As more people shift to digital tools and apps, the chances of identity theft is increasing. A report by Experian shows that in the U.S. alone, identity theft has increased to 84% in 2024 from just 64% in 2023. Along with identity theft, phishing, scams, and stolen credit card rates have gone up as well. This growing concern among businesses and consumers put the spotlight on the verification and authentication of documents to prove a person’s identity.

Know Your Customer (KYC) is a set of guidelines that can help identify scams and online thefts. Though KYC is mandatory for mostly financial institutions and fintech companies, more businesses are adopting it to protect their customers from potential fraud and scams.

Read on as we explore the best practices for implementing KYC and a list of tools that can come in handy to handle the required verifications.

What is KYC?

As the name suggests, KYC is a set of processes to determine if an individual is who he/she claims to be. It safeguards financial institutions from fraud, money laundering, and terrorist funding. More importantly, this regulation verifies customer identities before onboarding them.

KYC consists of three components, namely:

- Customer Identification Program (CIP) – In this program, businesses collect and verify customer details like name, date of birth, address, and identification documents like a passport or driver’s license.

- Customer Due Diligence (CDD) – This process involves assessing the credit standing and trustworthiness of a customer based on past financial transactions, credit scores, and source of money. Note that customers who are considered risky may have to go through an additional process called Enhanced Due Diligence (EDD).

- Continuous Monitoring – KYC is not a one-off program. Rather, it requires continuous monitoring of transactions and activities. Based on these results, businesses must update records and take additional actions if required.

Many regulators worldwide, including the Financial Action Task Force (FATF), the U.S. Financial Crimes Enforcement Network (FinCEN), and the European Banking Authority (EBA), enforce strict KYC requirements. Failure to comply can result in heavy fines, reputational damage, and legal consequences.

To meet these requirements and safeguard their operations, businesses must implement appropriate KYC measures. This includes adopting the industry’s best practices and leveraging advanced technological tools.

KYC Best Practices

To follow the KYC requirements and protect your business and customers from fraud, here are some best practices to consider.

- Create custom KYC processes for different customers. For example, Politically Exposed Persons (PEPs) require more stringent checks when compared to lower-risk clients.

- Regularly check customer names against national and international watchlists and sanction lists.

- Maintain accurate records of verifications for audit and to protect your business from future fines and legal challenges.

- Provide regular training for employees to help them maintain KYC requirements.

- Combine KYC with AML for better resource efficiency and productivity.

- Consider customer experience to prevent dropout rates.

- Lay down your KYC process clearly before onboarding new customers, so they know what to expect during the process.

- Use AI-driven tools where possible to reduce manual errors and speed up the verification process.

- Stay on top of KYC requirements and update your process accordingly.

Along with these best practices, you also need the right tools to ease the KYC process while meeting the regulations.

Best KYC Tools

Given the importance of KYC, many platforms are available today. Below are some popular ones.

1. ComplyAdvantage

This AI-driven fraud and AML risk detection claims to reduce false positives by 70% and shorten onboarding time by 50%. Additionally, it provides the visibility you need to prevent crimes in real time. It can also monitor hundreds of trends and typologies and analyze many parameters to identify suspicious behavior.

Source: ComplyAdvantage

Key Features

- Customizable risk rules.

- Dynamic risk scoring.

- Automated transaction monitoring.

- API integrations for seamless onboarding.

- Access to a real-time risk database that continuously updates information about individuals and businesses.

- Smart alerts to improve the efficiency of compliance teams.

Pros:

- Accurate.

- Highly efficient.

- Reduced manual errors.

- User-friendly interface.

Cons:

- Dependence on AI.

- Complex integration.

2. Trulioo

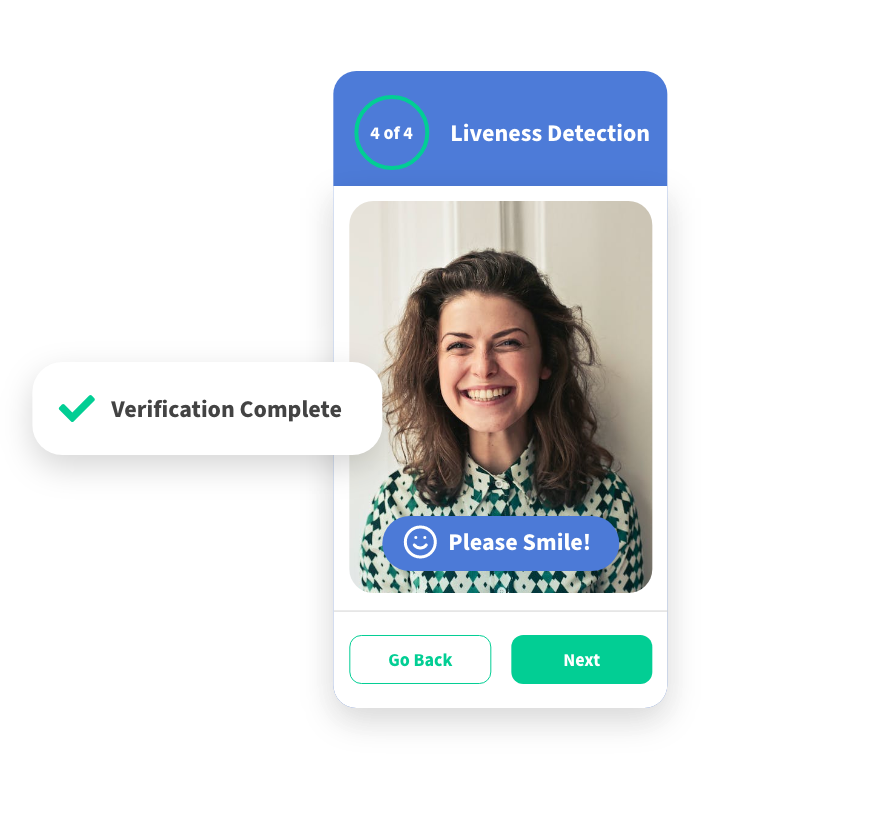

Trulioo is a global identity verification platform that checks and verifies the identity of billions of people across 195+ countries. It meets the requirements of both KYC and AML, making it ideal for businesses with a global presence. Moreover, it provides access to a vast network of identity data sources.

Source: Trulioo

Key Features

- Supports a wide range of IDs and documents for better flexibility.

- Offers facial recognition, biometric verification, and liveness detection for greater accuracy.

- Regularly checks sanction lists, PEPs, and adverse media to identify risky customers.

- Provides the flexibility to customize KYC processes based on your needs.

- Comes with API integrations.

Pros:

- Extensive global coverage.

- Scalable and flexible.

- User-friendly.

- Reduced onboarding time.

Cons:

- Complex customization.

- Dependence on data sources.

3. Ondato

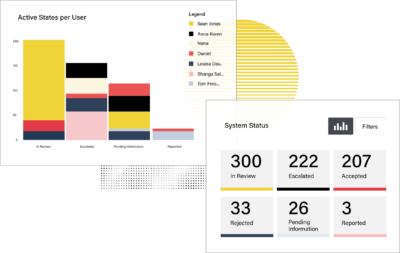

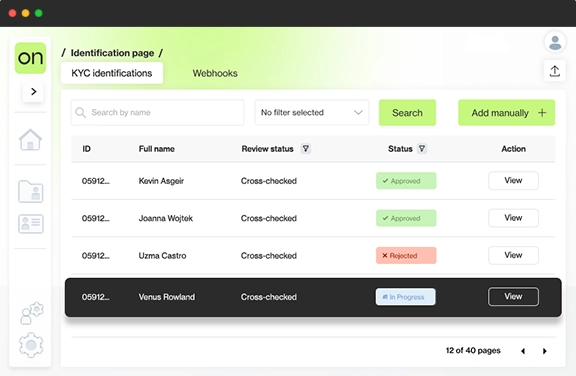

Ondato is a comprehensive KYC and AML verification service provider that offers client identity verification and lifecycle management. It offers a wide range of solutions like transaction monitoring, due diligence, age verification, identity verification, Know Your Business (KYB), authentication, Customer Data Platform (CDP), and more.

Source: Ondato

Key Features

- Biometric verification for better accuracy.

- Support for multiple ID types.

- Its online age verification can be useful for eCommerce businesses.

- Comprehensive AML screening.

- Real-time dashboards.

- Data-driven analytics.

Pros:

- Quick onboarding.

- A high success rate of 99.8% as per the website.

- Comprehensive KYC, KYB, and AML.

- Automated customer risk assessment and scoring.

Cons:

- Customizing workflows requires technical expertise.

- It may not cover all regions.

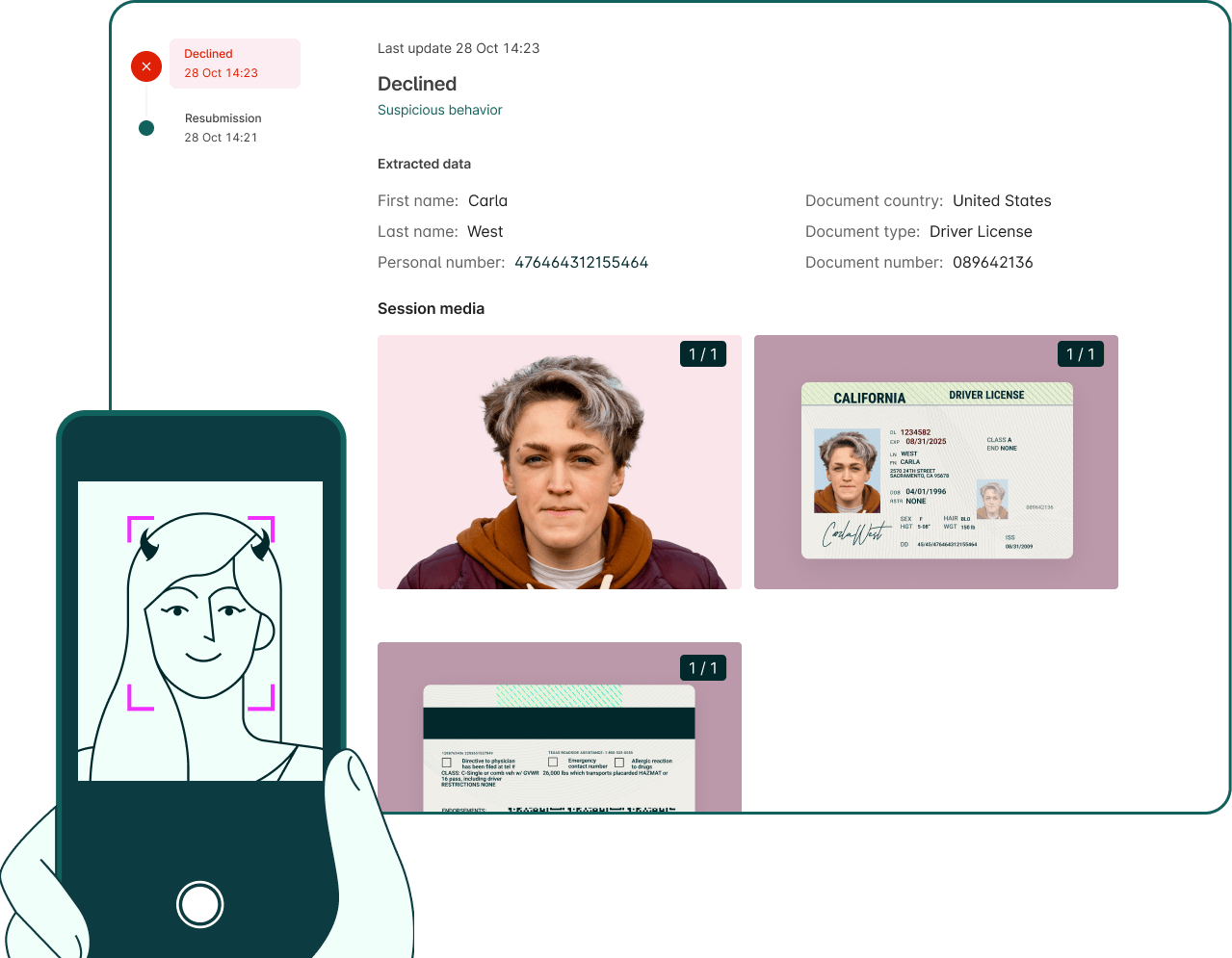

4. Veriff

Veriff is an AI-powered identity verification platform that helps prevent fraud and improve compliance with KYC regulations. It uniquely combines AI and human verification teams to reduce dependence on technology while improving the speed and accuracy of onboarding.

Source: Veriff

Key Features

- Verifies a wide range of documents for streamlined onboarding.

- Reduces friction with users, thereby reducing the dropout rate.

- Automates age checks.

- Offers KYC and AML screening.

- Supports biometric authentication.

- Offers advanced fraud intelligence.

Pros:

- High accuracy levels.

- Combines AI and humans for better results.

- Strong liveness detection to prevent fraud.

- Quick and scalable.

Cons:

- The mix of AI and manual checks can slow down verifications.

- Expensive.

5. Sumsub

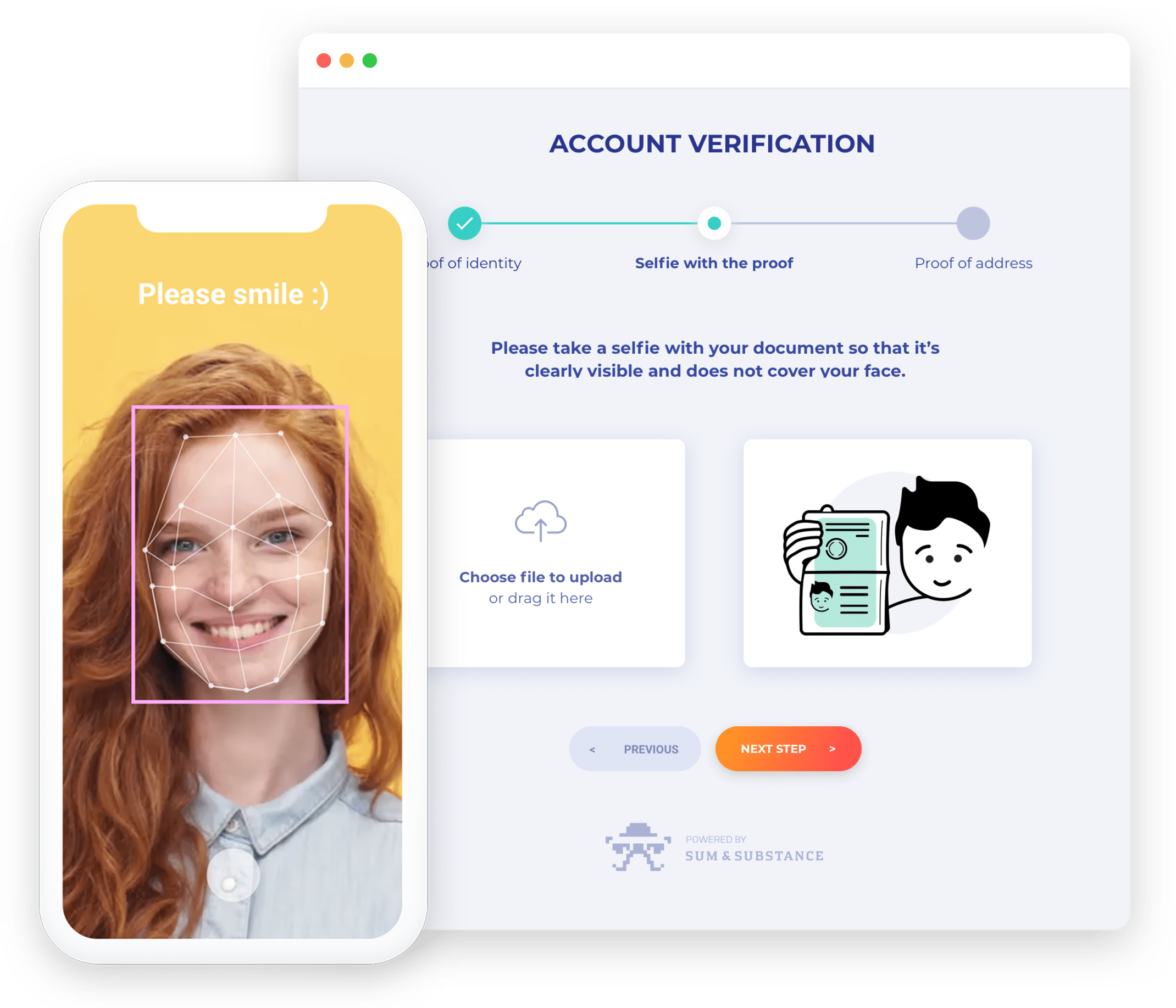

This comprehensive KYC, AML, and fraud prevention platform helps businesses verify customer identities and comply with global regulations. It operates in 220+ countries and claims to offer a high success rate. It secures the entire user journey and the results can be seen on a single dashboard.

Source: Sumsub

Key Features

- Smooth online identity verification and compliance.

- Verifies both individuals and businesses.

- Detects suspicious activity in user transactions.

- Uses advanced machine learning algorithms to identify different types of fraud.

- Supports non-doc verification, duplicate checks, known face search, address verification, and more.

Pros:

- Fast and accurate identity verification.

- Supports global compliance requirements.

- Offers a full-stack solution.

- Automatically extracts data from documents.

Cons:

- Advanced features may require extra customization.

- It may not cover some countries/regions.

6. iComply

iComply is a compliance management platform for KYB, KYC, and AML verifications. It helps manage the complete lifecycle of user management, from onboarding to continuous monitoring. Its intuitive workflows improve efficiency and effectiveness by up to 90%, as per the website.

Source: iComply

Key Features

- AI-powered identity verification.

- Supports biometric authentication.

- A unified platform for KYC, KYB, and AML.

- Provides risk-based customer screening.

- Offers APIs and SDKs.

Pros:

- Modular and flexible for different requirements.

- Automates identity verification.

- Global coverage.

- Security features.

Cons:

- Complex for small businesses.

- It can be expensive.

7. Persona

A secure identity verification solution that works well for all organizations and use cases. It is highly modular, and you can customize it based on your requirements. It is easy to use and streamlines onboarding to reduce the dropout rates for new customers.

Source: Persona

Key Features

- Supports KYB, KYC, and AML.

- It triggers verification flows across different points to safeguard businesses.

- Augments AI detection with manual reviews where needed.

- Supports global operations.

- Enables businesses to verify age at any point in the workflow.

Pros:

- Highly customizable.

- No-code customizations.

- Continuous monitoring.

- API-based integrations.

Cons:

- Manual verifications can take more time.

- OCR limitations.

Thus, these are the popular tools for KYC compliance.

How to Choose the Best KYC Tool

Choosing the right KYC tool must be based on factors like business size, industry requirements, relevant regulations, and budgets. To some extent, it can also depend on the available knowledge of resources and accordingly, the level of automation required. Another aspect would be the scale and region of operations. For example, companies with a global presence can select Veriff or Trulioo while those that require greater fraud prevention but operate within a smaller geography can go for Sumsub or Ondato.

Another aspect is the level of sophistication and advancement requirement. If businesses need advanced biometric authentication and liveness detection, opting for tools like iComply is a good step. Similarly, businesses that require both KYC and KYB verification should consider iComply or Trulioo, as they offer robust business verification capabilities. Persona stands out for its flexibility, allowing companies to create custom workflows without requiring deep technical expertise.

Pricing is another critical factor, since most providers do not disclose costs upfront, requiring businesses to request a quote based on their specific needs. Additionally, integration matters, especially for organizations with limited development resources. Such organizations may prefer tools with no code or easy API integrations, like Persona.

Finally, businesses must assess risk tolerance, compliance obligations, and operational needs before looking for a KYC tool. Ideally, the tool they select must balance security, efficiency, and cost-effectiveness.

Final Thoughts

To conclude, KYC compliance is necessary both from a regulatory and business continuity standpoint. Businesses must ensure that the individuals or businesses they onboard are who they claim to be and are not risky from a money laundering and terrorism funding perspective. At the same time, an extensive KYC process can frustrate customers leading them to drop off. Also, it could entail a ton of resources, making every verification expensive for the organization. To strike a balance between these aspects, consider the above-mentioned tools as they are comprehensive and can protect your business against frauds.