The identity verification market continues to grow every year, and by 2027, global spending could be over $18 billion. No organization wants to deal with the stress of fraud and illegal transactions. However, it is a pressing problem for financial companies. Know Your Customer (KYC) procedures should be an integral part of your risk management to secure your business. KYC checks can help you assess a customer’s risk and stay compliant with Anti-Money Laundering (AML) laws.

Checking The Quality Of Your KYC Compliance

Regulators want you to have KYC procedures in place to secure your business. But it’s important to realize that it’s not only about having a system set up. The quality of your KYC compliance is also a benchmark for regulators. Can you honestly say that you are fully compliant? If you don’t get it right, the repercussions can be severe. It can damage your company’s image and reputation. Also, you can expect heavy fines or sanctions.

Set Up Effective KYC Procedures

There are three main areas your business has to have to ensure that you have effective KYC procedures:

- Customer Identity Program (CIP) – you need to know a customer’s identity. You need to have the ability to know who they are.

- Continuous Monitoring – You have to assess a customer’s financial activities. This monitoring is a constant process. You need to report any suspicious transactions immediately.

- Customer Due Diligence (CDD) – Understand the level of risk a customer poses for your company. CDD can also involve checking the owners of companies.

Who Needs To Follow KYC Regulations

Any financial institution with customer accounts requiring account maintenance needs to follow KYC regulations. In effect, KYC regulations can apply to any business that works with money. But this level of responsibility can also pass down to business patterns. For example, any business partner of a bank needs to follow KYC regulations. It’s better to set a system in place than suffer severe financial consequences.

The Power Of Protocols

Protocols are potent tools in different work situations. Consequently, it is possible to use more than one protocol simultaneously in a business. You can use protocols for auditing, accounting, authorization, and authentication. With identity verification, a network authentication protocol is an industry-standard way of confirming a user’s identity when accessing network resources.

When a network administrator logs into a network device, the device checks if the username and password are correct. The device does this by checking against existing user account details. This process is hard to manage if you have several devices. These existing accounts could be accessed easier by using a protocol. The devices access the account details from a central server using a protocol.

A Network Authentication Protocol For Identity Verification

There are many different tools and systems on the market to help you manage your KYC commitments. MIT created the protocol in the 1980s to deal with network security problems. It gives strong authentication for client/server applications; Microsoft even used it in Windows 2000. It can allow you to secure your information systems across your whole business.

Strong cryptography means that a client can prove its identity to a server across an insecure network. This system works vice versa as well. Once the client and server have confirmed their identities, they can encrypt all their communications. It has three key components, a client, a Key Distribution Centre (KDC), and a server. The main benefit is that a device can be unsecured and still communicate information securely.

Speed Up KYC Checks By Using An App

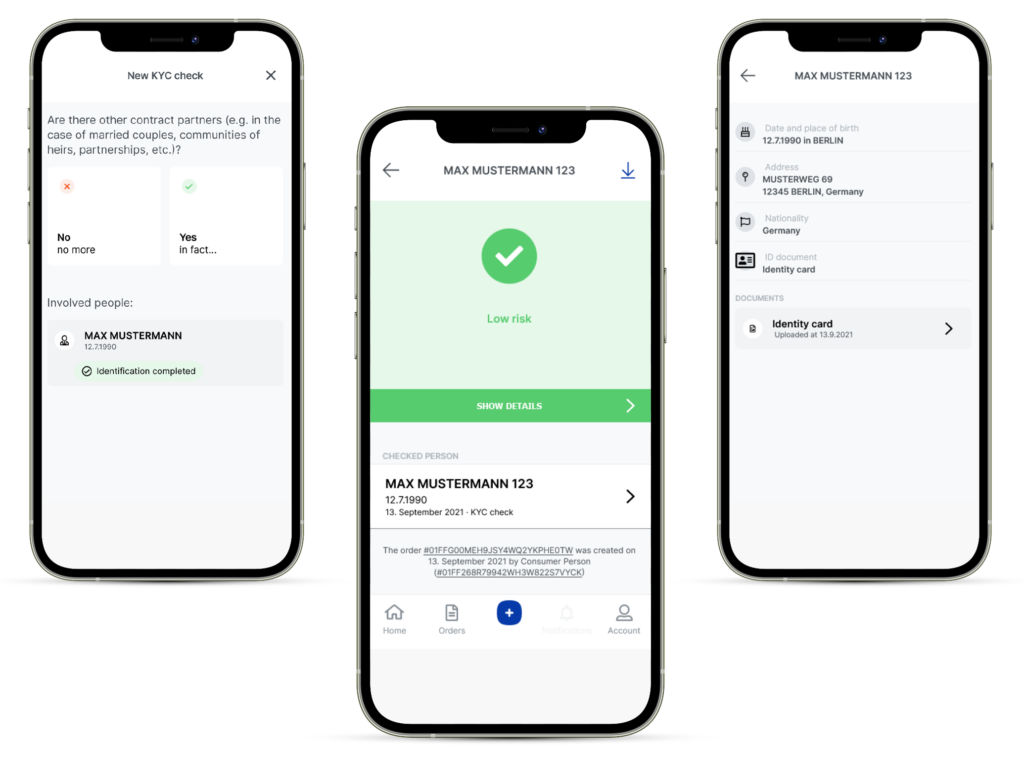

Kerberos Compliance has a KYC app that helps you perform customer identification checks via your smartphone. Kerberos Compliance is one of the leading providers of digital solutions in the field of money laundering prevention in Germany. It might seem strange to use your mobile phone if you like to use a PC. However, the app is easy to use via step-by-step instructions, advising which documents you need. You then scan the document with your camera and answer several questions. Moreover, the KYC app also has a browser version so even if you prefer to use your PC, you are free to do that.

Once you submit the relevant document to the app, Kerberos does a KYC verification and gives you the results after a short time. You receive a recommended action to reduce risk and make the transaction legally compliant. You can also use the system to record any KYC measures, and you can refer to Kerberos for any audits.

It’s an easy way to fulfill your due diligence obligations, and there are some distinct benefits to using the tool:

- The checks and documents on your phone are 100% legally compliant.

- The whole process is quick, so you can keep customers and clients happy.

- You will use less paperwork.

- You will have access to a speedier accounting system.

Planet Compliance asked Andreas Engels, Managing Director at Kerberos, to explain how the app can help with money laundering prevention. Andreas said. “Thanks to the automated execution, the check with our KYC app achieves a speed that would not be possible using manual methods. Within minutes, it can be determined whether a possible transaction can be carried out in a legally secure manner.

With this, we want to continue our mission to make effective money-laundering prevention possible for everyone. Our clients, especially in the real estate sector, already use and benefit from the KYC app, which has also recently been complemented by the Kerberos platform, where clients can digitally view and manage all their services – from risk analysis, policies to KYC queries and trainings – at a glance”.

Know Your Customer, And You Will Know Yourself

In our digital era, cybercriminals become more resourceful every year. It’s hard to always stay on top, but KYC compliance will make your organization more secure. There are many ways to implement KYC in your workplace. Consider using a modern app to speed up your processes and minimize paperwork. KYC solutions focusing only on simple ID checks will very soon not be sufficient as criminals are working constantly on new methods to outsmart existing systems. Using innovative KYC solutions such as KYC apps will help you to be less prone to fraud and other illegal activities. Your compliance team can work smarter together, protect the company, and excel.

Sally Leslie

Sally creates B2B content for businesses, entrepreneurs, and startups. She has a PR degree and a background in business development and sales. She is passionate about motivation, time management, and the changing world of finance.

Write a guest post for Planet Compliance and share your thoughts and ideas with the world. We can’t wait to hear from you!