like biometrics, account verification, ID verification, PEP, and more.

- Compliance with KYC and AML.

- Integration with existing systems.

- In-depth analytics

- Audits and reporting.

Best Identity Verification Software

Now that you know why some tools made it to our list, let’s jump into a detailed review of each.

1. Trulioo

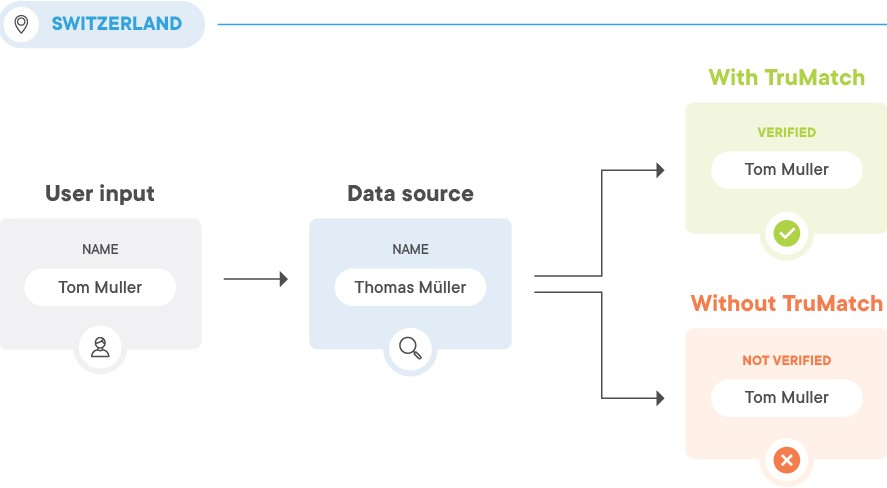

Trulioo is an identity verification platform that optimizes the verification processes to safeguard you from fraud while enabling the right environment for growth and innovation. Its integrated platform helps build onboarding workflows easily while managing global regulations like AML.

Source: Trulioo

Read on to understand Trulioo’s identity verification capabilities.

Unified Compliance

Trulioo helps you comply with not just AML but also regulations that are specific to some geographic regions or countries. Additionally, you can meet many voluntary frameworks like FinCEN, FINRA, FCA, FINTRAC, CySEC, and more. The advantage of Trulioo is that you can customize your workflow to meet the regulations of specific countries, as you expand to new markets.

AI-driven Insights

This platform uses AI to route users to the best verification option based on their region, type of document, and the applicable regulations. Moreover, its Workflow Studio makes it easy to create a no-code and drag-and-drop workflow to connect to specific verification services. All this means you can quickly start your verification processes without spending much time in development.

Secure and Compliant Onboarding

One of the problems with verification is that it operates in silos, making it difficult for organizations to gain a holistic view of the onboarding process. But Trulioo changes this process with its unified platform that provides the required visibility and helps spot security gaps and areas for improvement.

Due to these factors, Trulioo is a comprehensive choice for building trusted identity verification solutions that can work for a global customer base.

Pros:

- Low maintenance and easy to use.

- Excellent customer service.

- Simple API extensions.

- Flexibility and use across wide geographic regions.

Cons:

- Expensive.

- Reports can be more detailed.

2. iDenfy

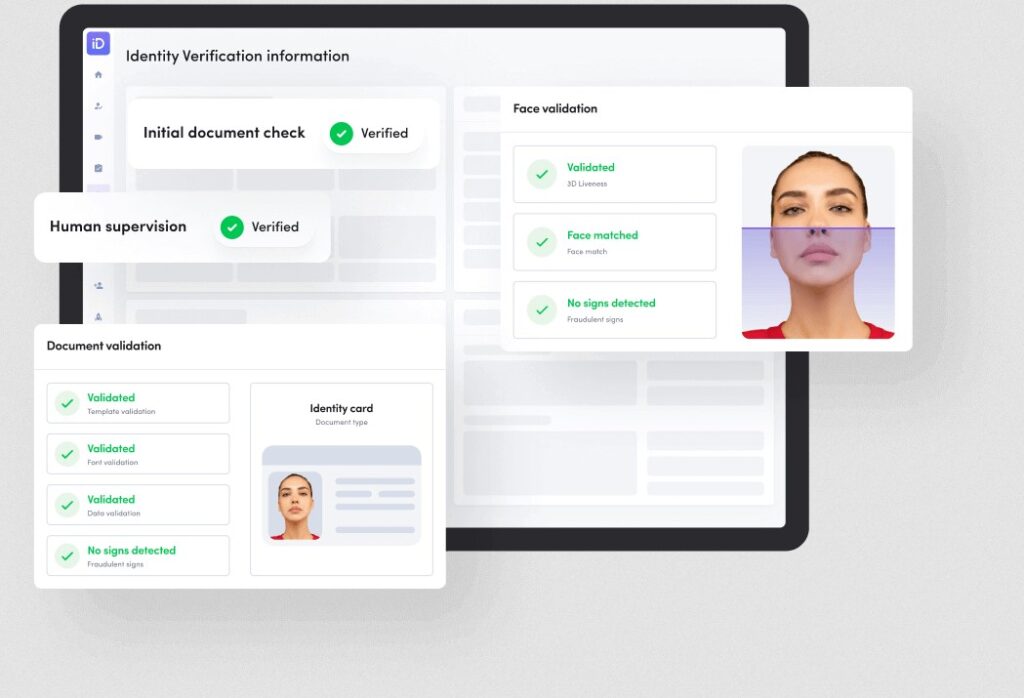

iDenfy is an all-in-one identity verification platform that quickly onboards users while ensuring fraud prevention and compliance. This platform is well-suited for businesses in the fintech, crypto, blockchain, online gambling, and e-commerce industries.

Source: iDenfy

Below are iDenfy’s features.

Easy Onboarding

An arduous and complex onboarding process negatively impacts user experience, and in turn, your business. To avoid this hassle, iDenfy makes the user boarding process easy and intuitive. It extracts data in 0.02 seconds from 3500+ government-issued ID cards spread across 200 countries. Furthermore, it provides users with the option to upload IDs through mobile apps, web browsers, and iFrames.

Three-layer Protection

iDenfy offers a three-layer protection to your verification process to ensure transparency and improve efficiency. The first layer is where the user uploads the documents. The system automatically extracts the data and verifies it. This is followed by a second layer where a human expert checks the document within three minutes of uploading the data. Lastly, your new user can take a selfie and the system verifies if the face matches with the facial patterns on the ID’s photo.

Fake Detection

iDenfy uses many techniques to detect fake documents. Its patented 3D liveness detection technology can spot fraudulent verifications. Moreover, it can access watchlists, sanction lists, and PEPs to comply with AML and other regulations.

With such integrated features, iDenfy reduces fraud, improves compliance, and provides the confidence to scale your business.

Pros:

- Good customer support.

- Filters fraud and increases trust.

- Smooth and reliable.

- Easy-to-use administrator panel.

Cons:

- Confusing pricing model.

- Integration requires technical expertise.

3. Jumio

Jumio is an automated identity verification platform that can quickly assess the risks involved while ensuring compliance with leading standards. It leverages biometrics, AI, and other latest technologies to help maintain trust among customers. It eases the onboarding process as well.

Source: Jumio

Let’s now see how Jumio’s features support identity verification.

Quick Verification

Jumio’s mobile app can quickly verify users and keep fraudsters off your platform. It verifies the user’s ID, takes a selfie, and compares the photo on the ID with the selfie to ensure that the user is who she/he is claiming to be. It also helps collect supplemental documentation like utility bills and verifies them.

AML Screening

During the entire verification process, Jumio automatically screens customers against watchlists, sanction lists, and PEPs. Besides helping your organization comply with mandatory regulations like AML, this process also protects your business from fraudsters and helps build trust.

Intuitive Workflows

Jumio can seamlessly integrate with websites, iOS apps, and Android applications through SDKs and APIs. As a result, users can get an automated eKYC user experience that takes under a minute to complete. Moreover, its AES 256-bit encryption safeguards the stored data from unauthorized access.

Overall, Jumio supports risk assessment, compliance, and automated verification through an intuitive user interface.

Pros:

- Intuitive interface.

- Quick verification.

- Reliable and scalable.

- Secure storage.

Cons:

- Requires a smartphone to capture selfies.

- Limited documentation.

4. Veriff

Veriff is an AI-powered identity verification platform that prevents fraud and protects your customers’ data. In the process, it meets global compliance and helps build trusted global communities for your offerings. Its simple UI helps drive growth as well.

Source: Veriff

Human-Machine Combination

A highlight of Veriff is its human-machine combination that identifies fraudulent actors while providing a friction-free experience for genuine users. It uses AI as the first layer for verifying identities, and this process is cross-checked by humans for improved accuracy.

Fraud Protection

Veriff’s anti-fraud activities analyze multiple data points to determine genuine users from fraudulent ones. Moreover, it analyzes individual data points to uncover fraud patterns and potential fraud rings, which are otherwise hard to detect. With such features, you can protect your organization from impersonation, identity document fraud, and more.

Biometric Authentication

You can use Veriff to go beyond one-time passcodes and passwords, as it provides the option to use biometric data to secure customer accounts. Moreover, the facial biometrics features are quick and provide 99.99% accuracy. It even automates the verification process while providing a 99% first-time match.

With such features, Veriff can offer immense benefits to your organization.

Pros:

- Works well across many industries and use cases.

- Customizable integrations.

- User-friendly experience.

- Supports compliance.

Cons:

- Customer support can be better.

- Expensive for small businesses and startups.

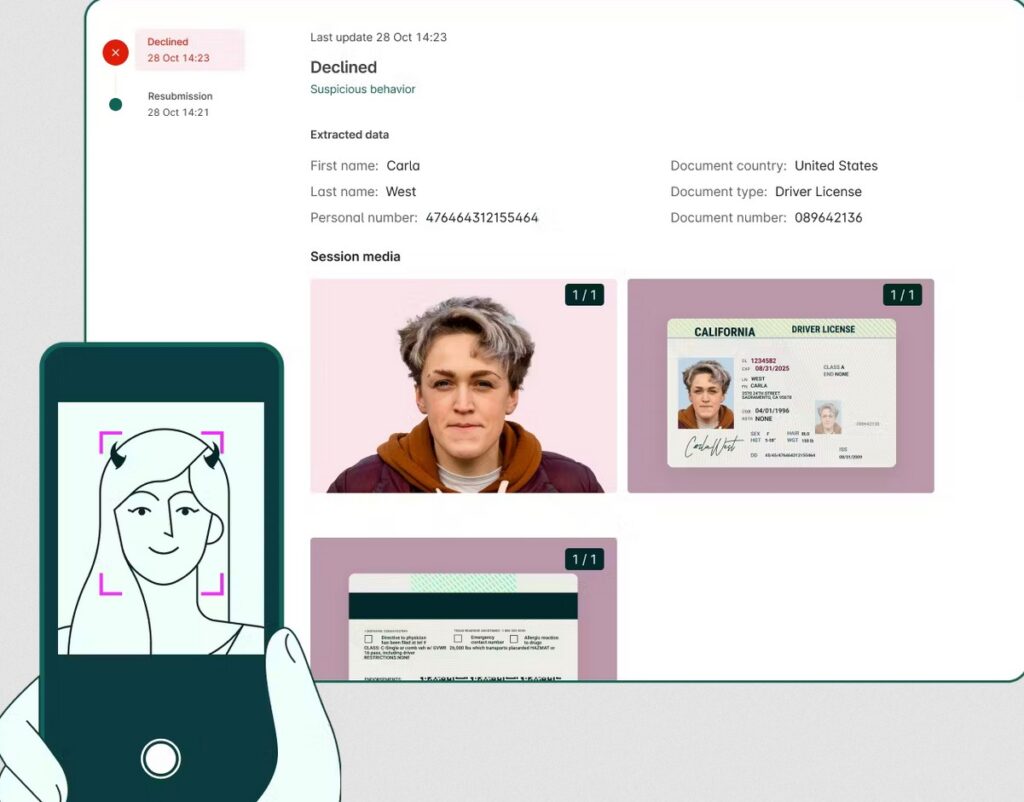

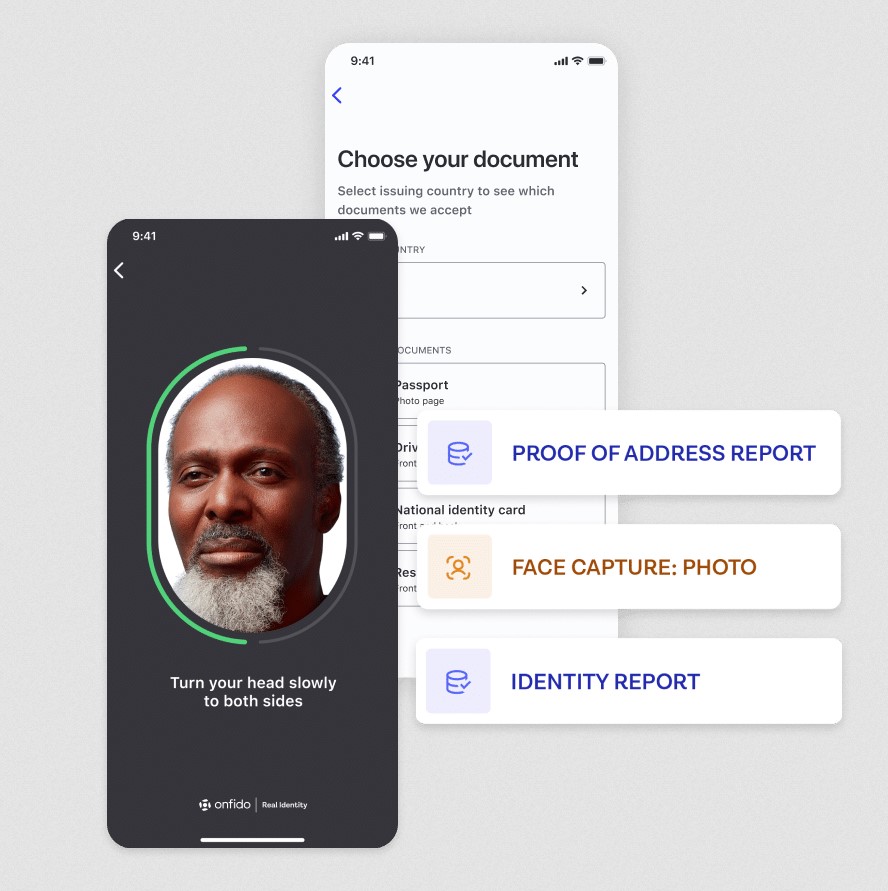

5. Onfido

Onfido uses automation and AI algorithms to verify the identity of new users. In the process, it enhances user experience and helps your organization comply with AML and KYC regulations. It also helps to know your customers while keeping the costs low.

Source: Onfido

Read on to learn how Onfido verifies your customers’ identities.

Document Verification

Onfido uses a proprietary algorithm called Atlas AI to verify a photo ID. It supports more than 2,500 documents across 195 countries, to empower you to reach a global audience. More importantly, it simplifies the verification process for your customers.

Biometric Verification

Stolen IDs and impersonation are a big threat to businesses, and Onfido addresses these issues by asking the user to take a selfie. It matches the facial patterns of the selfie with the ID on the photo to ensure the identity of the user.

Fraud Detection

Onfido creates a 360-degree view of every customer’s identity using its fraud detection technology. Its device intelligence and AI-powered algorithms alert you of potential frauds, without impacting user experience.

Overall, Onfido is a comprehensive platform that securely verifies identities with a hassle-free user experience.

Pros:

- Supports facial recognition and matching.

- It offers SDKs for easy integration.

- Automates document processing and validation.

- Good API documentation.

Cons:

- The dashboard can display more detailed information.

- The pricing tiers are unfavorable for small businesses.

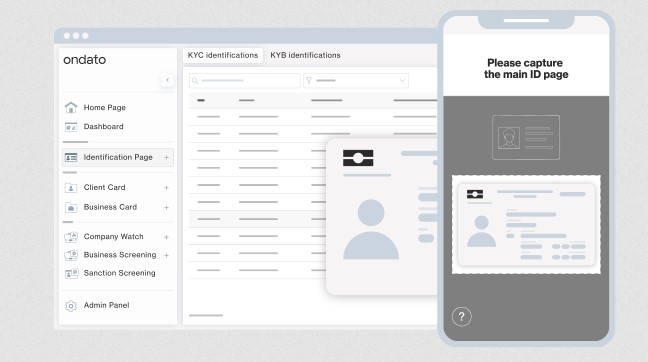

6. Ondato

Ondato is a SaaS-based solution that addresses the challenges of meeting KYC and AML requirements. It combines all the required tools and digital identity services for AML screening and identity verification.

Source: Ondato

Below are Ondato’s identity verification capabilities.

Customer Due Diligence

One of the key aspects of AML compliance is Customer Due Diligence or CDD in short. This is a process where you continuously check a customer’s identity against global sanction lists, watch lists, and PEPs to ensure that your system does not have anyone who is on those lists. Ondato automates this process for both new and existing customers, saving many hours of work for your employees.

Remote Onboarding

You can use Ondato to onboard new users from any part of the world. Its AI-powered identity verification solutions protect data, mitigate fraud, and improve the efficiency of your operations. All along the process, it keeps you compliant with AML.

Authentication Tools

Besides identity verification, Ondato also eases the authentication process of returning users. It uses techniques like multi-factor authentication to ensure security and, at the same time, reduces the hassles of authentication for your users.

Overall, Ondato comes with many tools that keep your users and business safe along with ensuring compliance.

Pros:

- It supports web, Android, iPhone, and iPad devices.

- Good customer support.

- Intuitive user interface.

- Automated client onboarding.

Cons:

- Limited integration options.

- API implementation requires improvements.

Thus, these are the best identity verification software based on our criteria. While selecting the tool, check if you have any specific requirements like compliance with a particular regulation, and see if your selected matches these requirements.

Bottom Line

Identity verification is a central pillar of today’s business because of the growing cyber threats and impersonation activities. Moreover, the emergence of stringent regulations like AML necessitates organizations to follow a set of verification processes to ensure their compliance.

In this guide, we looked at some reasons for having identity verification software as a part of your tech stack, even if you operate in a sector that doesn’t require mandatory AML screening. More importantly, we looked at some of the best identity verification software. We hope this information helps you to streamline identity verification with appropriate software that best meets your needs.