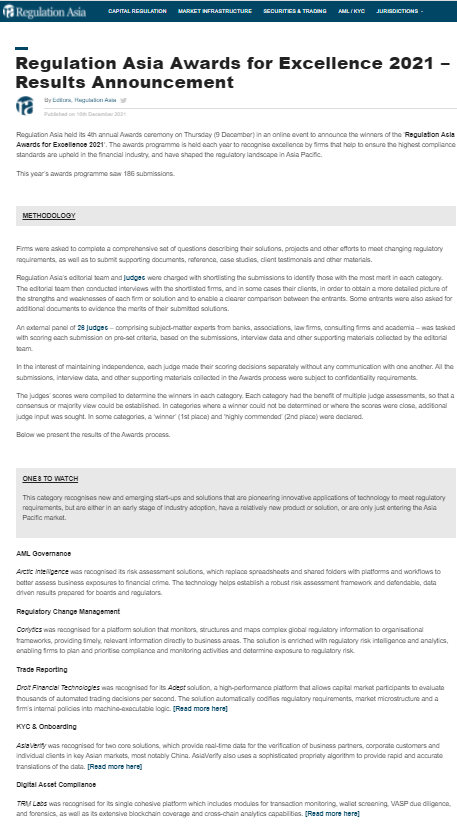

Regulation Asia Awards for Excellence 2021 – Results Announcement

Regulation Asia held its 4th annual Awards ceremony on Thursday (9 December) in an online event to announce the winners of the ‘Regulation Asia Awards for Excellence 2021‘. The awards programme is held each year to recognise excellence by firms that help to ensure the highest compliance standards are upheld in the financial industry, and have shaped the regulatory landscape in Asia Pacific.

This year’s awards programme saw 186 submissions.

Firms were asked to complete a comprehensive set of questions describing their solutions, projects and other efforts to meet changing regulatory requirements, as well as to submit supporting documents, reference, case studies, client testimonals and other materials.

Regulation Asia’s editorial team and judges were charged with shortlisting the submissions to identify those with the most merit in each category. The editorial team then conducted interviews with the shortlisted firms, and in some cases their clients, in order to obtain a more detailed picture of the strengths and weaknesses of each firm or solution and to enable a clearer comparison between the entrants. Some entrants were also asked for additional documents to evidence the merits of their submitted solutions.

An external panel of 26 judges – comprising subject-matter experts from banks, associations, law firms, consulting firms and academia – was tasked with scoring each submission on pre-set criteria, based on the submissions, interview data and other supporting materials collected by the editorial team.

In the interest of maintaining independence, each judge made their scoring decisions separately without any communication with one another. All the submissions, interview data, and other supporting materials collected in the Awards process were subject to confidentiality requirements.

The judges’ scores were compiled to determine the winners in each category. Each category had the benefit of multiple judge assessments, so that a consensus or majority view could be established. In categories where a winner could not be determined or where the scores were close, additional judge input was sought. In some categories, a ‘winner’ (1st place) and ‘highly commended’ (2nd place) were declared.

Below we present the results of the Awards process.

ONES TO WATCH

This category recognises new and emerging start-ups and solutions that are pioneering innovative applications of technology to meet regulatory requirements, but are either in an early stage of industry adoption, have a relatively new product or solution, or are only just entering the Asia Pacific market.

AML Governance

Arctic Intelligence was recognised its risk assessment solutions, which replace spreadsheets and shared folders with platforms and workflows to better assess business exposures to financial crime. The technology helps establish a robust risk assessment framework and defendable, data driven results prepared for boards and regulators.

Regulatory Change Management

Corlytics was recognised for a platform solution that monitors, structures and maps complex global regulatory information to organisational frameworks, providing timely, relevant information directly to business areas. The solution is enriched with regulatory risk intelligence and analytics, enabling firms to plan and prioritise compliance and monitoring activities and determine exposure to regulatory risk.

Trade Reporting

Droit Financial Technologies was recognised for its Adept solution, a high-performance platform that allows capital market participants to evaluate thousands of automated trading decisions per second. The solution automatically codifies regulatory requirements, market microstructure and a firm’s internal policies into machine-executable logic. [Read more here]

KYC & Onboarding

AsiaVerify was recognised for two core solutions, which provide real-time data for the verification of business partners, corporate customers and individual clients in key Asian markets, most notably China. AsiaVerify also uses a sophisticated propriety algorithm to provide rapid and accurate translations of the data. [Read more here]

Digital Asset Compliance

TRM Labs was recognised for its single cohesive platform which includes modules for transaction monitoring, wallet screening, VASP due diligence, and forensics, as well as its extensive blockchain coverage and cross-chain analytics capabilities. [Read more here]