Businesses registered and operating in the United States have additional compliance requirements, with the Office of Foreign Assets Control (OFAC) being a prominent one. OFAC is a framework released by the U.S. Department of the Treasury, and it lays down the economic and trade sanctions against targeted governments, groups, entities, and individuals. OFAC aims to protect the U.S. national security and foreign policy goals and objectives through its restrictions.

Not all OFAC compliance software is built, and this is why we have identified the ones that can be used across a wide range of use cases. Our choices are:

- Dow Jones Risk and Compliance A modular web-based tool to perform due diligence on different entities before transacting with them.

- Oracle Financial Crime & Compliance Management A comprehensive compliance suite that helps you adapt to evolving changes in OFAC.

- LSEG Data & Analytics A leading provider of financial news, insights, data, and analytics to check compliance with leading regulations like OFAC.

- Visual OFAC A screening platform that thoroughly analyzes U.S. government and international watch lists for OFAC compliance.

- Middesk A business identity platform that helps companies verify their stakeholders for compliance with OFAC and AML.

This guide will look at OFAC in detail along with its essential components. Following this, we will review the best tools that can ease OFAC compliance for you.

What is OFAC?

The Office of Foreign Assets Control (OFAC) is an agency of the United States Department of the Treasury. It aims to protect the country against terrorists, international narcotics traffickers, and others who can pose a likely threat to the national security, foreign policy, or economy of the United States. It also includes the selective or complete blocking of assets and trade restrictions against specific entities.

Organizations subject to U.S. jurisdiction and foreign entities operating in the U.S., working with U.S. persons, or using U.S.-origin goods and services must follow OFAC guidelines. As per these guidelines, organizations can develop and implement their respective Sanctions Compliance Program (SCP), provided it adheres to the essential components of OFAC.

What are OFAC’s Components?

OFAC has five essential components that organizations must include in their SCP. These five components are:

Management Commitment

As a first step, your organization’s leadership, including the CXOs and board of directors, must commit to an effective compliance program. They must approve to create and implement a Sanctions Compliance Program (SCP).

Also, they must provide authority and autonomy to internal departments overseeing compliance. It also helps to have direct reporting lines between the SCP team and senior management to ensure alignment with business goals and compliance requirements.

Risk Assessment

Risk assessment is another key aspect, and it spans across both internal and external operations to identify potential areas of sanctions violation. Risks may come from clients, products, services, supply chain entities, transactions, and geographic locations, and organizations must keep an eye out across all these touchpoints. Regular updates and active monitoring can help exercise due diligence at various stages.

Internal Controls

Internal controls include clear policies and procedures that map with SCP’s objectives. Such a mapping helps to create everyday operations to prevent misconduct and violations. Also, these controls help identify, escalate, and report prohibited transactions for taking corrective action. Regular internal and external audits ensure compliance, while robust logs provide evidence and accountability.

Testing and Auditing

Testing and auditing reflect the efficiency of your SCP, as they identify deviations and point to their root cause. These results must also be visible to the senior management, so they can approve compensating controls and the required remediation efforts.

Training

Regular training completes the SCP compliance framework as it equips employees with the required knowledge and tools to fulfill their sanctions’ compliance responsibilities. These tailored training programs must happen at least annually, especially for high-risk roles.

These are the five components that every organization must include as a part of its sanctions’ compliance program. Not meeting these provisions can prove to be disastrous, as it can result in liability offenses, including hefty fines and legal consequences. Note that a lack of intent to violate or a lack of awareness of the law are not acceptable defenses against the legal consequences. In other words, you must know OFAC’s provisions and implement them in your organization.

Now that you know what is OFAC and why you should comply with it, let’s look at some best practices that can help you achieve this compliance.

Best Practice for OFAC Compliance

As mentioned before, OFAC offers flexibility to organizations to develop a SCP that aligns with their operations and business goals. Below are some best practices that can boost compliance rates while protecting your business interests.

Understand the Provisions

Before you get down to implementation, make sure you completely understand OFAC’s provisions. The U.S. Department of the Treasury lays down specific guidelines for entities related to specific countries. Make sure to understand these provisions, especially if you plan to transact with them.

Effective Communication and Reporting

Establish clear communication channels to quickly close the non-compliance gaps. Also, set clear accountability and reporting hierarchy to create a comfortable environment for employees to report violations and take corrective action as required.

Collaboration and Partnerships

Collaborate with your partners, vendors, and external shareholders to help them comply with SCP. More importantly, provide the necessary training, tools, documentation, and anything else they need to understand and meet OFAC. You can also enter into partnerships with legal firms, auditors, and GRC companies to help with your compliance.

Thorough Documentation

Documentation is often an overlooked aspect of compliance because it requires additional time and effort. However, the benefits and insights of documentation can make a difference to your efficiency, so make documentation an essential part of your compliance process.

Along with the above best practices, consider using OFAC compliance tools that can increase the compliance rate without putting too much additional burden on your resources. Many of these tools even come with automation features to save time and effort.

Our Methodology

We evaluated hundreds of tools against a set of criteria to identify the ones that can best meet your needs. The criteria we used are:

- The ability to process partial matches to identify names by aliases, alternate spellings, and more.

- The flexibility to select multiple lists and ensure compliance with all of them.

- Continuous monitoring.

- Well-developed search capabilities.

- Seamless integration with multiple official sources.

Best OFAC Compliance Software

Next, let’s look into each of these tools in depth to help you decide on the best fit.

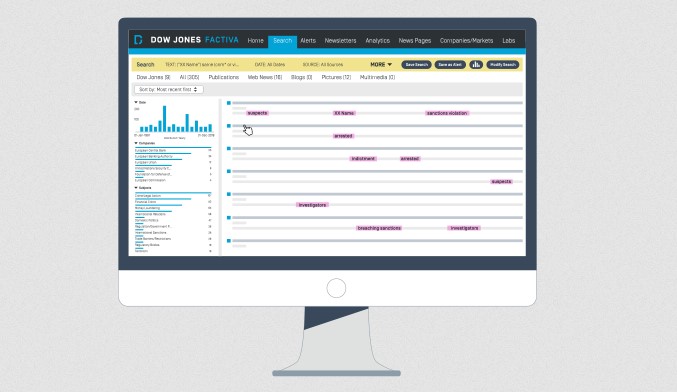

1. Dow Jones Risk and Compliance

Dow Jones Risk and Compliance is an advanced risk management solution built on its world-class data. Also, it leverages artificial intelligence and automation to create applications and workflows that help meet OFAC and other compliance requirements. Specifically, it protects your organization against anti-money laundering, sanctions, anti-bribery, and more.

Source: Dow Jones

Here’s a look at this compliance tool’s features.

Complete Data and Insights

A highlight of the Dow Jones tool is that it provides access to specialized data feeds that are known for their high accuracy levels. This feed refreshes up to six times a day, and this means, you always have access to the latest data.

Advanced Filters

Scanning your data against large lists with millions of entries can strain your resources. To ease the process, Dow Jones offers many meaningful filters. You can screen your customers, businesses, and other stakeholders against these lists to ensure that transacting with them does not violate OFAC compliance.

Managed Services

Along with the platform, Dow Jones also offers managed services where the expert team handles the screenings and backlog reviews to save time and effort. You can also get detailed reports, covering more than 270 million entities, without straining your existing resources.

Due to these features, the Down Jones Risk and Compliance can be a handy platform to maintain OFAC compliance, regardless of your industry or nature of operations.

Pros:

- Real-time monitoring of various risks.

- Protects against financial, reputational, and regulatory non-compliance.

- It enables you to take proactive measures to mitigate compliance gaps.

- Automated workflows.

Cons:

- Configurations can be rigid for some scenarios.

- Reporting can be better.

Contact the sales team for more information.

2. Oracle Financial Crime & Compliance Management

Oracle Financial Crime & Compliance Management is an advanced analytics software based on AI/ML algorithms that continuously scan for new developments and adapt your organization’s compliance processes to meet these changes. Using this tool, you can improve your OFAC, AML, and KYC compliance while maintaining operational efficiency.

Source: Oracle

Below are the key capabilities of Oracle Financial Crime & Compliance Management.

Holistic Risk-Based Approach

Oracle takes a holistic risk-based approach to manage all your mandatory compliance. It continuously monitors your users, vendors, and partners to see if they are featured in any of the sanction lists. Accordingly, you get notifications, based on which you can take further action.

Advanced Analytics

Oracle’s advanced analytics can provide the insights you need to investigate specific transactions or activities. Its artificial intelligence, machine learning, and graph analytics capabilities can improve the outcomes of your anti-financial crime program.

Quick Response to Evolving Sanctions

The dynamic and ever-evolving world of sanctions requires you to have an agile solution that can quickly adapt to and respond to these changes. With Oracle, you can get comprehensive screening coverage and fewer false positives. Additionally, Oracle can make compliance cost-effective as well.

Due to these features, Oracle Financial Crime & Compliance Management can help you meet the stringent requirements of OFAC, AML, and more.

Pros:

- Highly customizable.

- Tracks frauds at all levels.

- Updates the latest regulations and changes.

- Uses advanced AI and ML algorithms.

Cons:

- Complex.

- Expensive.

Contact the sales team for more information.

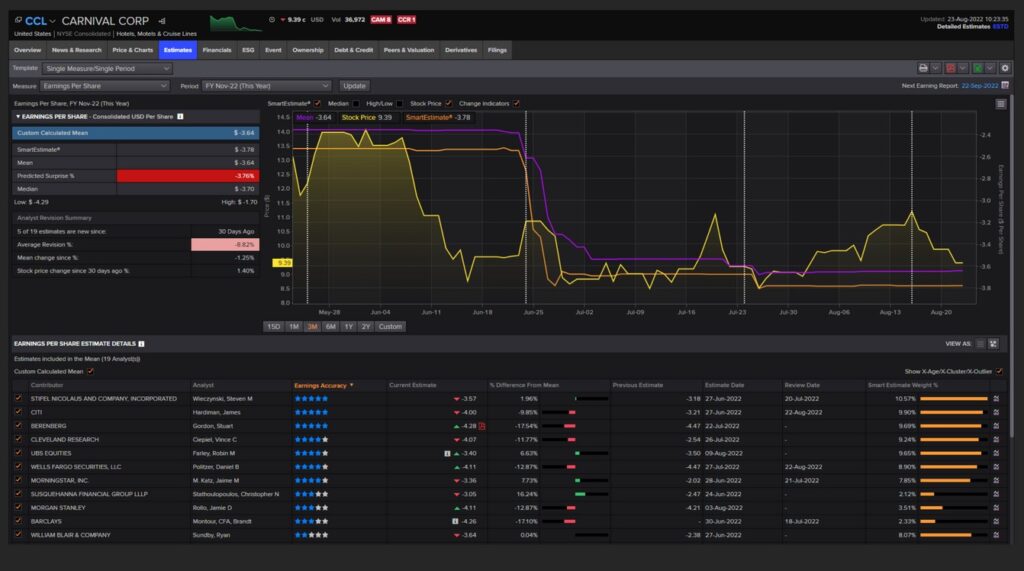

3. LSEG Data & Analytics

The London Stock Exchange Group (LSEG) Data & Analytics is an AI-powered business analytics solution that gathers the latest data and insights from high-profile sources. You can analyze this data and compare them against your organization’s information to identify deviations in OFAC and AML compliance.

Source: LSEG

Let’s now look at how LSEG Data & Analytics can help with OFAC compliance.

Analysis of Critical Factors

LSEG’s Signal Search feature instantly provides the critical factors that can affect your operations and compliance. It searches for signals across research reports, news, transcripts, and filings to provide relevant information, saving you tons of time and effort.

Intuitive Interface

You can use LSEG’s intuitive user interface and search to quickly identify the information you need. It also offers generative AI-powered predictive recommendations to provide insights that are hard to detect. At the same time, it analyzes data from the most accurate sources. Armed with this information, you can take the necessary actions to ensure compliance.

Open and Connected

Another advantage of LSEG is you can seamlessly integrate its APIs and data with your system. It even integrates well with Microsoft Office to help you build models and view them across the Office suite. Its integrated Python scripting opens new possibilities for data usage.

With such features, LSEG Data & Analytics can help you find the latest information and take the required action.

Pros:

- Instant access to relevant data.

- Advanced search capabilities.

- Simple user interface.

- Seamless integration.

Cons:

- Limited customer support.

- Complex.

4. Visual OFAC

Visual OFAC is a comprehensive screening tool that provides up-to-date information to ensure compliance with OFAC, SDN, and AML regulations. This tool makes it easy for organizations of all sizes to get started with OFAC compliance. Moreover, it offers sophisticated integration to work well with all tech stacks.

Source: Visual OFAC

Read on to learn how Visual OFAC’s features can help meet your compliance requirements.

Accurate Screening

Visual OFAC makes it easy to accurately screen and identify entities that are on sanction lists. It indexes dozens of government watch lists and other highly accurate sources to provide relevant information. This data is backed by experienced compliance experts, making the entire process highly reliable.

Flexible Deployment

This platform offers a ton of deployment options to meet your organization’s specific needs. You can choose from options like one-at-a-time, ad hoc, and screenings for everyday checks based on your organization’s needs. It also offers a suite of value-added OFAC compliance options.

Easy-to-use Interfaces

A highlight of this tool is its easy-to-use interfaces that make it easy to find what you want. Its search capabilities are also notable and is backed by an in-house support team.

Overall, Visual OFAC helps organizations seamlessly comply with OFAC and AML requirements.

Pros:

- Flexible and can be adapted to any environment.

- Multiple layers of built-in redundancy.

- Excellent customer support.

- Automated re-screening.

Cons:

- Limited documentation.

- No on-premises deployment.

Contact the sales team for further steps.

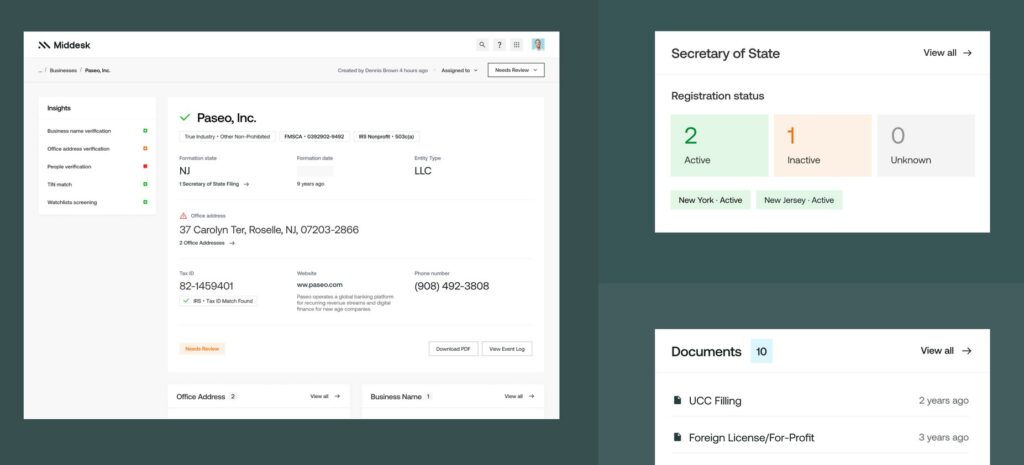

5. Middesk

Middesk is a business identity platform that helps U.S. companies meet mandatory compliance requirements like OFAC. With its suite of identity products, Middesk ensures companies can verify both individuals and businesses to avoid any associated risks.

Source: Middesk

Let’s run through Middesk’s features to understand how they can benefit your organization.

Unified Platform

You can use Middesk for a wide range of verification, underwriting, registration, filing, and monitoring tasks. It is a unified platform for verifying entities belonging to different nationalities. Through this comprehensive verification process, you can identify entities that are in the sanction lists of OFAC and AML.

Flexible and Customizable

Middesk offers flexible features that can be customized to meet your organization’s specific requirements. At the same time, it provides accurate and the latest data to ensure you are always compliant with the changing sanction lists.

Easy to Set Up

Another advantage of Middesk is its ease of setup and use. More importantly, its APIs help integrate with any tech stack. Middesk’s dashboard is also well-designed and displays the most recent and relevant information, for data-driven decisions.

With such features, Middesk can help with KYB, KYC, AML, and OFAC, especially for fintechs, banks, and lending companies.

Pros:

- Good customer service.

- Improves the efficiency of registration.

- Easy user onboarding.

- Highly flexible and scalable.

Cons:

- Status information requires more clarity.

- Hard to translate documents to tasks or actions.

Thus, these are some of the best OFAC compliance software. Before making your pick, check if your organization has mandatory compliance requirements with other regulations like GDPR, and if your selected software meets them. At the same time, focus on user onboarding experience and ease of use as well.

Final Thoughts

OFAC is a mandatory framework laid down by the U.S. Department of the Treasury and applies to all businesses that operate in the U.S., work with U.S. people, and use U.S.-origin goods. With this framework, the Department of Treasury imposes trade restrictions on companies operating in certain countries from a national security and foreign policy alignment perspective.

That said, OFAC is only a framework with five essential components, and the exact implementation depends on each organization. This is where it gets tricky because sanction lists and the geopolitical environment are dynamic and always evolving. Moreover, non-compliance can lead to hefty fines and even civil and criminal lawsuits.

To avoid these hassles, consider using automated data lists and tools that can help you comply with OFAC without too much pressure on your resources. In this guide, we looked at five tools that can ease the compliance process while providing the latest data lists. We hope you can leverage these tools to enhance compliance with OFAC with minimal time and effort.