The EU’s Action Plan on Financing Sustainable Growth,

When the European Commission last year published its Action Plan on Financing Sustainable Growth, it did so with bold intentions. The plan was to reorient capital flows towards sustainable investment in order to achieve sustainable and inclusive growth; to assess and manage relevant financial risks stemming from climate change, resource depletion, environmental degradation and social issues; and to foster transparency and long-termism in financial and economic activity.

With these ambitions sustainable finance goes beyond climate to include all aspects of environmental aspects and not limited to climate change alone as well as social and governance objectives.

Preparation Work

For financial institutions this means that they will need to start preparing for the impact of new rules if they haven’t already begun to address these since the focus on sustainable finance is already firmly fixed in the priorities of the European Supervisory authorities.

The problem was that other than general parameters only little was available in terms of concrete rules. This has taken a turn when Parliament and Council adopted the Commission’s proposal for a Regulation on disclosures relating to sustainable investments and sustainability. Another important piece of the puzzle that is going to be the future framework was the publication of the technical report on an EU classification system for environmentally sustainable economic activities, short Taxonomy, by the Technical Expert Group on Sustainable Finance

The Taxonomy for Sustainable Finance

The Taxonomy sets out so called technical screening criteria that are to be used as performance for economic activities which a) make a substantive contribution to environmental objectives – starting with climate change mitigation or climate change adaptation; and b) avoid significant harm to other EU environmental objectives (pollution, waste & circular economy, water, biodiversity). In terms of use, institutional investors and asset managers marketing investment products as environmentally sustainable would need to explain whether, and how, they have used the Taxonomy criteria. Investors could state that they are seeking to invest in Taxonomy-eligible activities or disclose their own preferred approach to determine that their investment is environmentally sustainable. Having a EU Taxonomy therefore provides clarity for investors through a common language, puts environmental data into context, supports different investment styles and strategies, saves time and money, and helps avoiding reputational risks among a range of other benefits the Technical Report describes in its 414 pages.

The Taxonomy will eventually be used by institutions marketing portfolio management, UCITS funds, alternative investment funds (AIFs), insurance-based investment products (IBIP), pension products and pension schemes as environmentally sustainable could use the Taxonomy in the design of their fund-products but could also be relevant beyond this remit as provides a common set of standards against any form of sustainable finance can be measured against.

Practical Use

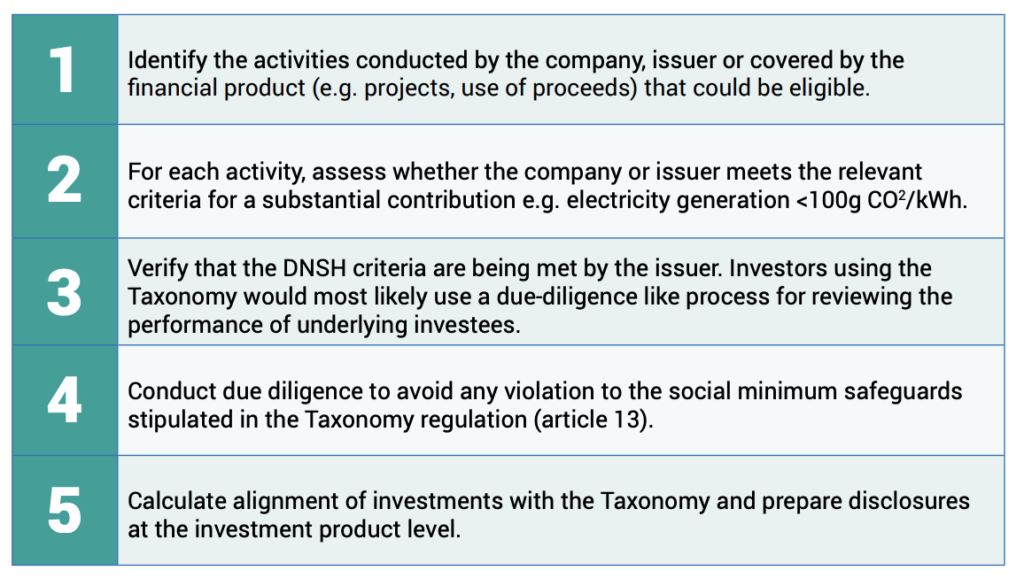

The report also proves a simple five step procedures for investors to use the proposed Taxonomy:

On the question what companies should do, the report suggests that Companies should provide Taxonomy related data to investors via the revised guidelines accompanying the Non-Financial Reporting Directive. The guidelines recommend that companies provide their revenues or turnover broken down according to the taxonomy classification as well as how they meet DNSH criteria and their capital expenditure in taxonomy-eligible activities.

The direct benefit for companies and projects whose activities meet the taxonomy criteria is that they are eligible for both environmentally oriented equity and debt funds. That is also the case for those companies and projects that develop technologies and products that are critical for other sector companies to meet environmental objectives.

Even beyond these immediate benefits, preparation for the application of the Taxonomy seems a reasonable approach though in light of the impact the sustainable finance framework is going to have.

Next Steps

Following the report, the Technical Expert Group held a call for feedback from 3 July until 16September 2019, and is now in the process of analysing the responses and advise the Commission on how to take the feedback forward.