Businesses continuously face risks from many internal and external sources. Foreseeing these risks and planning for them can reduce their impact on an organization’s operations and profitability. However, given the complex nature of risks and the multitude of sources, it’s not possible to manually identify risks. This is where Enterprise Risk Management (ERM) platforms come into play.

Moreover, many industry bodies and governments recognize the importance of ERM and lay down rules that mandate organizations to implement them within their operations. To address these compliance requirements and to protect operations from potential risks, organizations need the right ERM.

Read on as we discuss the top SaaS platforms available today for ERM compliance.

What is ERM?

ERM is a comprehensive and organization-wide strategy that’s implemented to identify and mitigate risks. It encompasses many types of risks like financial, operational, strategic, and compliance-related risks.

Unlike traditional risk management approaches, ERM takes a holistic view by considering many factors and analyzing them together for greater insights. It also uses technology to continuously gather and analyze data points to support informed decision-making.

Moreover, the growing complexity of compliance requirements has led organizations to use ERM compliance frameworks to continuously assess operations against the different compliance points. ERM also helps with automated risk identification, reporting, and custom workflows for mitigating them.

Due to these features, ERM is increasingly becoming an important part of an organization’s tech stack. However, not all ERM tools are built the same, and this is why we assess the top ERM platforms to help you select the right one.

1. Mitratech

EnterpriseInsight from Mitratech is a next-gen platform that overcomes the limitations of traditional ERM tools. Its pre-built enterprise risk templates make it easy to assess the risks of your processes, products, applications, and even service providers and vendors. Overall, it provides comprehensive visibility over your enterprise risk landscape.

Source: Mitratech

Key Features

- It offers a Cybersecurity Assessment Template (CAT) to evaluate cybersecurity risks for remote work.

- Business Continuity Planning (BCP) assesses the vulnerabilities in your processes.

- Configurable role-based credentials for secure access control.

- Visualizes, generates, and exports information to reports.

- Sends alerts and reminders for action items.

- Intuitive user interface with comprehensive user management.

Pros:

- Comprehensive integration of risk silos.

- Efficient compliance reporting.

- Automated approval workflow.

- Easy implementation.

- Complete visibility.

Cons:

- Higher focus on cyber risk.

- Expensive.

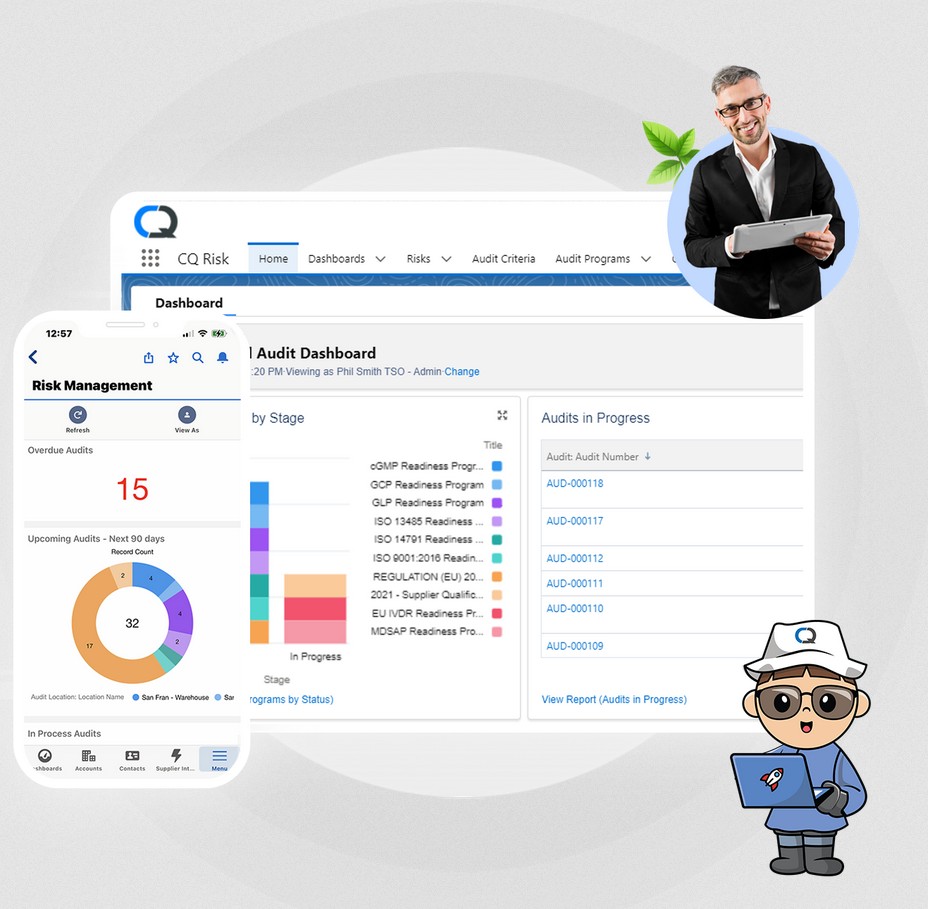

2. ComplianceQuest

ComplianceQuest is another cloud-based platform that offers comprehensive risk mitigation and compliance capabilities to boost the safety and efficiency of your operations. It consolidates different risk points and turns them into a competitive advantage for your business. In particular, its risk management suite provides real-time and trending data to help you make the right decisions.

Source: ComplianceQuest

Key Features

- Uses AI to predict, assess, and rank risks.

- Automates compliance with regulatory standards like ISO, FDA, OSHA, and more.

- Provides a centralized repository of identified risks.

- It evaluates and identifies risk and compliance weaknesses across your organization.

- Supports audit and document controls for regulatory reporting.

Pros:

- Strong integration with Salesforce.

- Customizable compliance frameworks for different industries.

- Third-party risk management tools.

- Cross-departmental collaboration.

Cons:

- Dependence on Salesforce, as it’s built on that platform.

- Complex setup.

- Limited standalone adoption.

3. RiskWatch

RiskWatch is an automated risk and compliance platform that allows businesses to assess, identify, and mitigate risks. It uses AI to collect and analyze information for predicting risks and tracking progress. RiskWatch is highly customizable and can fit well into different organizations.

Source: RiskWatch

Key Features

- Performance assessment to identify gaps in compliance

- Identifies, assesses, and prioritizes risks across your organization.

- Creates and manages policies and procedures.

- Handles third-party risk assessment and management.

- Mitigates cyber threats and vulnerabilities.

Pros:

- Scalable and robust.

- Generates detailed reports.

- Automated reminders.

- Interactive dashboard for visualization.

Cons:

- Complex customization.

- Training is required for using advanced features.

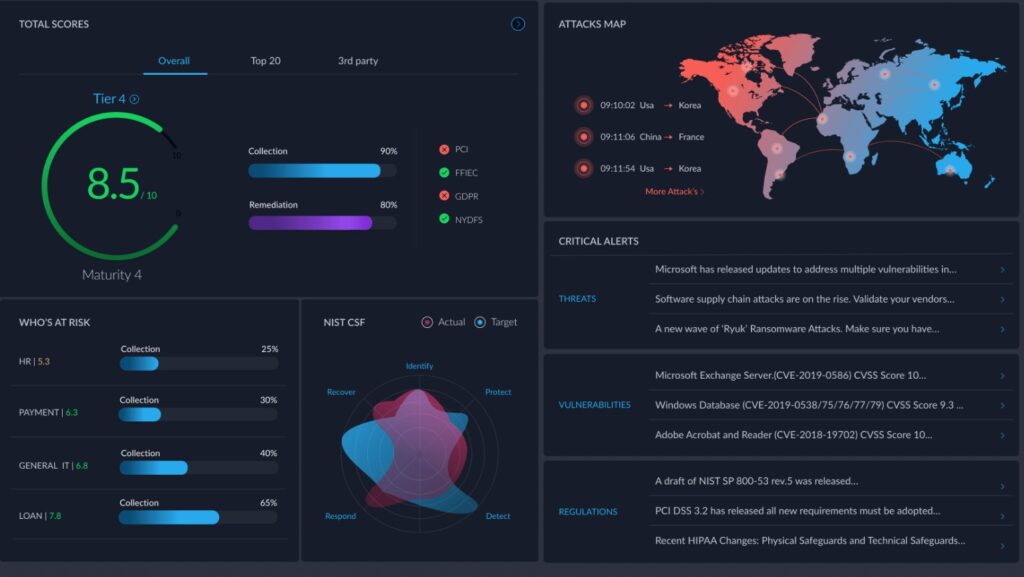

4. Centraleyes

Centraleyes is a cyber risk management platform that helps organizations create and define risk frameworks based on changing needs. Alongside this flexibility, it offers thousands of pre-populated templates that can be used as-is or modified to meet specific requirements. With these capabilities, you can achieve cyber resilience and meet compliance regulations.

Source: Centraleyes

Key Features

- AI-powered automation for risk assessment and compliance.

- Real-time risk visualization with heat maps and dashboards.

- Third-party risk management to assess, categorize, and prioritize risks.

- Executive reporting for strategic decision-making.

- Automated workflows, questionnaires, and smart data feeds for internal risk and compliance.

- Compatibility with 100+ risk and compliance frameworks.

Pros:

- Comprehensive dashboards and visualizations.

- Extensive support for frameworks.

- Works well for multiple industries.

- Saves time with pre-loaded questionnaires and automated workflows.

Cons:

- Focus on cyber risks.

- It could require training, especially for new users.

5. AuditBoard

AuditBoard is a complete audit, compliance, and risk management tool ideal for internal audit teams and risk managers. It streamlines risk assessments and tracks regulatory compliance for compliance teams. Moreover, it supports key frameworks like NIST, ISO, GDPR, and SOX, making it a comprehensive tool for GRC activities.

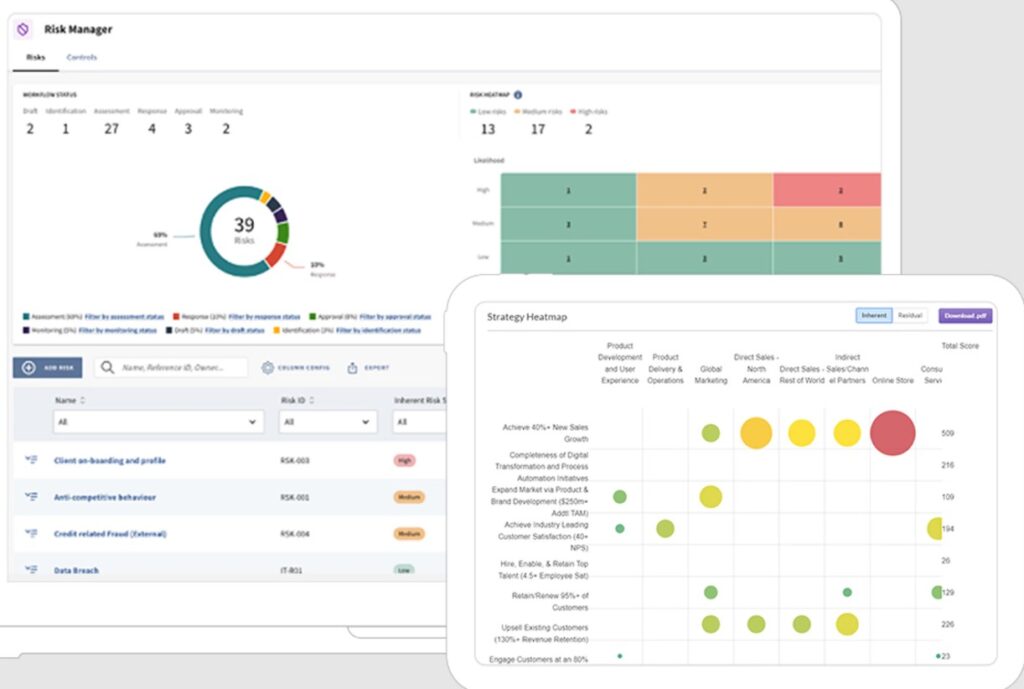

Source: AuditBoard

Key Features

- Provides real-time access to risk assessments, control testing, and other issues identified by different teams in your organization.

- Offers 200+ integrations to improve compliance.

- Supports collaboration and documentation.

- Generates detailed and insightful reports.

- Uses AI for intelligent recommendations, automation, and contextual insights.

- Enables no-code analytics to simplify control testing and prioritize remediation.

Pros:

- Strong audit management.

- Seamless integration.

- Real-time collaboration among teams.

- Combines audit, risk, compliance, and ESG in a single tool.

Cons:

- Fewer risk modeling features.

- Customization requires technical expertise.

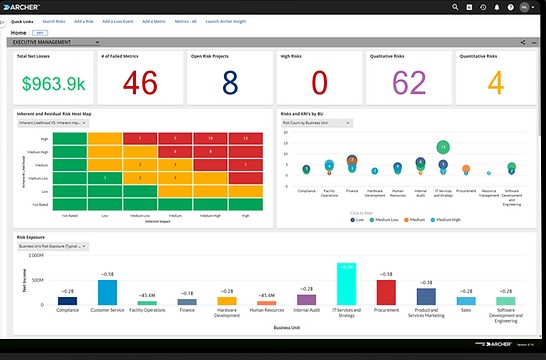

6. RSA Archer

RSA Archer, a GRC solution from RAS Archer and Deloitte, helps businesses manage risk and continuously comply with different frameworks. It allows teams to assess, monitor, prioritize, and address risks effectively while meeting compliance requirements.

Source: Archer

Key Features

- Supports collaboration and a streamlined structure to achieve business continuity.

- Promotes a strong compliance culture within organizations while reducing compliance costs.

- Elevates risk management by moving from a siloed to an integrated framework.

- Manages assets and protects IP.

- Consolidates and assesses vulnerabilities for quick remediation.

Pros:

- Highly customizable to fit different industries.

- Strong reporting and analytical capabilities.

- Integrates well with the most popular platforms.

- A centralized and clear view of risks and vulnerabilities.

Cons:

- It has a steep learning curve.

- Implementation and customization can be time-consuming.

- Requires a reliable IT infrastructure.

7. Diligent One

Diligent One is another popular ERM compliance platform that helps organizations manage enterprise risks and regulatory compliance. It offers a suite of tools for risk assessment, internal audits, policy management, third-party oversight, and more. Furthermore, it supports popular regulatory frameworks like NIST, ISO, SOX, ESG, and GDPR.

Source: Diligent One

Key Features

- Provides insights for informed decision-making.

- Identifies and manages risks to avoid financial and reputational losses.

- It combines GRC and board governance, making it a comprehensive platform for large organizations and government agencies.

- Supports third-party risk management and vendor compliance monitoring.

- Offers AI-powered insights and automation for greater efficiency.

Pros:

- Comprehensive policy and audit management.

- Customizable dashboards.

- Scalable and flexible.

- Supports collaboration.

Cons:

- Too complex for SMBs.

- It can be expensive.

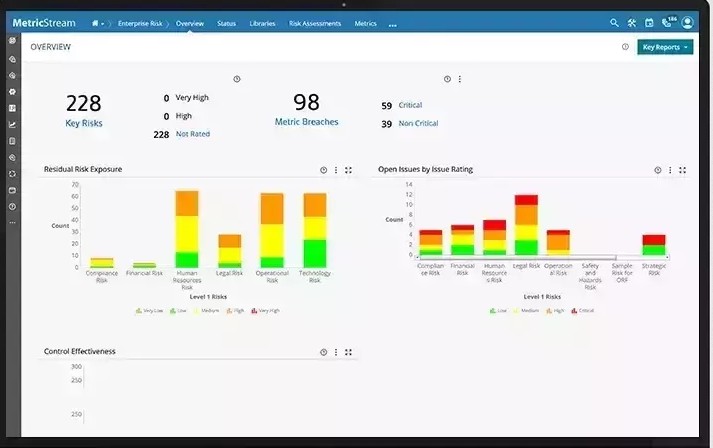

8. MetricStream

MetricStream is an AI-powered GRC and ERM solution that provides integrated risk and audit capabilities for large organizations. It strengthens compliance posture and prevents penalties due to non-compliance. Also, its modern risk management approach helps executives make informed risk-aware decisions.

Source: MetricStream

Key Features

- Helps understand risk exposure at multiple levels and take the necessary actions for remediation and mitigation.

- Uses qualitative and quantitative parameters to establish your risk profile.

- Provides real-time insights into risk management processes for continuous monitoring and improvement.

- Uses analytics, heatmaps, charts, dashboards, and reports for smarter decisions.

- Supports cross-department collaboration through a federated and centralized data model.

- Leverages AI/ML to reduce redundancies and identify risk-related issues.

Pros:

- Strong compliance tracking.

- AI-powered insights.

- Scalable.

- Supports many regulations and standards.

Cons:

- Requires training.

- Complex setup process.

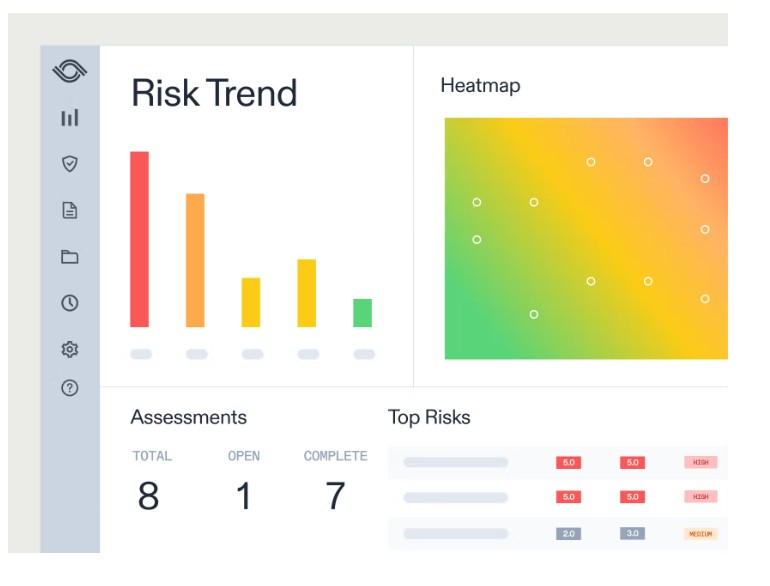

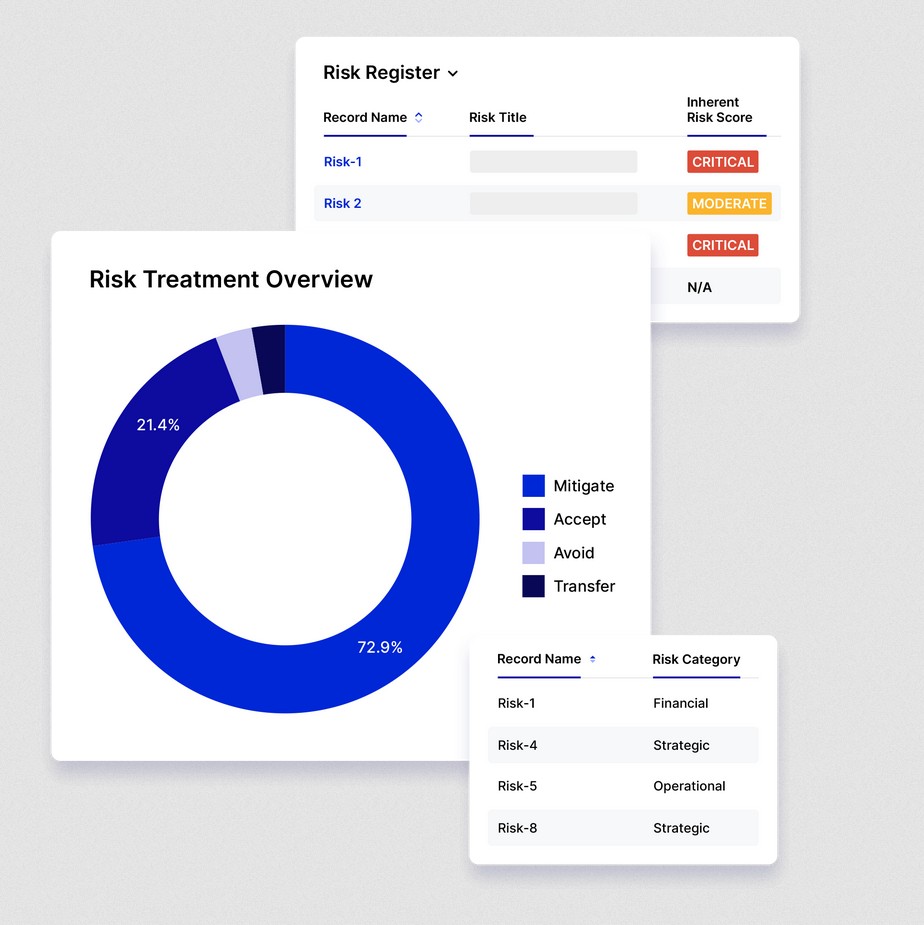

9. LogicGate

LogicGate is a flexible ERM that identifies and prioritizes risks threatening your organization. Its connected view of risks and controls enables you to quickly assess each risk and take the required action. Its automation, dashboards, and analytics allow you to prioritize risks and make informed decisions to mitigate them.

Source: LogicGate

Key Features

- Eliminates manual workflows with automated workflows.

- Its pre-configured risk scores help prioritize risks, so mitigation is faster.

- Connects seamlessly to other applications for seamless data flows.

- Easy to configure and adapt to your changing needs.

- Customized reports and dashboards

Pros:

- Quantifies risks where possible.

- Automates tasks to save time and effort.

- Centralizes data for greater visibility.

- Breaks down silos for collaboration and a comprehensive approach.

Cons:

- Customization may need expertise.

- Expensive for smaller organizations.

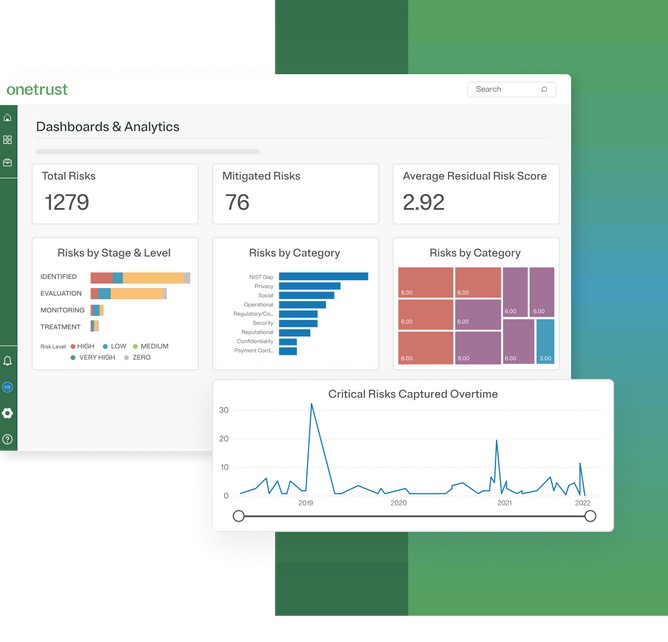

10. OneTrust

OneTrust ERM unifies your risk management initiatives and aligns them with your organization’s goal. It combines privacy, security, and compliance for a streamlined risk assessment and management. Moreover, it comes with built-in support for popular frameworks like the CCPA, GDPR, NIST, and ISO.

Source: OneTrust

Key Features

- Converts risk and compliance processes into small and manageable activities.

- Contextualizes risks across the entire business for better monitoring.

- Generates reports for the leadership to make informed decisions.

- Centralizes risk compliance, enabling you to prioritize resources.

- Maintains an asset inventory through automated assessments.

Pros:

- Optimizes risk and compliance.

- Builds logic into risk assessment for scalability and customization.

- Engages stakeholders.

- Automates reporting.

Cons:

- It can be expensive.

- Requires heavy customization for industry-specific compliance.

Thus these are the top platforms for ERM compliance.

Final Words

In all, ERM platforms enable you to stay on top of risks and mitigate their impact on your organization. These platforms gather data from different sources and analyze them to identify risks. Using advanced AI, they prioritize risks, so you can focus on the most important ones first. Many ERM platforms support collaboration and generate reports for informed decision-making. With such features, you have better control over your risks and can address them before they turn into financial losses.

The platforms described in this article offer comprehensive visibility into potential risks and help you quickly address them. We hope this information helps you decide on the tool that best meets your objectives and fits well with your operations.