It must be tough to be in wealth management these days: first, the fund industry came under a lot of pressure from Exchange-Traded Funds (ETF) that are significantly cheaper than traditional investment funds who in turn often struggled to even generate better returns for the extra charge than the ETF’s that simply track an index. Now, it seems that the whole advisory model itself may come under threat by the rise of FinTech and its robo-advisors. But with all the talk surrounding the topic, let’s get a better understanding and have a look at the facts.

What’s a Robo-Advisor?

Wealth Management usually comprises of a combination of professional services, i.e. financial and investment advice, but also legal, accounting and tax advice, depending on how holistic the service is. Obviously, this comes for a fee, which in most cases limits wealth management to those individuals with deep pockets. However, the aspect of financial and investment advice in particular undergoes major changes due to the application of technology to drive down costs and achieve better results (though the other aspects are subject to their own form of disruption. For instance, read our recent article on LegalTech here.). Robo-advisors employ automated portfolio management based on algorithms. It’s an online service and thus eliminates the need for a human financial advisor from the equation. Robo-advisors employ the same or similar software as their human counterparts, but because of automation they can offer their services at a fraction of the costs and therefor making it accessible to the more average investor. In addition to lower costs, Robo-advisors also offer lower minimum investment amounts than traditional financial planners opening them to a wider audience. Having said that traditional wealth managers have also seen their wealthy clients moving to new providers or demanded the use of robo-advisors to reduce fees. However, millennials in particular have been the first among those who have picked up on the trend since they are in most cases simply more open to using online services.

Trends in Robo-Advising

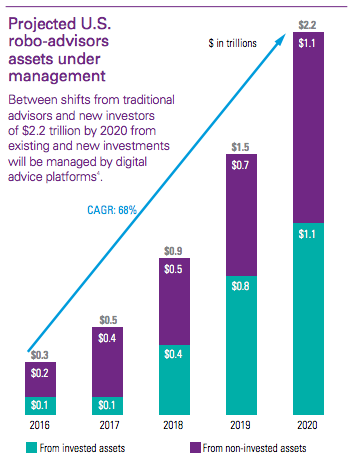

A recent KPMG report predicted that robo-advisors will be managing more than US$2 trillion in the U.S. alone by 2020, so it is clear why it’s not only newcomers battling for a piece of the cake. Traditional providers and banks have entered the market, too, but for them as well as FinTech start-ups it is important to understand that change has not reached its limits yet and that the sector is undergoing a continuous transition. Comparatively small income based on the low fee model combined with significant costs for sophisticated software means that the new business model has little room for manoeuvre. Eventually, it is likely to lead to a consolidation of the industry through closing down of some and the acquisition of others by competitors.

At the same time, consumers demand more innovation that the progress in artificial intelligence, machine learning and big data analysis readily seem to offer. Already it is suggested that hybrid models of human financial advisors supported by robo-advisors might produce better results combining the strengths of the both parties: a computer’s ability to digest large amounts of data, while the human financial advisor can focus on the personal aspect of the relationship.

In the same bracket falls the disruption of other professional services we already referred to above. Since traditional wealth managers offer additional services to financial planning, new players will add services such as insurance, accounting and retirement planning to their range of products, probably through innovative technology again.

Another trend in favour of robo-advisors lies within the demography of traditional wealth management providers itself: the incumbents find it more and more difficult to recruit new talent. Given the increased competition in the industry and the added pressure from new technology in combination with lower margins, careers in financial advice have become less attractive, which doesn’t mean though that excellent financial advisors will find rewarding opportunities.

Regulation

The biggest trend that will impact the industry most possibly is regulation though. Wealth Management is a highly regulated area and newcomers must play by the same rules. However, in addition to existing laws new regulations must address the risks of new business models and regulators around the globe monitor the situation closely.

In May 2015 the U.S. regulatory watchdogs FINRA and SEC issued a joint investor alert (https://www.sec.gov/oiea/investor-alerts-bulletins/autolistingtoolshtm.html) to provide investors with a general overview of automated investment tools. The alert made it clear that investors ought to make sure that they understand any terms and conditions, such as the fees and expenses associated with using the tool or with selling or purchasing investments. They should also review all relevant disclosures for an automated investment tool. Investors need to consider the tool’s limitations, including any key assumptions. They have to be aware that an automated tool may rely on assumptions that could be incorrect or do not apply to your individual situation. The regulators also pointed out that a robo-advisor relies entirely on the information provided by the investor and may not be able to spot any errors.

FINRA followed up on this in March 2016 in its report on effective practices for Digital Investment Advice (https://www.finra.org/newsroom/2016/finra-reports-effective-practices-digital-investment-advice). In this report, FINRA pointed out that financial services firms’ offerings of digital investment advice need sound governance and supervision, including effective means of overseeing suitability of recommendations, conflicts of interest, customer risk profiles and portfolio rebalancing. The report outlines regulatory principles and effective practices in five key areas:

- Governance and supervision of algorithms, including initially assessing the methodology of digital tools and the quality and reliability of data inputs, as well as ongoing evaluation such as testing the tools to ensure they are performing as expected, and determining whether models used by a tool remain appropriate as market conditions change;

- Customer profiling, including assessing both a customers’ risk capacity and risk willingness, and addressing contradictory or inconsistent responses in customer-provided information;

- Governance and supervision of portfolios and conflicts of interest, including determining the risk, return and diversification characteristics of a portfolio that is suitable for a given investor profile, and mitigating – through avoidance or disclosure – conflicts that can arise through the selection of securities for a portfolio;

- Rebalancing, including providing descriptions of how the rebalancing works and procedures that define how the tools will act in the event of a major market movement;

- Training that enables financial professionals to understand the key assumptions and limitations of individual digital investment advice tools, and determine when use of a tool may not be appropriate for a client.

- The International Organization of Securities Commissions (IOSCO) already undertook in July 2014 a project to study the use of social media and automated advice tools in the capital markets by market intermediaries and how regulators are overseeing the use of these tools. In its “Report on the IOSCO Social Media and Automation of Advice Tools Surveys”, regulators identified three areas where they believe additional guidance from IOSCO would be helpful in the future. IOSCO has indicated that it will review this work before the end of the year and it is likely this review will cover the following areas:

- Best practices for intermediaries providing advice via automated tools (e.g., how best to comply with suitability obligations).

- What principles should an intermediary consider when designing an automated tool?

- What principles should regulators consider when regulating intermediaries that use automated tools?

In Europe, the Joint Committee of the three European Supervisory Authorities (ESAs) – EBA, EIOPA and ESMA – launched a Discussion Paper on automation in financial advice in December 2015, aimed at assessing what, if any, action is required to harness the potential benefits of this innovation and mitigate its risks. The consultation closed and the regulators stated that they will assess the feedback to this Discussion Paper in order to better understand the phenomenon. Based on this analysis, the ESAs are going to decide which, if any, regulatory and/or supervisory action is required, though it is likely that further initiatives on automated advice will be issued.

List of Robo-Advisors

To conclude our review of Robo-Advisors we have compiled a list of some of the firms that provide this service:

- AssetBuilder

- com

- Blooom

- Charles Schwab Intelligent Portfolios

- Covestor

- Edelman Financial Services

- Financial Guard

- FlexScore

- Folio Investing

- FutureAdvisor

- Hedgeable

- Jemstep

- LearnVest

- MarketRiders

- Motif Investing

- Motley Fool Wealth Management

- com

- Personal Capital

- RebalanceIRA

- Schwab Intelligent Portfolios

- SigFig

- Smart401k

- TradeKing

- Vanguard VPAS

- Wealthfront

- WiseBanyan