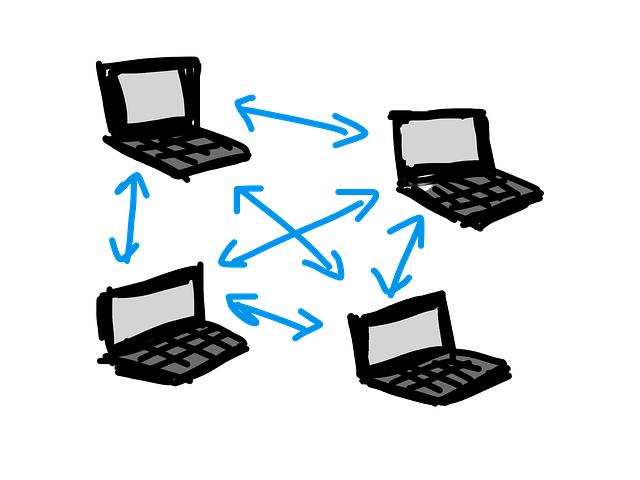

The original idea behind Marketplace Lending, often synonymously used with P2P Lending, comes from loans being made between peers, i.e. peer-to-peer excluding traditional financial institutions as the middleman. Personal loans obviously are nothing new, but like in many fields the internet has become the game changer since it has introduced online platforms where borrowers and lenders are matched.

Since the term peer to peer has often been mistakenly confused with person to person or peer being a small retail investor, it has more recently been rebranded. Its new denomination focuses thus on the second differentiator, the marketplace in between the two peers, which can be, in fact, be a single person or more and more so institutional investors on the hunt for a return that is difficult to find in regular debt instruments.

So on side of the transaction sits a borrower who frequently can obtain the funds more quickly, with less bureaucracy and (sometimes) at better interest rates than at banks and traditional lenders.

On the other side sits at least one investor, but in most cases the loan is provided by several lenders. This is because in many cases the whole loan sum cannot be provided by just one investor, but also for reasons of risk distribution where investors rather than keep all their eggs in on basket, spread their investment into several loan contributions, thus reducing the consequences of a loan going bad.

Returns are in most cases higher than in other investment classes, but can also contain a significant risk, since some borrowers – depending on the kind of lending platform – choose to obtain funds in this manner, as they cannot tap the usual channels because of a poor credit score. The online platforms in the middle, other than bringing the two parties together, try to reduce this risk by verifying the customers and running credit checks for which they use conventional systems as well as loan models based on algorithms that crunch all sorts of data, for example, in some cases even the Facebook profile of borrowers.

As a lending activity it is subject to government regulation depending on the respective jurisdiction, which will be subject of separate articles