Know Your Customer (KYC) compliance is a fundamental requirement for financial institutions worldwide. As the name suggests, it helps a financial institution to understand each customer for safer operations. In particular, this check prevents banks from lending to individuals who are a part of a terrorist group. Also, banks and businesses can ensure that their customers are who they claim to be, preventing money laundering, fraud, and other financial crimes.

Traditionally, KYC compliance involved manual processes—collecting paper documents, verifying identity in person, and maintaining large repositories of customer data. However, with the rapid advancement of technology, digital ID verification has emerged as a game-changer in KYC procedures. This digital verification streamlines customer onboarding while strengthening the integrity of the verification process. It also prevents bias and other personal factors from impacting an organization’s decision-making.

In this post, let’s talk more about the rise of digital ID verification, how it fits into the broader KYC compliance framework, and why it’s becoming indispensable in today’s financial world.

The Evolution of KYC Compliance

Historically, KYC regulations emerged as a response to growing concerns over financial crimes, such as money laundering and terrorist financing. The global Financial Action Task Force (FATF), established in 1989, has set international standards that guide national governments in creating their own KYC frameworks. These standards enable financial institutions to have stringent mechanisms for verifying the identities of their customers and monitoring suspicious activities.

While KYC compliance can vary among jurisdictions, most follow the common steps mentioned below.

- Customer Identification Program (CIP): Collecting and verifying a customer’s identity using official documentation.

- Customer Due Diligence (CDD): Assessing the potential risk a customer may pose to the institution.

- Ongoing Monitoring: Continuously reviewing customer transactions to detect any suspicious behavior.

However, as financial systems became more complex and globalized, traditional KYC methods began to face limitations. Manual processes were not only time-consuming but also prone to human error. Additionally, the surge in cross-border financial activities and the rise of digital banking demanded a more efficient and scalable solution. This is where digital ID verification emerged as a convenient alternative.

What is Digital ID Verification?

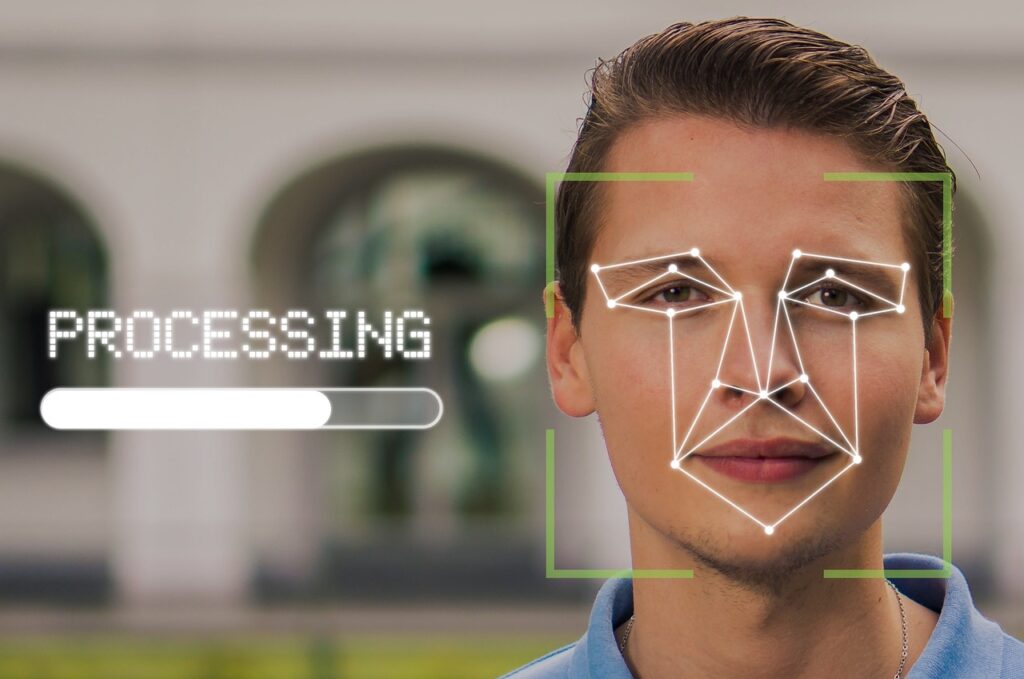

Digital ID verification is the process of authenticating an individual’s identity in real-time, using digital tools and databases. These systems use various methods to confirm a person’s identity, including:

- Biometrics like facial recognition, fingerprint scans, and iris recognition.

- Analysis of government-issued IDs like passports and driver’s licenses using AI and machine learning.

- Cross-reference of customer details with public and private databases to confirm identity and spot anomalies.

When these advanced technologies are integrated into the KYC process, the verification is smoother and more efficient. More importantly, businesses can easily meet regulatory requirements and reduce inaccuracies to improve the customer experience.

Why Does Digital ID Verification Matters for KYC Compliance?

So far, we have looked at KYC and digital ID verification, but why should you use this digital verification for your compliance? Here are a few important benefits.

Improved Security

Traditional KYC methods involve the submission of paper documents or scanned images, which can be tampered with or forged. Digital ID verification, especially when combined with biometrics, adds a layer of security that is difficult to bypass. For example, facial recognition software can compare a customer’s selfie with their ID photo to ensure they are the same person. Similarly, fingerprint recognition ensures that the individual is physically present during the verification process. Such biometric processes reduce the risk of fraud and identity theft.

Compliance with Global Regulations

Digital ID verification eases compliance with global regulations. Due to its many benefits, regulators in many jurisdictions are pushing for stricter KYC measures. A case in point is the European Union’s 5th Anti-Money Laundering Directive (5AMLD) which emphasizes electronic identification methods, including digital IDs, to streamline cross-border financial services.

More importantly, the audit trails of every verification are well-documented, making it easier to comply with audit requirements and respond to regulatory inquiries.

Faster Customer Onboarding

One of the biggest advantages of digital ID verification is the speed at which it allows businesses to onboard customers. Manual KYC checks can take days or even weeks, frustrating customers and leading to higher abandonment rates. With digital verification, this process can be completed in minutes, if not seconds.

This efficiency is particularly important in sectors like fintech, where businesses compete based on customer experience. Streamlined onboarding can provide a competitive edge as it reduces friction and provides a positive customer experience.

Cost Reduction

KYC compliance is notoriously expensive, with financial institutions often spending millions on manual processes and workforce management. A report from Consult Hyperion shows that every KYC can cost anywhere from $13 to $130, resulting in millions of dollars each year.

But by automating the identity verification process, these banks can reduce labor costs, minimize errors, and avoid hefty fines associated with non-compliance. The cost savings extend beyond onboarding, as digital systems can also facilitate ongoing monitoring and reduce the need for human intervention in routine compliance checks.

Scalability for Global Operations

As businesses expand globally, they require a scalable KYC solution. Verifying customers’ identities across different countries, each with its unique regulations and documentation requirements, can be a daunting task using traditional methods. Digital ID verification platforms can handle this complexity by integrating with international databases and leveraging global standards for identity verification. Besides streamlining the process, digital ID verifications can also quickly onboard customers from various regions without having to establish separate compliance infrastructures in each country.

Despite the above benefits, many challenges come with implementing digital ID verification.

Challenges and Concerns

Below are a few challenges that organizations must address to make the most of digital ID verification.

Data Privacy

With the increase in digital ID verification comes the challenge of safeguarding customer data privacy. In jurisdictions like the EU, the General Data Protection Regulation (GDPR) imposes strict guidelines on how customer data should be handled. Organizations using digital ID verification systems must comply with these data protection laws to avoid legal repercussions. Additionally, institutions must be transparent with customers about how their biometric and personal data will be stored, used, and shared. Any breach of trust in this area can lead to reputational damage and regulatory fines.

Technological Barriers

Not all customers have access to the technology required for digital ID verification. Some individuals may not own smartphones capable of supporting biometric verification. Also, KYC verifications may not be accessible to people with disabilities. This is where organizations must balance innovation with inclusivity to prevent their KYC processes from alienating certain customer segments.

Accuracy of Biometric Data

While biometrics offers better security, it is not infallible. Factors like lighting, camera quality, and facial changes over time can affect the accuracy of facial recognition. Similarly, fingerprints may not always be clear, especially for manual laborers whose prints may be worn.

Institutions must invest in robust technology and backup systems to address these issues. In cases where biometric verification fails, alternative methods should be available to ensure that genuine customers are not unfairly rejected.

The Future of Digital ID Verification in KYC Compliance

The future of KYC compliance lies in continued innovation. Emerging technologies like blockchain and decentralized identity systems are poised to further revolutionize digital ID verification. Blockchain, for instance, can enable the creation of self-sovereign identities, where individuals control their own identity data and only share it with institutions when necessary.

Such systems would not only enhance privacy but also reduce the need for repetitive verification processes. Once a customer’s identity is verified by one institution, it could be securely shared with others through the blockchain, streamlining KYC across the financial ecosystem.

In all, digital ID verification is transforming KYC compliance by offering greater security, improved efficiency, and better scalability. As regulatory demands continue to evolve and financial crime becomes more sophisticated, traditional methods are no longer sufficient. Financial institutions that embrace digital ID verification are better positioned to meet these challenges head-on while providing a seamless customer experience.