Digital compliance from one source, at a glance and in an app format

The obligations under the Money Laundering Act (GwG) in Germany are numerous. This makes digital compliance solutions supporting obligated parties in managing their obligations without considerable paperwork and complicated procedures all the more important.

What role do 360-degree solutions and apps play in the context of effective and efficient money-laundering prevention?

Whether insurance companies, real estate agents, finance companies, precious metal or car dealers – the challenges surrounding compliance and money laundering prevention can quickly become overwhelming. Few regulations such as money laundering law have been subject to so many changes in recent years and can reach such complexity in practical compliance. This makes it all the more important to have compliance that is proactive so that problems are identified as early as possible to avoid heavy fines and reputational damage.

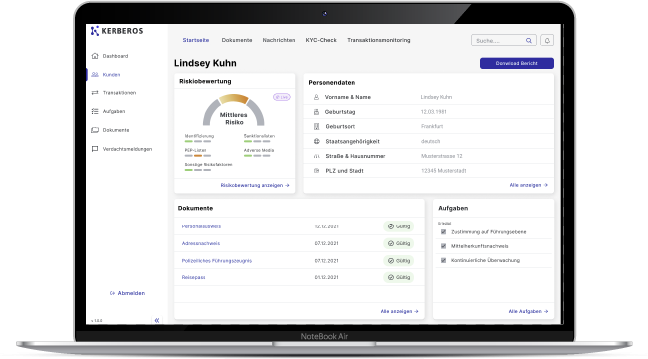

With the new Kerberos platform, we have taken another step in working towards our vision to digitise and automate compliance to the maximum, making it simple, affordable and actionable for all. On the platform, clients can manage all services, risk reports and KYC (“Know Your Customer”) checks from one source at a glance. This is to enable obligated parties, according to the Money Laundering Act, to conduct business without obstacles and concerns so that they can concentrate on their core business.

The Kerberos platform complements the Kerberos KYC app as another important milestone in digital compliance. Obligated parties can use the app to perform KYC checks in a legally secure and mobile manner. With the KYC app, real estate agents, for example, can fulfil their due diligence obligations flexibly and effectively. Retailers in particular benefit from simple applications in an app format.

On a clear basis, obligated parties without expert knowledge, can conduct legally secure transactions without obstacles. On their smartphone, customers can normally view the results of the customer identification in their app in just a few minutes. In addition to identifying the business partner, the check for risk factors is also ensured. This also includes the audit-proof documentation of compliance processes, an essential part of due diligence.

As a result, this means that everyday business is made easier, obligations under money laundering law can be met, and you are also safely prepared for audits by the authorities.

What are the next steps? With machine learning and artificial intelligence, the verification of transactions can reach a speed that would not be possible manually. This includes automated corporate KYC or the forecasting and early detection of expected money laundering cases.

The use of artificial intelligence should help to equip digital compliance for the future in order to protect companies from abuse by money launderers in Germany and Europe and thus create added value for all of us in society.