The numbers alone are overwhelming: More than 2 billion people don’t have access to banking across the world. Over three billion people – that is almost half the world – live on less than $2.50 a day and at least 80% of humanity lives on less than $10 a day. And to make matters worse, over 80 % of the world’s population lives in countries where income differentials are widening. Most people understand the need to do something to improve financial inclusion, but why is it so difficult to achieve more and what are the obstacles that need to be overcome? Unsurprisingly, regulation is one of them.

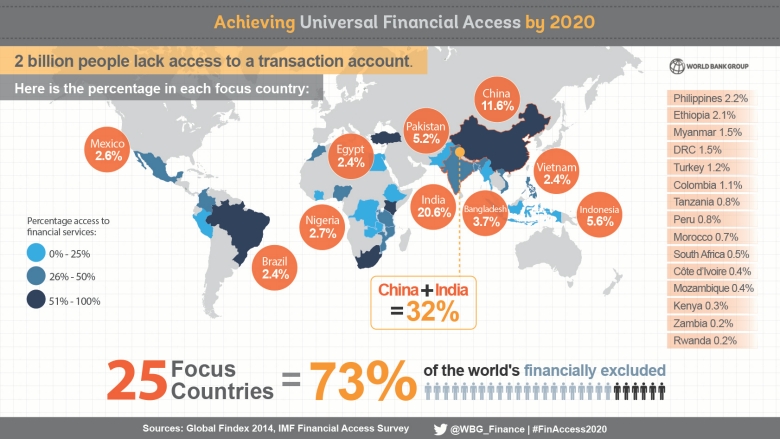

The numbers are jaw dropping and the future doesn’t look good either. At the same time the majority of people and institutions appreciates the need to do something. For instance, the World Bank has launched its Universal Financial Access 2020 (UFA2020) initiative with the objective that by 2020, adults, who currently aren’t part of the formal financial system, have access to a transaction account to store money, send and receive payments as the basic building block to manage their financial lives. But there are several obstacles that hinder improvements and financial regulation is one of them. Unlike in the developed world where financial institutions complain about over-regulation, in this case it is rather the lack of an effective and conducive regulatory framework. The World Bank Group and the Committee on Payments and Market Infrastructures (CPMI) of the Bank for International Settlements convened a task force on Payment Aspects of Financial Inclusion (PAFI) to comprehensively examine how payment systems and services affect financial inclusion efforts. The task force came to the conclusion that among other aspects a legal and regulatory framework underpins financial inclusion by effectively addressing all relevant risks and by protecting consumers, while at the same time fostering innovation and competition.

However, establishing such a framework takes time and especially in underdeveloped and conflict areas the success of such initiatives is doubtful. Fintech on the other hand can help by bypass such issues and several firms are actively working on such solutions. One of them is Humaniq, which is on a mission to bring new mobile financial services to help the two billion unbanked people around the world who have no access to the digital economy. Our goal is to help lift people out of poverty by providing them with a financial inclusion circular economy P2P platform app that includes blockchain foundation technology and biometric identity, a mobile device and a financial application that aims to give them access to microloans, donations, peer to peer lending services and even a digital work ecosystem similar to fiverr where they can multitask on their phones, similar to what Amazon Mechanical Turk does.

Asked about the potential suspicion of users to provide biometric information because of its individual uniqueness and importance and the risk of loss through data theft, Humaniq’s CEO, Dinis Guarda, said that the company’s biometric technology options include a combination of voice, face and fingerprint and that Humaniq is determined to respect the data of its users and use for that the most advanced encryption and the security of the blockchain P2P ecosystem.

To ensure security of the biometric information submitted and to prevent fraud, the information submitted will be held in a central database until blockchain technology evolves to the point where the company is comfortable putting it in a public shared database, according to Guarda. He added that at that point Humaniq was also considering moving the entire framework over to a DAC run completely on smart contracts.

Time will tell whether the company will have success with this strategy, but it is a great example of how FinTech can drive Financial Inclusion and the potential it has to solve a problem institutions have failed to address successfully for a long time. Who knows, maybe the idea of a world where everyone has access to the financial system is not so remote after all.