Tax filing can be a stressful experience. According to a survey by Nextdoor, 64% of the 1,000 adults surveyed feel stressed and overwhelmed during the tax season. Similarly, 80% of small business owners also feel anxious during this time of the year.

Below are the best tax compliance software available today:

- QuickBooks An online accounting software that manages your cash flow, tracks expenses, and maintains an audit trail for tax filing and compliance.

- Vertex O Series An indirect tax management tool to determine taxes across multiple jurisdictions.

- Bloomberg Tax An integrated solution to modernize your tax process, from collection to reporting.

- Drake Tax A professional tax preparation software for computing federal and state taxes.

- TaxCloud A sales tax calculator for eCommerce businesses.

- TaxAct A simple tool to file business taxes online.

We have many tax automation software available today to address this stress and streamline the tax filing process. In this guide, we will explore what these software can do and how they benefit organizations. Lastly, we will review the best tax compliance tools to help you decide on the one that best fits your needs.

What is Tax Compliance Software?

Tax compliance is streamlining tax computation to make it more efficient and less error-prone. The ever-changing provisions and the growing complexity of business operations have made it increasingly difficult for businesses to file taxes correctly. At the same time, taxation errors can lead to heavy fines.

Tax compliance software helps organizations balance error-free tax filing and the resources spent on computing them. These platforms handle the complete lifecycle of taxation, from collecting data to computing the tax payable and refunds. They also generate extensive reports for internal auditing and compliance.

Types of Tax Compliance Software

I identified that there are three broad types of taxation software, though some tools even combine them all. The three categories are:

- Tax calculation

- Tax preparation

- Compliance reporting

Let’s take a brief look at each of these types.

Tax Calculation

As the name suggests, this kind of software computes the complex indirect taxes that vary greatly among jurisdictions. If your business has operations in multiple states, you may have to calculate taxes differently for each state, and this can be arduous. This software will handle all the different computations and even stay on top of the latest changes to calculate your indirect taxes.

Tax Preparation

Tax preparation has a specific workflow that can be resource-intensive. At the same time, these processes are repetitive and hence can be automated. The tax preparation software automates tasks like data gathering from different sources, running them through filters, and more to ease the preparation process. You can equate this software to an SQL query that fetches information from multiple tables that meet specific criteria, except that the software can scale well to thousands of tables and even departments.

Compliance Reporting

Tax compliance reporting tools go beyond just calculation and preparation and also file your taxes before deadlines. These tools start with a taxation calendar to help you stay on top of different tax filing deadlines, especially if your business spans multiple countries. It also alerts you on upcoming deadlines and you can even customize reminders.

Some compliance reporting tools also generate extensive reports that can be used to communicate with investors, management, and other stakeholders. They may even have a performance dashboard to provide visibility into critical statistics.

Many tools also come with all three capabilities.

Moving on, let’s see the benefits of investing in tax compliance software.

Benefits of Tax Compliance Software

Tax compliance offers many benefits for organizations, leading to more organizations integrating them as a part of their tech stack. Below are the important benefits.

Increased Accuracy

Tax compliance software calculates your taxes with the highest accuracy levels. More importantly, it minimizes the risk of human error.

Time Efficiency

Tax preparation can involve many manual and repetitive data entry tasks, and compliance software can automate them, allowing employees to focus on more important activities. Moreover, its streamlined processes also help organizations consistently meet deadlines.

Cost Savings

Your organization can save costs, as tax compliance software reduces the resources required for tax preparation and submission. More importantly, you can use your resources more efficiently for a better return on investment.

Compliance Assurance

Non-compliance with taxation can attract heavy penalties, and tax compilation software minimizes these risks. Also, they constantly monitor regulatory changes to ensure accurate compliance.

Improved Data Security

Many tax compliance software come with features like encryption to protect sensitive financial information. They also support single sign-on and provide access only to authorized employees, leading to more data security.

Enhanced Reporting Capabilities

You can generate detailed reports quickly and easily with the right tax compliance software. Many of them even come with templates and customizable reporting features to meet our specific requirements while providing visibility into your taxation process.

Streamlined Workflow

Most popular tax compliance platforms integrate well with your existing systems through APIs to streamline the entire tax process, from data collection to reporting.

Scalability

Another benefit of tax compliance software is that it can scale well with your organization’s growth. As you expand to new markets and jurisdictions, these tools will automatically manage taxes across these regions.

Audit Trails

Tax compliance software provides comprehensive documentation and audit trails for internal compliance and reporting. Also, it provides comprehensive control and visibility over the complete taxation lifecycle.

Due to the above benefits, many organizations are adopting the appropriate software for handling their taxes. Next, we will evaluate the best tools that provide most of the above-discussed benefits.

Our Methodology

The factors we considered while coming up with this list are:

- Compatibility with your existing system, specifically your databases and back office tools.

- Comprehensive tax lifecycle management, including preparation, computation, and reporting.

- Training and documentation

- Excellent customer support.

Best Tax Compliance Software

Next, let’s do a deep dive into each tool.

1. QuickBooks

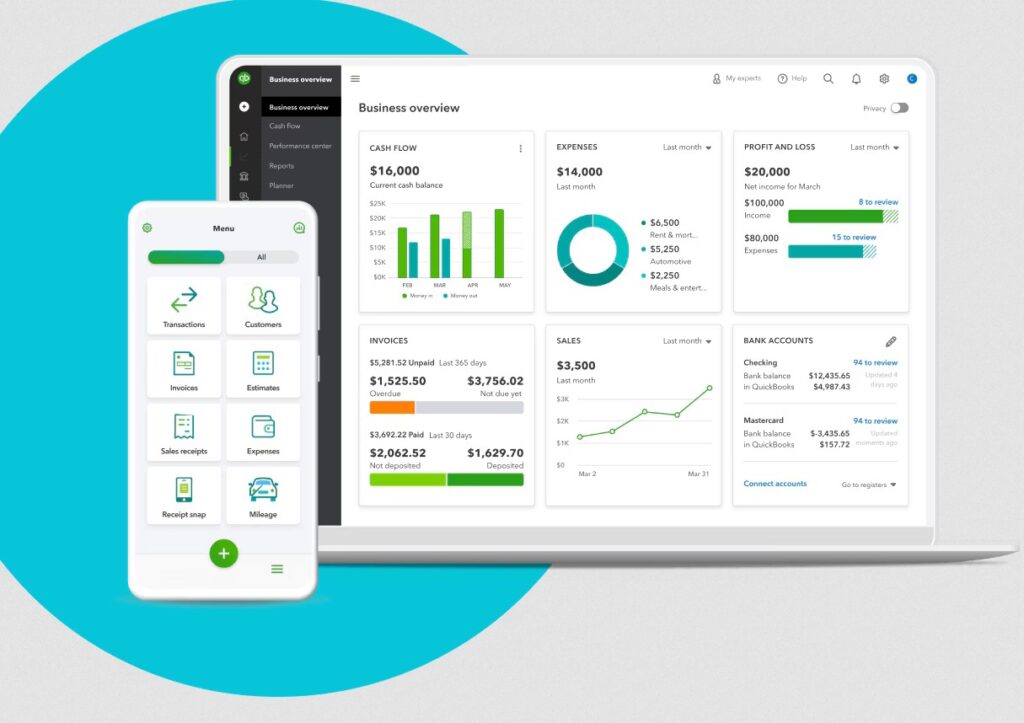

I determined that QuickBooks is a comprehensive accounting platform that manages everyday accounting, and at the end of the year, prepares your taxes based on these daily transactions. The advantage of this tool is that it stores all the necessary paperwork and evidence to ensure compliance.

Source: QuickBooks

Here are QuickBooks’ taxation features.

Accurate and Efficient

As QuickBooks already has all the required client data, you can complete the year-end accounting and taxation faster. Moreover, its efficient workflows automate repetitive processes, reducing the time and effort involved. Also, the single source of data reduces manual errors.

Intuitive User Interface

The user interface is simple and intuitive. You can attach receipts to individual transactions, connect bank feeds, and set rules to categorize your transactions automatically. Moreover, you can easily find the information you need for internal auditing.

Automated Tax Filing

With QuickBooks, you can automatically file your T1 and T2 returns. There’s no need to export data to another format or tool for taxation. Additionally, you can also generate other reports and documents like Notice to Reader (NTR), monthly income statements, and balance sheets based on your needs.

Overall, QuickBooks automates daily accounting, and with the available data, it prepares and files taxes online.

Pros:

- Easy to learn and use.

- Integrates well with other systems.

- Multiple reporting options.

- Good customer support.

Cons:

- Lack of industry-specific features like barcode scanning for e-commerce sites.

- More suited for small businesses.

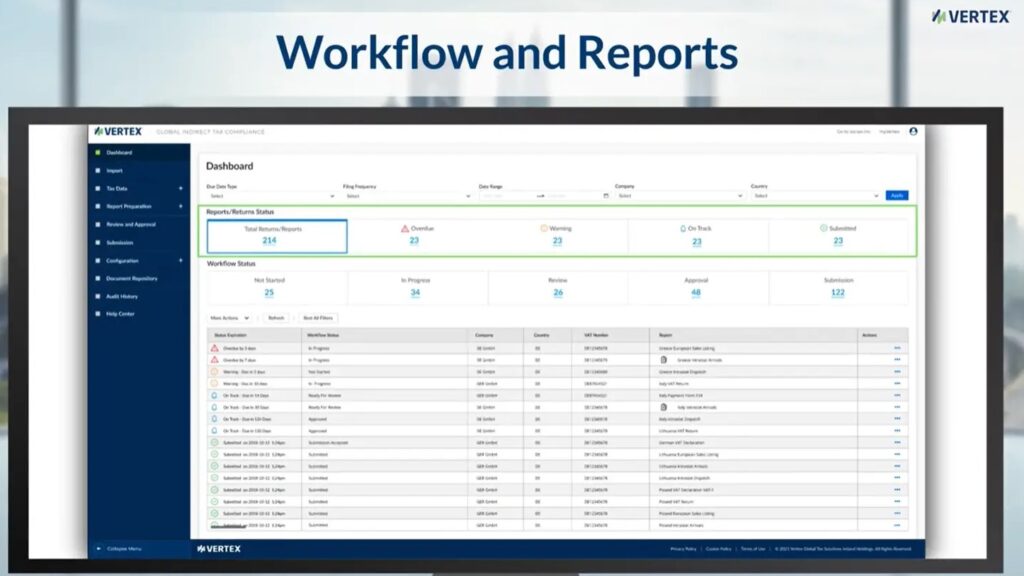

2. Vertex O Series

Vertex O Series is an indirect tax management tool that computes taxes for different jurisdictions. This tool saves organizations from the hassle of noting the changes in every jurisdiction and computing taxes based on them. Moreover, it computes Valued Added Tax (VAT) seamlessly, saving you many hours of time and effort.

Source: Vertex Inc

Here’s a look at Vertex O Series’ tax compliance features.

Integrates with Existing Systems

I noted that a highlight of the Vertex O Series is its ability to integrate well with any existing system. You can connect your ERP, e-commerce, procurement, and other financial systems with Vertex for automatic data flow. Using this information, Vertex calculates tax while providing complete visibility into the process.

Updated Tax Content

Vertex continuously checks for regulatory changes and updates them monthly to ensure the right categorization of transactions and the resultant tax computation. It also has extensive documentation for industry-specific tax content. You can license this content from Vertex, based on the areas in which you operate. This flexible model also ensures scalability.

Data Security

Vertex offers role-based access to enable your organization to control who can access sensitive financial documents. Its single sign-on further enhances convenience without compromising security. It also maintains audit logs to help with SOX compliance.

In all, Vertex O Series automates the computation of indirect taxes across multiple jurisdictions.

Pros:

- Accurate computation of indirect taxes.

- Well-designed and insightful reports.

- Flexible to accommodate changes in tax rules.

- Vertex University offers extensive tax content.

Cons:

- No real-time reporting.

- Limited views into rule mappings.

Request more information about the Vertex O Series.

3. Bloomberg Tax

I found Bloomberg Tax to be a proven tool to optimize your taxation process, starting from data gathering to computation and reporting. With this tool, you can save on manual processes that are both time-consuming and error-prone. Moreover, its extensive data connections make it easy to connect to any source for data gathering.

Source: Bloomberg Tax

Now, we’ll see how Bloomberg Tax eases your taxation workflows.

Extensive Automation

Bloomberg Tax offers extensive automation to help you focus on the more important activities in your organization. All the tools in the suite communicate with each other and share data through integrations. The advantage is that your data will be consistent, resulting in accurate tax computations.

Embedded Intelligence

You have access to embedded intelligence across the entire Bloomberg Tax suite. As a result, your taxation meets the latest guidelines and regulatory changes, the formulas are automatically updated to meet the new requirements, you have access to templates, and can get AI-powered answers to your questions.

Extensive Documentation

Bloomberg Tax provides information on the latest updates and regulatory changes. You can use this information to make informed decisions that can help you reduce your tax burden and improve your organization’s efficiency.

With such powerful features, Bloomberg Tax saves time and effort while ensuring the accuracy of your tax computation.

Pros:

- User-friendly interface.

- Extensive reporting.

- Multiple filters for sorting and finding the required information.

- Works great for fixed assets.

Cons:

- Better design for the depreciation section.

- No scanning of servers and computers.

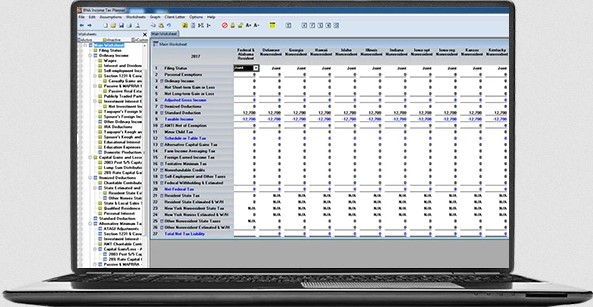

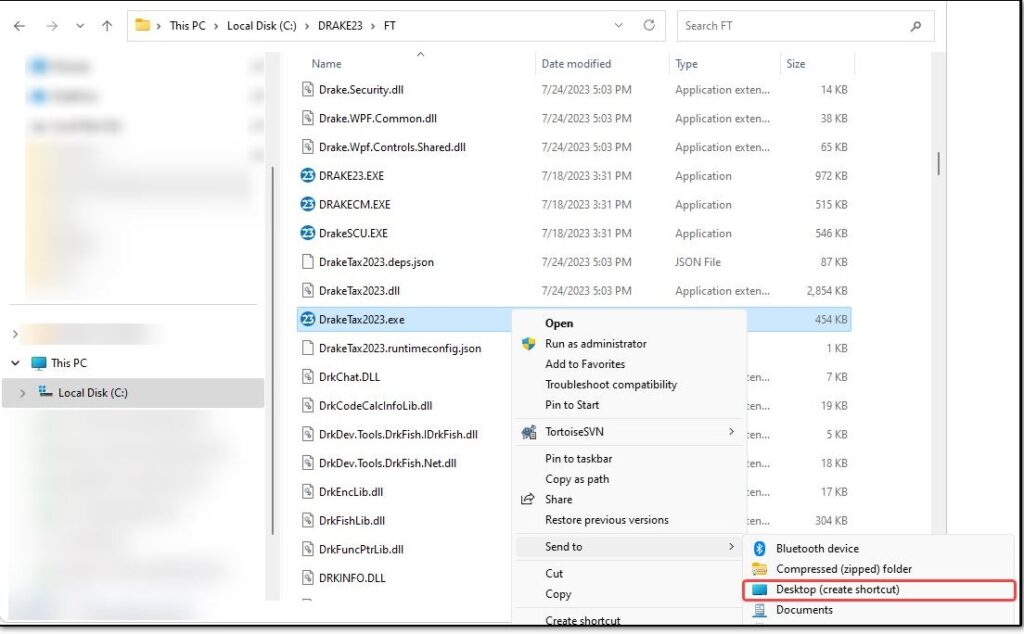

4. Drake Tax

Drake Tax is a tax preparation and efile software that eases your taxation process. It offers an on-premises and cloud deployment option to suit every organization. Moreover, its service and support are top-class, and it strives to provide regular information through its webinars, blogs, and other materials.

Source: Drake Tax

Below are Drake Tax’s features.

Planning and Analysis

I determined that you can use the Drake Tax Planner to understand how changes in your operations and products can impact your taxes. Also, you can analyze multiple tax years in a worksheet to understand patterns. Armed with this information, you can plan better for the upcoming year.

Improved Productivity

With Drake Tax, you can prepare and calculate taxes quickly. Its many shortcut keys reduce typing keystrokes to save time and effort. It automatically backs all data to a safe cloud storage for easy reference, if you choose to opt for the backup. The software updates are also automatic, with no additional effort.

Federal and State Returns

Drake Tax ensures the seamless flow of data from your federal to state and city returns. It also offers override options to generate state returns when needed. More importantly, it supports multiple state tax returns to cover every part of the U.S.

With such features, Drake Tax is a good choice for individuals, small businesses, and tax accounting firms that compute taxes on behalf of their clients.

Pros:

- Affordable.

- Good customer service.

- Easy to use.

- Extensive video tutorials.

Cons:

- Limited flexibility.

- Not suited for large enterprises.

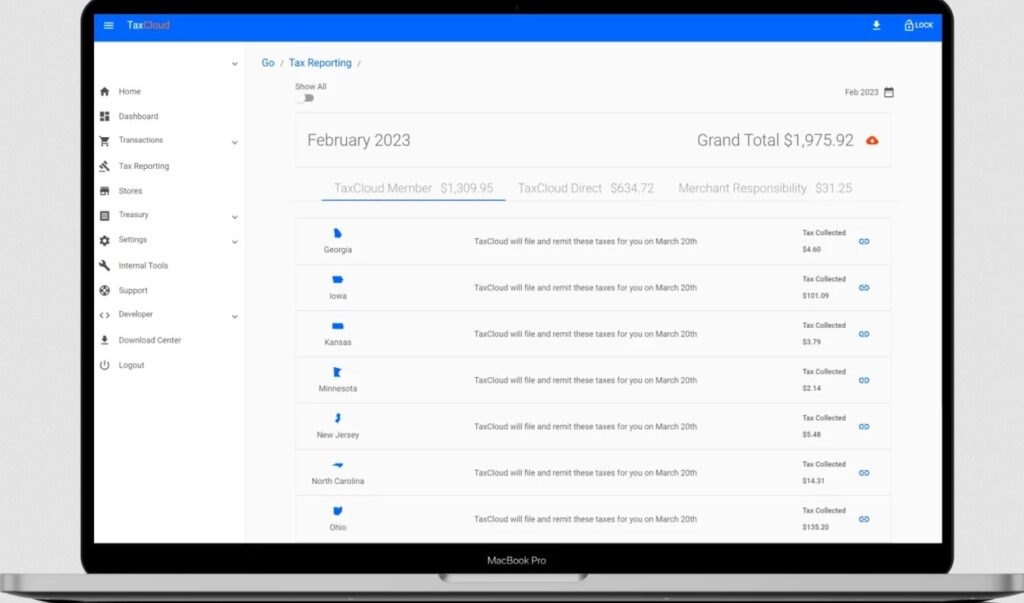

5. TaxCloud

TaxCloud is a tool that automates sales tax compliance for your eCommerce business. With its real-time calculator, you can meet the requirements of the 13,000+ jurisdictions spread across the U.S. With this too, you can ensure compliance with the varying sales tax laws.

Source: TaxCloud

Here’s a look at TaxCloud’s features.

Save Money

The sales tax laws vary greatly between different states. Knowing all the available exemptions and sales tax holidays across states can help you save money. But given the changing regulations, it’s hard to be aware of it all, and this is where TaxCloud helps, as it uses the latest regulations for computations.

Meet Tax Obligations

Sales tax computations are complex. I learned that if you’re operating across multiple states, you can miss out on filing on any of them due to manual oversights and errors. Moreover, there are remote tax obligations, also called economic nexus, that you must pay even if you don’t operate directly in a state. Unfortunately, non-compliance can lead to heavy fines. With TaxCloud, you can meet all these requirements.

Extensive Integrations

TaxCloud offers multiple integrations with eCommerce platforms like Shopify and Odoo to ease data collection and sales tax computation. The entire process is automatic and seamless, saving you many hours of time and effort.

Due to these capabilities, TaxCloud is a handy tool for eCommerce businesses operating in the U.S.

Pros:

- Accurate tax calculations.

- Affordable.

- Simple APIs.

- No prior experience is necessary.

Cons:

- The user interface is not intuitive.

- Customer support can be better.

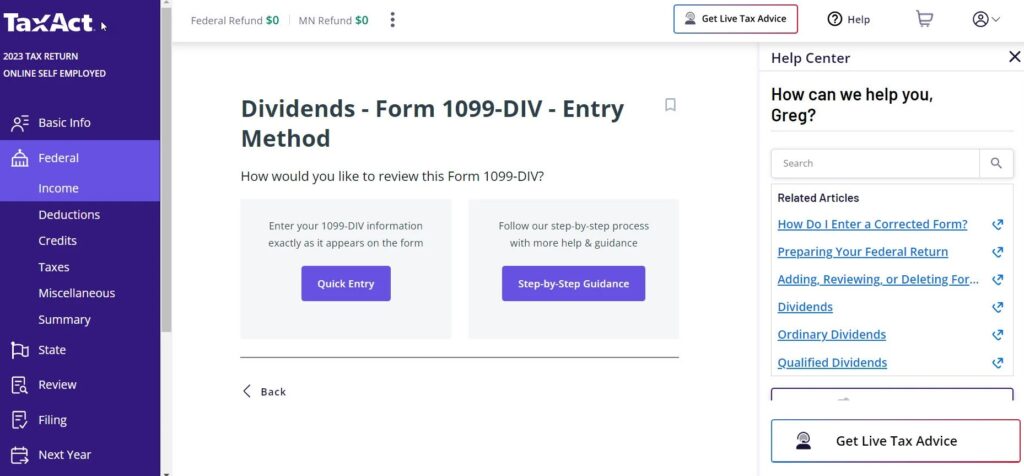

6. TaxAct

TaxAct is a simple and affordable platform for filing your business taxes online. It works well for partnerships, S corporations, C corporations, sole proprietors, tax-exempt organizations, and estates & trusts. More importantly, TaxAct offers a 100% guarantee on the accuracy of all tax calculations.

Source: TaxAct

Below are TaxAct’s business filing features.

Simple to Use

The highlight of this tool is its ease of use. I observed that the interface is intuitive and easy to navigate, and you can enter expenses under different heads. There are related articles displayed on the page to help you file correctly. At the end of adding your data, you can review the accuracy of your information before submitting it.

Federal and State

TaxAct supports both federal and state filing, including the variations that exist across states. It works well for individuals on W2, small businesses, and self-employed workers. This flexibility makes it a good choice for individuals and businesses.

Data Security

TaxAct works closely with the IRS and complies with the accepted procedures for physical and online security. It also implements multiple features to ensure that an authorized user is viewing or editing the data.

Overall, TaxAct is a good choice for computing and filing federal and state taxes for small businesses and individuals.

Pros:

- A well-developed mobile app.

- It provides context-sensitive information.

- Offers a final review.

- Good user experience.

Cons:

- Expensive.

- Search results can be better.

Thus, these are the best tax compliance software that can ensure that your organization is using the right forms with different authorities to file your taxes. More importantly, these tools help you file taxes before deadlines, saving you thousands in potential fines.

Final Thoughts

Taxation is not for everyone, and regardless of your industry and nature of business, there’s always a possibility for errors. However, errors and non-compliance can lead to heavy fines, making it essential to file taxes with all relevant authorities before the set deadlines.

To ease this process, many organizations are turning to tax compliance software. This guide discussed the different types of tax compliance software and their potential benefits to your organization. Finally, we reviewed the best tools in this category, and we hope this information helps you to file your taxes more easily.