Yesterday brought the publication of two reports by two of the three European Supervisory Authorities (ESAs), ESMA and EBA on the matter of crypto regulation.

ESMA provided Advice on Initial Coin Offerings and Crypto-Assets, while the EBA published a Report on Crypto-Assets.

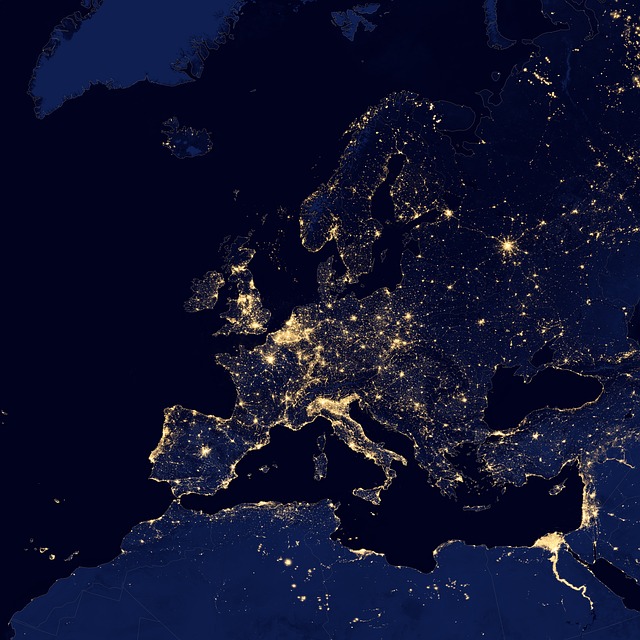

These two documents in particular together with the general European and Global approach towards the questions surrounding crypto regulation sometimes sadly reminds us of the infamous quote that has long been attributed to Henry Kissinger (“Who do I call if I want to speak to Europe?”). This isn’t a EU-only problem though: The US with its multitude of regulators is another jurisdiction that makes it easy to loose track of the different reports. And then there are other international organisations like the Basel Committee on Banking Supervision (BCBS), the Financial Stability Board (FSB), Financial Action Task Force (FATF), the Committee on Payments and Market Infrastructures – International Organisation of Securities Commissions (CPMI-IOSCO) that all have published recently relevant documents to determine the future of crypto regulation.

But let’s focus on Europe: the two reports are an excellent example of the current situation in terms of crypto regulation in Europe with a number of institutions issuing relevant documents. Exemplary, and only to name a few, are also the European Parliaments proposal to bring ICOs under its Crowdfunding rules, the Commission’s views as outlined for instance during last year’s roundtable on cryptocurrencies, or the efforts of national regulators like the FCA.

So, the EBA like other European institutions has been looking into virtual currencies for some time. In December 2013it issued a warning on virtual currencies in respect of the potential risks for crypto investors, which was followed by another warning note about cryptocurrencies– this time published together with the other European Supervisory Authorities ESMA and EIOPA. It also published two opinions that basically told national regulators to discourage traditional financial institutions from buying or selling virtual currencies as well as endorsing specific AML rules for crypto assets.

To put this latest paper into perspective, it basically constitutes the advice EBA gives to the Commission with regard to “the need for a comprehensive cost/benefit analysis to determine what, if any, action is required at the EU level at this stage to address these issues, specifically with regard to the opportunities and risks presented by crypto-asset activities and new technologies that may entail the use of crypto-assets”.

The report also highlights that “at the EU level it is important to provide clarity about the applicability of current EU financial services law to crypto-assets/activities to ensure that there is a common understanding of the extent to which current legislation addresses the risks and supports the opportunities relating to crypto-assets and DLT.” The lack of a common approach with regard to the application of existing securities regulation for instance has dominated the discussion for some time and only in the last 12 to 18 months the direction, into which lawmakers globally are going to go, has become more apparent. We will get to this crucial point in more detail when we tie it in with the ESMA advice on Advice on Initial Coin Offerings and Crypto-assets.

For sake of completeness, let’s look at the other points first:

The report analyses the guidance provided by the FATF and while the EBA gets behind the FATF recommendations (in particular, FATF has called for all countries to urgently take coordinated action to prevent the use of virtual assets for crime and terrorism), it will be very interesting to read the authorities own considerations in an upcoming report: later this month the ESAs will publish a Joint Opinion on the risks of money laundering and terrorist financing affecting the EU’s financial sector, which highlights potential money laundering and terrorist financing risks associated with new technologies, including virtual currencies.

Furthermore, the report as well provides guidance as to the possible measures that could be taken to promote consistency in the accounting treatment of crypto-assets. EBA in collaboration with the BCBS are currently working on the prudential treatment of banks’ exposures to/holdings of crypto-assets that could make the amendment or clarification of the prudential framework under the CRD/CRR as regards institutions’ exposures to/holdings of crypto-assets. In this context, the authority also notes that competent authorities currently do not have a specific Pillar 2 treatment for crypto-assets, which seems mostly due to the lack of clarity at the level of international and national accounting standard setting bodies in respect of crypto assets. As a result, the EBA urges the European Commission take steps where possible to promote consistency in the accounting treatment of crypto-assets.

And then, the report also names the steps that the EBA will take this year to enhance monitoring in relation to financial institutions’ crypto-asset activities, including with regard to consumer-facing disclosure practices. As set out in its detailed annual work programme for 2019, one of the EBA’s priorities is to focus on risks of financial innovations.

Getting back to the question of application of existing regulations and in order to do this the EBA conducted an analysis to determine whether crypto-assets may qualify as ‘electronic money’ within the EMD2 or as ‘funds’ under the PSD2. This is intended to complement ESMA’s analysis of whether crypto-assets may qualify as ‘financial instruments’ within the scope of the MiFID 2, where the EBA refers to the ESMA advice.

The EBA analysis concludes that the two relevant regulations it looked at – EMD2 and PSD2 – could in a handful of cases be applicable, but in more general terms it appears that a significant portion of activities involving crypto-assets do not fall within the scope of current EU financial services law, but may fall within the scope of national laws.

This conclusion in itself provides very little additional value for the overall discussion. The EBA stresses though that while there does not seem to be any apparent risk for financial stability due to activities related to crypto assets, there are some significant concerns in respect of consumer protection, market integrity and level playing field. For these reasons, the EBA advises the Commission to review whether “EU level action is appropriate and feasible”, which is somewhat remarkable given the apparent discrepancies in terms of application of financial services laws and the aspect of consumer protection. EBA then goes on to stress the need for an approach that is holistic and balance, activities-based and with a focus on the access points to the traditional financial system and consumers, but most importantly for a coordinated international response

And then there is, of course, the analysis of ESMA: the European regulator found that most regulators of the EU’s member states felt that a number of crypto assets qualified as transferable securities or other types of MiFID financial instruments. ESMA would not need not touch upon the classification itself as it is the responsibility of an individual National Competent Authority (NCA) and will depend on the specific national implementation of EU law and the information and evidence provided to that NCA. It showed however the differences of the implementation of EU law across the member states and the information and evidence provided to that NCA.

ESMA then went on to determine that if crypto assets indeed qualify as transferable securities or other types of MiFID financial instruments, a full set of EU financial rules is likely to apply to its issuer and firms providing related services. So, ESMA analyzed the impact of the Prospectus Directive, the

Transparency Directive, MiFID II, the Market Abuse Directive, the Short Selling Regulation, the Central Securities Depositories Regulation and the Settlement Finality Directive, with regard to cryptos and found ESMA a number of gaps and issues in the existing regulatory framework. The details of the analysis of these regulatory initiatives on crypto assets can best be found in the ESMA paper itself and there is little merit to reproduce them here, in particular since each ICO or crypto-related activity needs to be reviewed on an individual basis to understand, which rules might be applicable.

Instead, it should be noted that ESMA stressed that some member states are considering some bespoke rules at the national level for all or a subset of those crypto-assets, the European regulator made it clear that only an EU-wide approach can create a level playing field, mirroring the statement made by the EBA above.

What remains is that another little piece has been added to the overall puzzle that is crypto regulation in Europe and elsewhere. It is also clear however that more time will pass until the full picture becomes visible.