The digitization of financial transactions has increased scams, frauds, money laundering, and other illegal activities. To curb these malicious activities, many governments and leading industry bodies have implemented a regulation called Anti Money Laundering (AML). Every organization that handles financial transactions must adhere to AML regulations.

As with any compliance, using tech platforms makes it easier to comply with AML regulations. But, you must choose the right platform that best meets your budgets, and requirements, and is suitable for your specific industry.

In this article, we will explore some free and paid AML compliance software to help you pick the right one for your organization.

What is AML Compliance Software?

AML compliance software allows organizations to meet current regulations and prevent financial crimes. They offer features like automated workflows, reporting, screening customers against sanctions and watchlists, and transaction monitoring. Undoubtedly, using AML compliance software increases your operational efficiency and provides visibility into fraudulent transactions. Additionally, it helps meet global standards and regulations like the Bank Secrecy Act (BSA), EU’s Anti Money Laundering Directives (AMLD), Financial Action Task Force (FATF) guidelines, and more.

All AML compliance software typically offers capabilities for Customer Due Diligence (CDD), Suspicious Activity Reporting (SAR), and risk scoring. Some tools even leverage AI and ML algorithms to proactively predict suspicious activities based on past patterns and user behavior. Depending on your needs, you can look for an appropriate tool.

Factors to Consider While Selecting the Best AML Compliance Software

Below are some factors to consider when selecting the right AML compliance software for your organization.

- It is a good idea to opt for a tool that combines closely related regulations like KYC and KYM with AML, as there are common requirements among them.

- Make sure to check if the software monitors financial transactions and identifies suspicious behavior in real-time.

- The tool must support checks like CCD and screen against sanctions and watchlists. Note that this is a fundamental feature of any AML compliance platform.

- It must generate easy-to-understand reports that provide comprehensive audit trails.

- Look for a tool that integrates well with your existing apps and tech stack.

- It also helps to have a tech platform that can grow with your businesses without incurring a ton of additional investment.

- Ensure that your choice aligns with your operations and budgets.

- It is good to have a tool that also meets other regulatory requirements like GDPR, SOX, etc.

- Choose a vendor with a good reputation backed by solid customer support.

Besides the above factors, evaluate a tool based on its fit for your organization. Cost is a critical factor too, and this is why we will discuss both free and paid tools.

Free AML Compliance Software

Here’s a look at the popular AML compliance software. Note that most tools described below have a free and a paid version, with the free version having limited features and access.

Marble

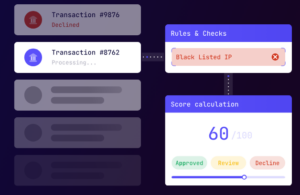

Marble is an AML compliance platform built specifically for financial services. Its open source version is free and is well-suited for small projects, while the paid version is a cloud or self-hosted version that’s available on demand.

Source: Marble

Key Features

- Its rule builder provides the flexibility to create complex rules through a simple user interface. No coding is required to build these rules.

- Supports peer and history trend comparisons.

- Uses common aggregates to calculate scores in real-time.

- Allows you to create custom lists for easy segmentation and tracking.

- Enables you to easily update through APIs or interfaces and manage version deployments.

- You can test multiple scenarios in its sandbox environment.

Pros:

- A good choice for startups.

- Offers extensive customization.

- Analyzes every transaction in depth.

- No prior coding is required.

Cons:

- No AI/ML features.

- Technical expertise is needed, as you have to download the open source from GitHub and install it.

AMLFilter

This is an enterprise-class open-source software used for monitoring AML compliance. It compares every transaction against AML watchlists and rules to reduce risks and meet compliance. It’s also highly efficient and accurate, with a low rate of false positives.

Key Features

- Cross-checks customer identities against global watchlists.

- Assigns risk levels to customers based on history and profile data.

- Detects unusual activities and flags them.

- Scans the Internet and media sources for adverse news.

- Sends real-time alerts and notifications.

Pros:

- High throughput, as it can handle thousands of transactions per second.

- Highly portable.

- Uses SSL 128-bit security and IP address validation.

- Easy integration through APIs.

Cons:

- Limited functionality.

- Lacks advanced tech like AI and ML.

Persona

Persona is a popular platform that offers identity and verification solutions. It offers a free tier that is ideal for startups and small businesses. Every account gets 500 free services per month, which includes government ID verification and watch list reporting meeting AML requirements.

Source: Persona

Key Features

- Supports KYC, KYB, and AML screening.

- Works well for passports, driver’s licenses, and other government-issued IDs.

- Checks individuals against OFAC, Interpol, and other international sanction lists.

- Allows the customization of workflows.

Pros:

- Free essential tools for AML compliance.

- Easy-to-use interface.

- Highly scalable.

Cons:

- Limited to just 500 free searches, which can get exhausted quickly.

- Advanced analytics and features are not available.

As you can see, the free tools are a good starting point, but as a business grows, it needs tools with more capabilities. These are available in paid tools.

Paid AML Compliance Software

Paid tools come with advanced features and the option to scale up or down as needed. This is why most established and growing businesses prefer these tools over the free ones that tend to be highly limited.

ComplyAdvantage

ComplyAdvantage is an AI-driven fraud and AML compliance software that reduces financial losses and risks of non-compliance to your business. According to the website, it reduces false positives by 70% and shortens onboarding cycle time by 50%.

Source: ComplyAdvantage

Key Features

- Detects suspicious transactions in real-time based on locations and user behavior.

- Monitors known typologies and trends to screen and stop risks before they occur.

- Allows you to customize risk profiles and rules to meet your business needs.

- Provides rich insights into financial transactions.

- Generates useful reports that can support informed decision-making.

Pros:

- AI-powered compliance for faster detection.

- Real-time screening against sanction lists.

- Continuous monitoring for changes and updates.

- Scalable, and hence suitable for businesses of all sizes.

Cons:

- Technical expertise is required for advanced integration.

- Manual reviews may be needed to counter false positives.

Protech

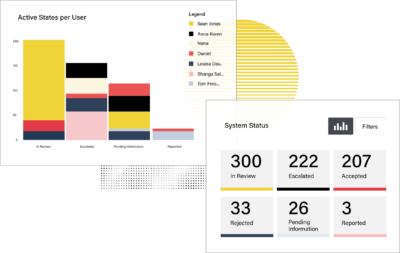

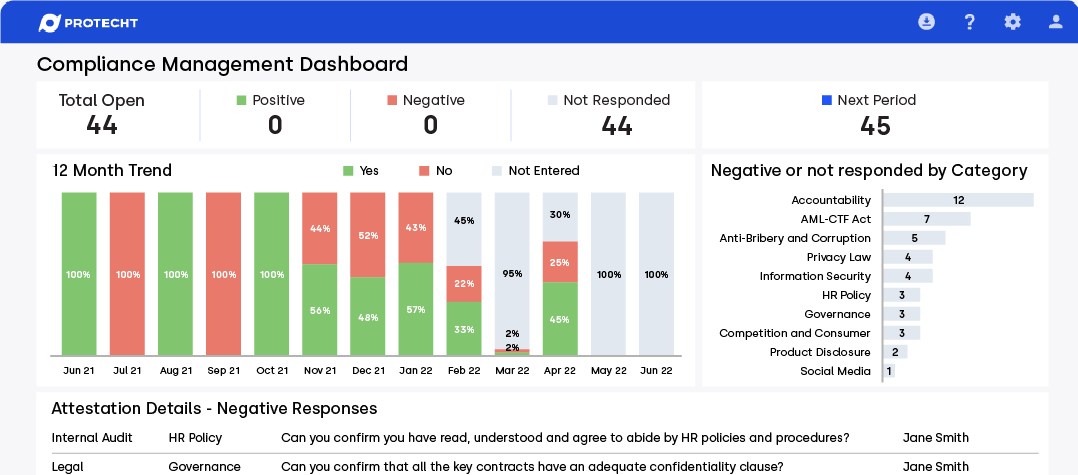

Protech is a comprehensive AML compliance management software that provides the required insights to drive strategic decision-making and improve employee engagement. Its automated workflows offer visibility while safeguarding your business from potential non-compliance.

Source: Protech

Key Features

- Centrally stores all your data in a structured format. This repository acts as a single source of truth for your entire organization.

- Intuitive and customizable dashboards and workflows provide comprehensive visibility.

- Provides real-time views and presentations of interconnected data.

- Allows you to select the modules you need depending on the regulations you want to meet.

- Automates report generation and distribution.

Pros:

- AI-based risk detection reduces false positives.

- No coding knowledge is required to configure.

- Highly customizable.

- Well-suited for multiple regulations.

Cons:

- Too complex for small businesses.

- It can be expensive.

Sumsub

Sumsub is an all-in-one AML compliance platform that provides identity verification, transaction monitoring, and fraud prevention through a single pane. It is widely used by financial institutions, fintech companies, crypto exchanges, and online businesses to manage KYC and AML requirements.

Source: Sumsub

Key Features

- Offer pre-screening through email and phone verifications.

- Monitors financial and crypto transactions.

- Supports a wide range of user verifications like age, business, address, video, ID, liveness, and database.

- Verifies companies by checking their documents, registry, ownership structure, and controls.

- Handles continuous monitoring to stay on top of changes.

Pros:

- Comprehensive for both individuals and businesses.

- Meets the latest FATF recommendations.

- Considers multiple factors while monitoring transactions.

- Completes KYB in three hours, as per the website.

Cons:

- Pricing is based on usage, making it expensive for companies with large volume transactions.

- Integrations are complex.

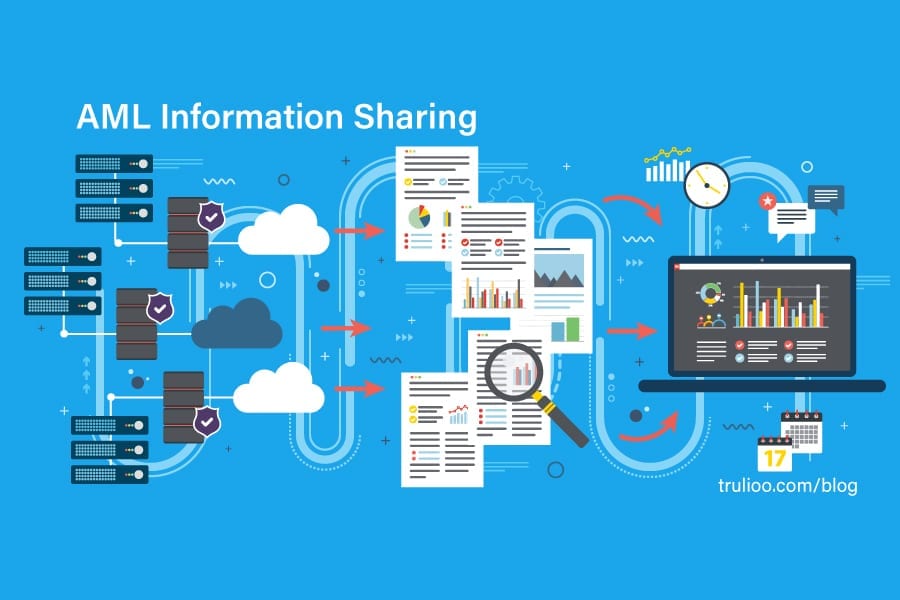

Trulioo

This is an advanced identity verification platform that combines KYC, KYB, and AML to fulfill some of the most complex regulations in the world. It screens users and businesses against 6,000 global watchlists and 20,000 adverse media sources for comprehensive identity checking.

Source: Trulioo

Key Features

- Uses a single API integration to fit well with your apps.

- Checks for Politically Exposed Persons (PEPs).

- It has access to print, online, and broadcast media to gain insights into customers and businesses,

- Optimizes onboarding to reduce dropout rates.

Pros:

- Uses sentiment analysis and relevance scores to reduce false positives.

- Continuously monitors watchlists.

- User-friendly interface.

Cons:

- It is expensive for small companies.

- Manual reviews may be needed.

Thus, these are the popular AML compliance platforms that offer good value for money.

Final Thoughts

To conclude, AML screening is mandatory for financial transactions and can attract heavy penalties for non-compliance. Given the complexity of these screenings, you require an appropriate tech platform that collates data and analyzes every entity against these lists and data.

In this article, we discussed some well-known free and paid AML compliance software. We hope this information is a good starting point for further research and the selection of the right tool for your needs.