Consumers are becoming more aware of their impact on the environment. With climate change arguments, governments and organizations are also looking to reduce their environmental and societal impact. To quantify the impact of every action, regulations like the ESG were formulated.

In this article, we will go in-depth on what ESG is and the tools that can be used to comply with these regulations.

What is ESG Compliance?

Environmental, Social, and Governance (ESG) is a broad set of frameworks and regulations that assess an organization’s commitment to the environmental, social, and governance factors. The idea is to ensure that every organization operates sustainably and without negatively impacting the world around them.

There are many ESG compliance frameworks, with some notable ones being Global Reporting Initiative (GRI) Standards, Sustainability Accounting Standards Board (SASB), and more. Every organization can pick one or more relevant ESG frameworks and work towards meeting its objectives.

To become ESG compliant, an organization must establish the right ESG strategy and implement a tracking system to collect and analyze data. The tracked data must also be converted into a report, in the format specified by each ESG regulation, and submitted within the due date. Since these regulations encompass multiple areas and apply organization-wide, ESG compliance tools have become an essential partner in meeting these regulations.

Best Tools for Managing ESG Compliance

Given the growing importance of ESG compliance, many options are available today. Below we have briefly described the popular ESG compliance software.

1. Workiva

Workiva is a cloud-based ESG reporting and compliance platform that helps organizations meet the requirements of different compliance standards like GRI, CDP, TCFD, and SASB. Its automated data collection and reporting workflows improve efficiency with fewer resources.

Source: Workiva

Key Features

- Offers pre-built templates for creating different reports.

- Centralizes financial, operational, and sustainability data in a single platform.

- Maintains traceable audit trails for verification.

- Supports real-time collaboration.

- Integrates ESG compliance with the organization’s broader risk strategies.

Pros:

- Supports multiple ESG frameworks.

- Cloud-based, so no downloads and installations.

- User-friendly interface.

- On-demand reports.

Cons:

- Complex implementation.

- Expensive.

Ideal for finance, accounting, and sustainability professionals.

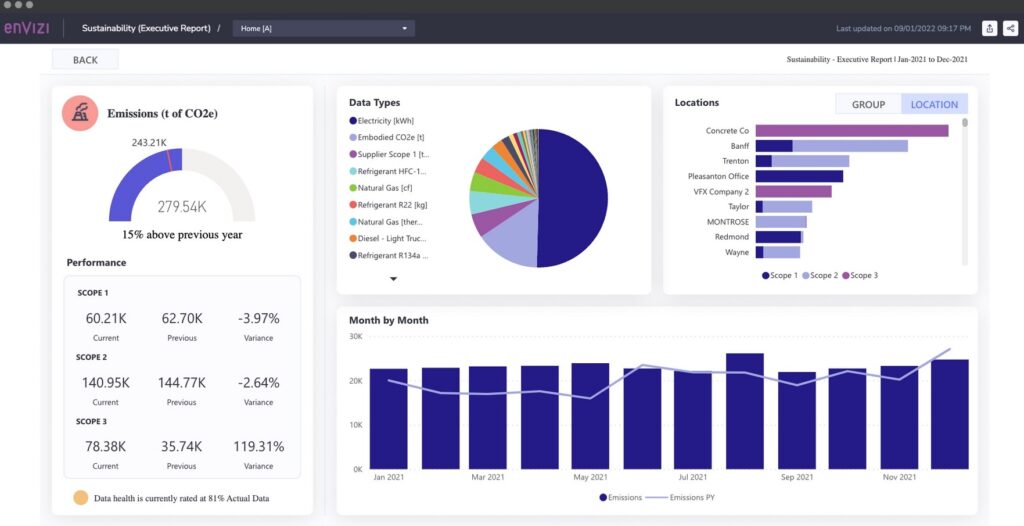

2. IBM Envizi ESG Suite

Envizi is a comprehensive suite that captures, consolidates, and analyzes disparate sustainability data to provide deep insights into how your organization is performing against the established ESG goals. It also integrates well with existing ERM, IoT, and CRM systems.

Source: IBM

Key Features

- Builds a centralized data system that acts as a single source of truth for your organization.

- It comes with centralized reporting processes filled with audit-ready data to save time and effort.

- Leverages AI for complex calculations for greater efficiency and accuracy.

- Supports informed decision-making.

- Aligns well with CSRD, GRI, SASB, and other ESG regulations.

Pros:

- Highly scalable.

- Seamless integrations.

- AI-driven insights and advanced analytics.

Cons:

- High costs.

- Too complex for small businesses.

- IT expertise required.

Ideal for large enterprises that need advanced ESG reporting.

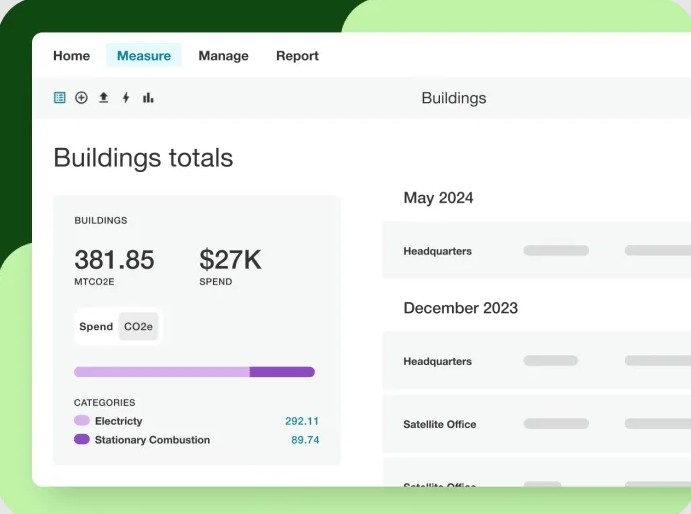

3. Salesforce Net Zero Cloud

Another popular ESG management platform, Salesforce Net Zero Cloud, connects your ESG data with other aspects of your business like suppliers, partners, and the entire value supply chain. Also, it automates reporting with Agentforce to create the reports required for different ESG compliance frameworks.

Source: Salesforce

Key Features

- Automatically converts energy data from travel, fleet operations, and utility bills to provide an accurate carbon footprint.

- Simulates scenarios to help identify future emissions, so you can plan accordingly.

- Creates a visualization of each program’s impact for greater insights and informed decision-making.

- Integrates through MuleSoft to connect with partners on the App Exchange.

- Tracks a wide range of metrics, including employee headcount, DEI success metrics, and more for a holistic picture.

Pros:

- Tracks scope 1,2, and 3 emissions.

- Supports easy comparison across programs.

- Scalable and flexible.

- Streamlined carbon credits management.

Cons:

- More suited for organizations using other Salesforce products.

- Customization requires Salesforce expertise.

Ideal for companies that are already using Salesforce for their operations.

4. Benchmark Gensuite

Gensuite and Benchmark are different application suites that are unified to offer Environmental, Health, and Safety (EHS) and ESG compliance. It comes with extensive features that allow you to track, report, and improve your sustainability performance.

Source: Benchmark Gensuite

Key Features

- It offers 800+ ESG KPIs that meet all major ESG frameworks.

- Integrates operational data from multiple sources for a unified picture.

- Supports collaboration and tracking across functional teams.

- Creates meaningful insights from multiple perspectives.

- Analyzes yearly performance for strategic decision-making.

Pros:

- Highly modular and configurable.

- Automates regulatory tracking.

- User-friendly dashboards.

- Enables quick response to ESG regulatory requests

Cons:

- Expensive.

- Complex customization.

Well-suited for enterprises looking for ESG and EHS compliance.

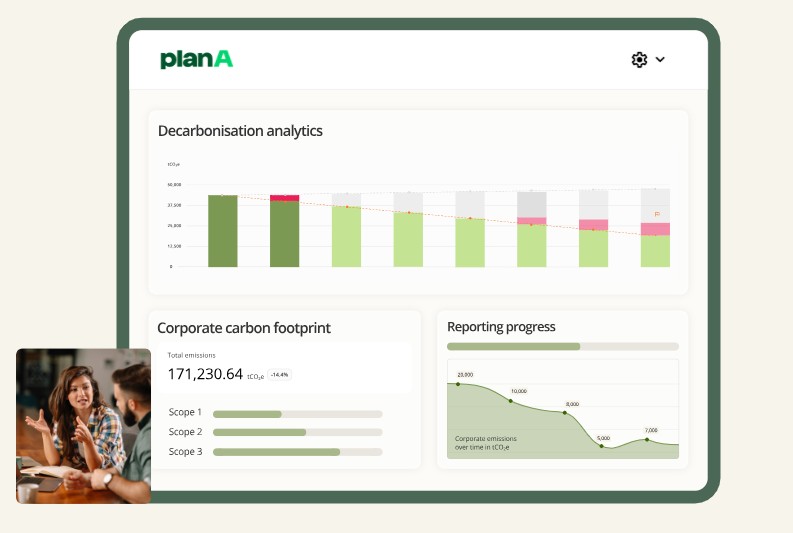

5. Plan A

Plan A is a carbon accounting and ESG-certified tool that improves the efficiency of your sustainability programs while enabling you to meet the requirements of different ESG compliance frameworks. It also supports decarbonization efforts with easy targets and forecasts.

Source: Plan A

Key Features

- Analyzes emissions across scopes, departments, and facilities.

- Handles CSRD reporting, from planning to auditing.

- Offers expert services to save time and effort.

- Measures outcomes against established KPIs.

- Tracks corporate carbon footprint.

Pros:

- Modular and scalable.

- Meets scientific standards like GHG Protocol and TUV Rheinland.

- Supports certified data security standards.

- Extensive reporting.

Cons:

- More focused on EU regulations.

- Limited third-party integrations.

Ideal for companies that are focused on carbon accounting and decarbonization.

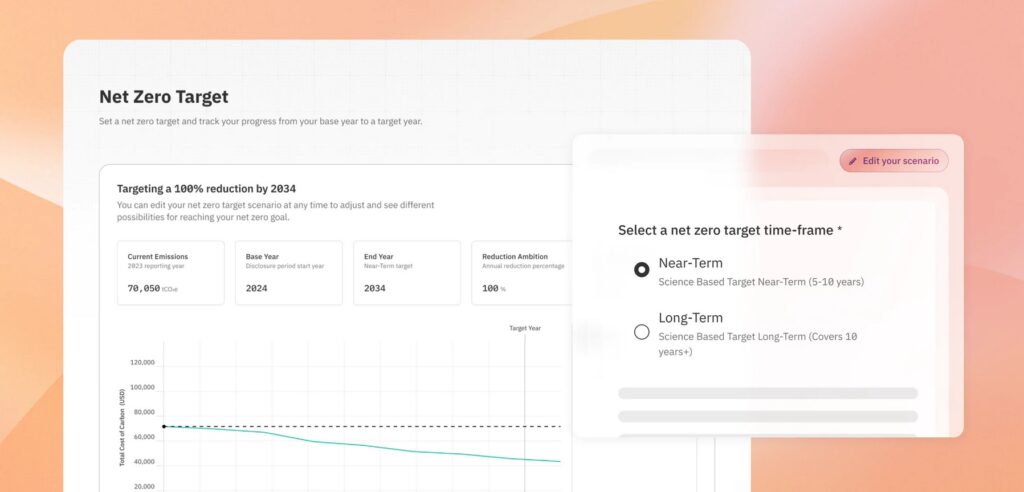

6. Persefoni

Persefoni is a climate management and carbon accounting platform that transparently and efficiently measures and reports your emissions data. It also provides automated solutions for climate risk assessment, ESG compliance, and carbon footprint and sustainability reporting.

Source: Persefoni

Key Features

- Generates scopes 1,2, and 3 carbon reports for businesses of all sizes.

- Provides GHG emissions reporting for all major climate regulations.

- Offers advanced decarbonization features like net-zero target setting, reduction modeling, and supplier engagement.

- Supports emissions measurement and analytics for financial services companies.

- Uses AI models to provide on-demand expertise.

Pros:

- Built-in climate risk management.

- Data-driven insights.

- Compliance with ESG and financial regulations.

- Automated audit trails.

Cons:

- Focused largely on carbon accounting.

- High costs.

- Complex.

Best for companies prioritizing carbon footprint management.

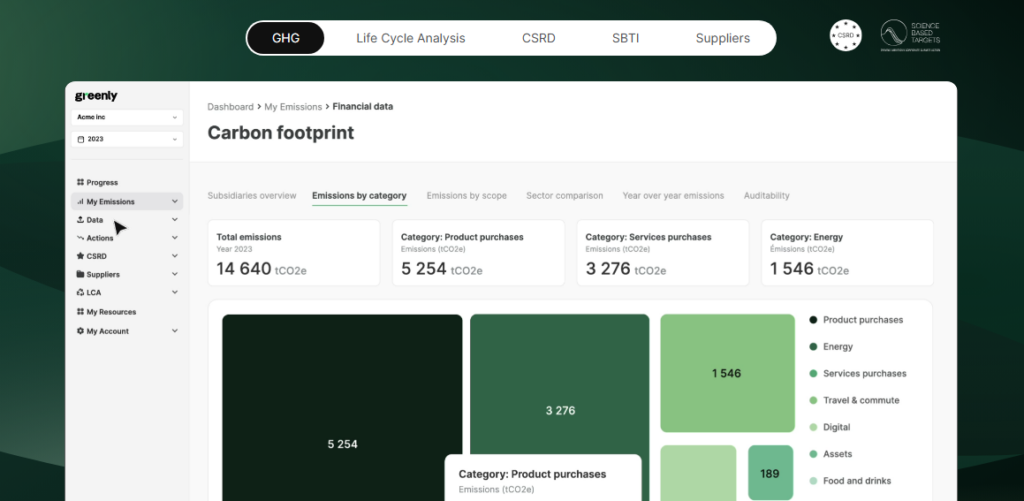

7. Greenly

Greenly is an ESG platform that primarily focuses on the measurement and reduction of carbon dioxide emissions. It streamlines data collection and matches it with different emission factors to provide a complete idea of where your organization stands against your established climate goals.

Source: Greenly

Key Features

- Saves time on paperwork. The website claims that there’s an 80% reduction in hours.

- Automatically collects data and matches it with emission factors for precise analytics.

- Customizable dashboards for yearly comparisons.

- Provides online support and project managers and experts to manage your compliance.

- Supports multiple criteria like Scope 1,2, and 3 emissions, CBAM, EPD, and more.

Pros:

- Affordable for businesses of all sizes.

- Complete carbon tracking.

- User-friendly interface.

- Focus on emission reduction.

Cons:

- Limited to mostly emission tracking.

- Few third-party integrations.

- Limited scalability.

Ideal for companies that are focused on decarbonization.

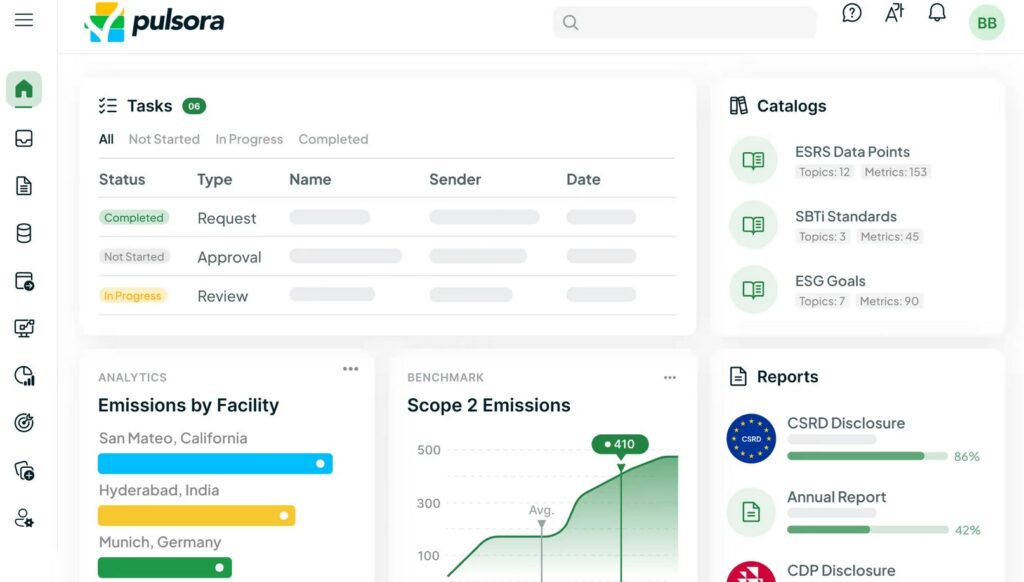

8. Pulsora

This all-in-one sustainability management platform reduces the administrative burden of ESG reporting and compliance and allows you to focus on the core aspects of your business while meeting ESG compliance requirements. Also, it provides actionable insights to drive measurable and sustainable outcomes.

Source: Pulsora

Key Features

- Consolidates ESG data and sustainability metrics into a single platform.

- Supports many ESG frameworks like CSRD, GRI, TCFD, and more.

- Identifies risks and sustainability gaps among partners, suppliers, and vendors.

- Provides predictive analytics and reporting tools to save time and effort.

- Generates investor-grade and audit-ready reports.

Pros:

- Comprehensive ESG data integration.

- Advanced reporting and analytics.

- Support global frameworks.

- Manages carbon data.

Cons:

- Complex setup.

- Steep learning curve.

A good choice for integrated sustainability solutions.

Thus, these are the different ESG compliance software.

Selecting the Right ESG Compliance Software

Choosing the right ESG compliance framework depends largely on your organization’s size, industry, budget, and regulatory requirements. As a first step, assess your compliance needs to determine which frameworks you want to comply with. Accordingly, look for a tool that offers compliance with all your selected frameworks. If you operate in specific industries like the financial sector or specific regions like the EU, you could have higher compliance requirements. Make sure the tool you select supports these requirements.

Another aspect to consider is the feature set. Ideally, you’d want a tool that is scalable to meet your growing needs. Also, your tool must have advanced reporting capabilities including automated workflows and pre-built templates that save time and effort. Moreover, it helps if your tool integrates with other tools used in your organization.

Lastly, look for tools that align with your budget. Free and low-cost solutions are best for small businesses and startups, though they may have fewer features than enterprise versions. If budget is not a constraint, go for large enterprise tools.

With these considerations, you can pick the tool that best meets your needs.

Closing Thoughts

As consumers and stakeholders become more aware of the environmental and social impact of organizations, ESG is no longer optional. It is emerging as an important regulation that helps build trust among stakeholders and meet their expectations. However, the key to success is to select the right ESG frameworks that align with your operations and back them up with appropriate software that will help with compliance. The ESG compliance software described in this guide can help you select the right one.