Until recently, cryptocurrency was viewed with derision by many in the traditional finance industry. But new advances are forcing a rethink.

Bitcoin and banks have always had an uneasy relationship. This is beginning to change as governments and fintech companies warm up to the idea of trading and holding cryptocurrencies for profit.

However the vision of Bitcoin was never to be a mere speculative asset, but to become a supplement (or replacement) for traditional financial institutions. The rise of Decentralized Finance (DeFi) means that this vision may be closer to reality than many thought. But a number of hurdles still remain.

Replacing Fiat Currency Is No Simple Task

There are two key reasons that Bitcoin and other cryptocurrencies have failed to achieve mainstream adoption: utility and access. While there are a number of tokens, such as Ripple, that have been adopted by mainstream finance players, these are generally examples of blockchain technology being adapted to existing financial payment systems. This is undoubtedly important, but it isn’t what most crypto analysts and enthusiasts would call a “true” cryptocurrency.

The long-term philosophical aim of advocates is to create decentralized alternatives to real-world financial products and systems. For many the logical starting point is currency.

Theoretically, a currency free from the control of financial institutions and central banks would be a fairer, more stable, foundation upon which to build an economy free from state interference. Bitcoin would act as a rough equivalent of an asset-backed currency that would help prevent artificial value changes.

While the idea is certainly enticing, many crypto enthusiasts have overlooked the reasons that modern currencies work. Liquidity is key. Accessing and spending fiat money is simple for most people.

At the moment, cryptocurrencies are not necessarily simple to obtain and are far more difficult to spend once acquired. This makes them serviceable as speculative assets but limits their utility as a replacement to fiat. But there is a solution.

Solving the Utility Challenge With Smart Contracts

Decentralized Finance (DeFi) apps (called DApps) are designed to create decentralized equivalents of existing financial products. There are a large variety of them in development. The most important to the cryptocurrency ecosystem are DeFi exchanges and lenders. Both these applications provide some of the necessary framework upon which a mature economic ecosystem could be built.

DeFi lenders have been the driving force behind the DeFi boom over the latter half of 2020. Instead of the lengthy due diligence process that traditional lenders are forced to rely upon, DeFi lenders use smart contracts. These smart contracts are essentially programs with specifically-coded triggers.

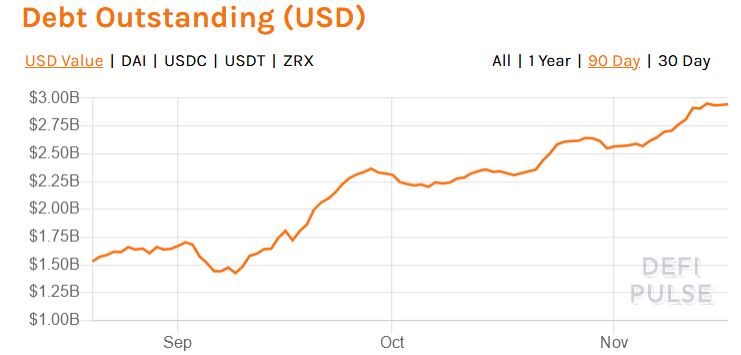

These apps have proven particularly popular with borrowers and there is over $2.9 billion in outstanding loans on DeFi platforms. The majority of these are based on DeFi lender Compound.

DeFi apps help to connect willing lenders with borrowers. In order for a contract to “start” there needs to be:

- A lender willing to put up cryptocurrency as collateral in exchange for interest

- A borrower willing to commit to paying back that cryptocurrency plus any applicable interest.

The number of borrowers on DeFi platforms has grown rapidly (screengrab via DeFi pulse)

Another important development is centralized exchanges like Uniswap. These have been used to create specialized contracts that allow individuals to trade cryptocurrency using advanced options.

They have become increasingly popular over the past 3 months and in September Uniswap outpaced Coinbase in volume. Together with lending platforms these exchanges represent the beginnings of a decentralized ecosystem for cryptocurrency.

Significant Regulatory Hurdles Remain

Technology is one thing, legislative acceptance is another. There are positive signs for cryptocurrency, most notably the US government’s decision that it is permissible for national banks and federal savings associations to provide crypto custody services.

This move toward liberalization has helped pave the way for PayPal’s landmark decision to allow US users to buy cryptocurrency and make purchases using it within their own network.

However, it is important to note that most moves to regulate or legitimize Bitcoin and other cryptocurrencies treat tokens as an asset and not as legal tender. Indeed some states, such as Russia, have expressly banned cryptocurrency as a means of payment.

While it would be exceedingly difficult for a nation to completely ban cryptocurrency, mainstream adoption relies upon government approval.

The cryptocurrency ecosystem is developing the right tools to become a mature economic system in its own right, but only time will tell if governments are willing to allow it to co-exist with their own centralized systems, let alone supplant them.