Not long ago, and Blockchain was the silver bullet for everything. But then cryptocurrencies entered a prolonged period of funk and regulators have cracked down on ICOs, so much that the concept of cryptocurrencies even has been declared dead. Real life application of blockchain technology in other fields has also hit some bumps, but there are glimpses of hope and areas that have managed to make progress. The use of the technology for RegTech solutions is such an area that shows real progress.

What is RegTech and why is it such a big thing?

Using technology to comply with regulatory requirements is nothing new. In fact, it has been around for decades, but while this mostly meant logging data on good old excel spreadsheet, the Regulatory Technology aka RegTech everyone is talking about in financial services is an entirely different animal. It covers innovative digital solutions based on artificial intelligence, machine learning, big data, or biometrics that make compliance more efficient and effective.

But is not only the rapid development of innovation that drives the rise of RegTech. The immense cost of compliance that weighs heavily on the cost of doing business is the second pillar its success is based on.

Following the Global Financial Crisis of 2007/2008 regulators have cracked down on financial institutions with unprecedented force and lawmakers have introduced thousands of new regulations around the globe (in 2015 alone 50,000 regulatory updates were made). In the last decade, financial institutions have paid more than US$ 332 billion for regulatory violations.

Financial institutions responded by increasing compliance headcount many times over: JPMorgan alone was said to spend US$4 billion but even for banks with smaller bills the cost of compliance was becoming too high.

The digital transformation of the sector is the solution to these problems and the almost incredible growth predictions of the RegTech sector aren’t actually as far-fetched as they may seem. With growth rates of more than 50% per year the market is to expand by a multiple of twenty in the next six years. RegTech spending is expected to exceed US$127 billion per year by 2024. In Europe, investments have already quadrupled last year and in only 75 deals almost US$1.3 billion were raised in 2019.

RegTech and Blockchain

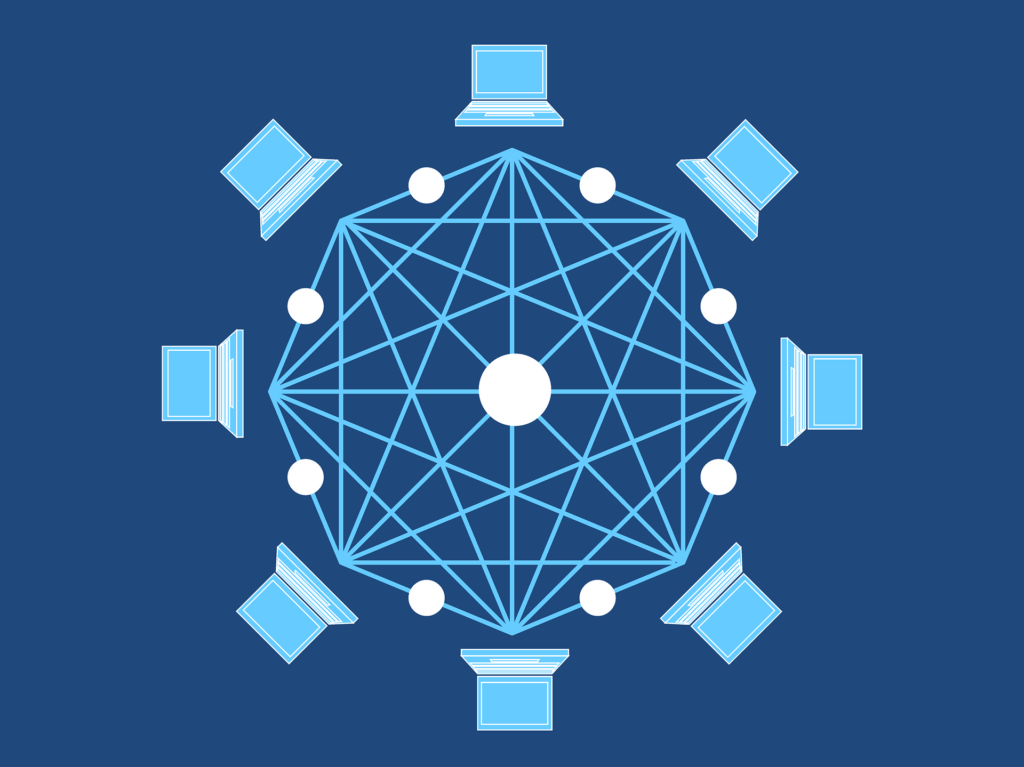

Blockchain is one of the technologies that is used to drive the RegTech revolution. Thanks to the various potential benefits of blockchain technology – increased transparency due to a distributed ledger, faster and more cost effective through automation, enhanced security through cryptography, and improved record-keeping – RegTech companies apply it to a number of use cases:

- Anti-Money Laundering, Client Onboarding and Fraud Prevention

To start with, Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations for client onboarding are the obvious choice when we talk about use cases for blockchain application in RegTech. Numerous companies try to tackle this area and the reason is simple: All financial institutions need to collect their own data on potential clients before they can start doing business with them. In addition, this data needs to be updated regularly for existing counterparties. Needless to say, that this a very time consuming and rather expensive with regard to both resources and money spent. The perfect solution would see a universal ledger all banks could use to identify their customers and monitor transactions. However, that is difficult to achieve and you do not need to look further than the ongoing battle between the different blockchain consortia seeking to establish common standards to understand why.

But already in the space of cryptocurrencies several firms have developed AML software tailored to Bitcoin and other crypto transactions, which monitor activity and allow for enhanced due diligence. At the same time blockchain is considered the answer to the digital identity crisis.

Identity management is the other side of the coin – no pun intended – with a whole army of RegTechs providing services to cryptocurrency firms to verify identity in a fast and cost-effective manner based on enhanced data analytics or biometrics in compliance with complex regulations.

- Monitoring

Monitoring is the second evident use case because of the increased transparency blockchain provides. Again, this a particularly obvious application in the blockchain world itself, i.e. the monitoring of transactions in cryptocurrenciesespecially given the increased use of virtual currencies for money laundering.

At the same time, blockchain promises better traceability and faster analysis wherever assets are digitalized.

- Record Keeping

The key problem of Big Data is that in many cases the massive collection of information has created enormous amounts of unstructured data that has little use. While this presents an attractive field for companies with very different approaches, RegTech firms applying blockchain technology seek to tackle the issue as its root. The objective is to produce data that is transparent and a distributed ledger to make is accessible for internal use, documented for audit purposes, and protected against falling into the wrong hands. Record keeping is for this reason another prominent example.

- Regulatory Fund Management

The tokenization of assets in the fund sector is another great example for the application of blockchain technology. The use of smart contracts presents an invaluable advantage due to the effects of automation, but at the same time covers important bases for regulatory reporting as well as the compliance of the regulatory obligations of a fund in real-time.

RegTech and Blockchain – The bottom line

However, these four use cases are only a glimpse of where blockchain technology stands in the RegTech space but the potential of blockchain technology naturally does not end here. It is most evident in the field of cross-sector application such as trade finance where the main functions are complemented by far-reaching secondary effects like compliance with monitoring obligations or the gains in terms of automation and de-bureaucratisation.

At the same time, blockchain is and can only be relevant in the RegTech sector where it is more than just window dressing. And lastly, as in most areas of blockchain application, it has to overcome the usual concerns in terms of an overhyped technology or the reputational effect of cryptocurrencies.