An Analysis of the new AML Action Plan of the European Commission that seeks to improve the organisation’s efforts in the fight against money laundering and terrorist financing

Last week, Valdis Dombrovskis stepped into the European Commission’s digital press room and announced that “we need to put an end to dirty money infiltrating our financial system”. That is an excellent idea and he followed up on his statement by releasing his organisation’s new action plan to “further strengthen the EU’s fight against money laundering and terrorist financing”. What are the chances the Commission’s AML Action Plan will achieve its ambitious targets? Let’s take a look.

The next installment in an ongoing saga

Anti-Money Laundering is one of the busiest areas of legislative efforts in the European Union. In January this year the 5th installment of the EU’s Money Laundering Directive became applicable across the Union’s member states. It extended the scope of its rules significantly: they now cover people doing similar works to auditors and accounts or traders in goods that require payment of €10,000 and more like dealers in work of art or estate agents acting as intermediaries. It captures parts of the infamous cryptocurrency world like exchanges and wallet providers. It lowered the thresholds for electronic money and prepaid instruments and it raises the bar in terms of Enhanced Customer Due Diligence measures for high-risk third countries. It is a pretty significant episode in this long saga of AML rules, but the next chapter has already been written. The 6th EU Money Laundering Directive has already been published eighteen months ago and member states have only until 3 December 2020 to transpose it into national law.

Then there is the consultation on revised guidelines on money laundering and terrorist financing risk factors of the European Banking Authority (EBA) and that it wouldn’t be the last of AML relevant documents was clear to anyone who had read the Commission’s Work Programme for 2020. If you read carefully you will find a paragraph where it says that “to ensure the integrity of the European financial system and reduce the risks of instability, a new Action Plan on Anti-Money Laundering will seek to improve the supervisory system and improve the enforcement of the rules“. Sounds familiar now, doesn’t it?

An uphill struggle

It has long been clear that the EC’s efforts weren’t enough to stop crooks abuse the financial system. Money Laundering is the continuous story of criminals finding new ways to launder illicit funds and these people are inventive. They seem to constantly come up with new ways, take advantage of innovation and the guardians of the law face a constant race to catch up with them. Take the case of cryptocurrencies: In 2017, a U.S. court convicted the operator of a digital currency exchange, which was allegedly used to launder more than $4 billion for people involved in crimes ranging from computer hacking to drug trafficking. It’s one high profile case and not all money launderers might be equally successful (at least initially), but it gives us an idea of how cryptocurrencies are used for money laundering and terrorism financing and the levels it reaches.

What is it then that the Commission proposes to create a stronger system of defense and enforcement?

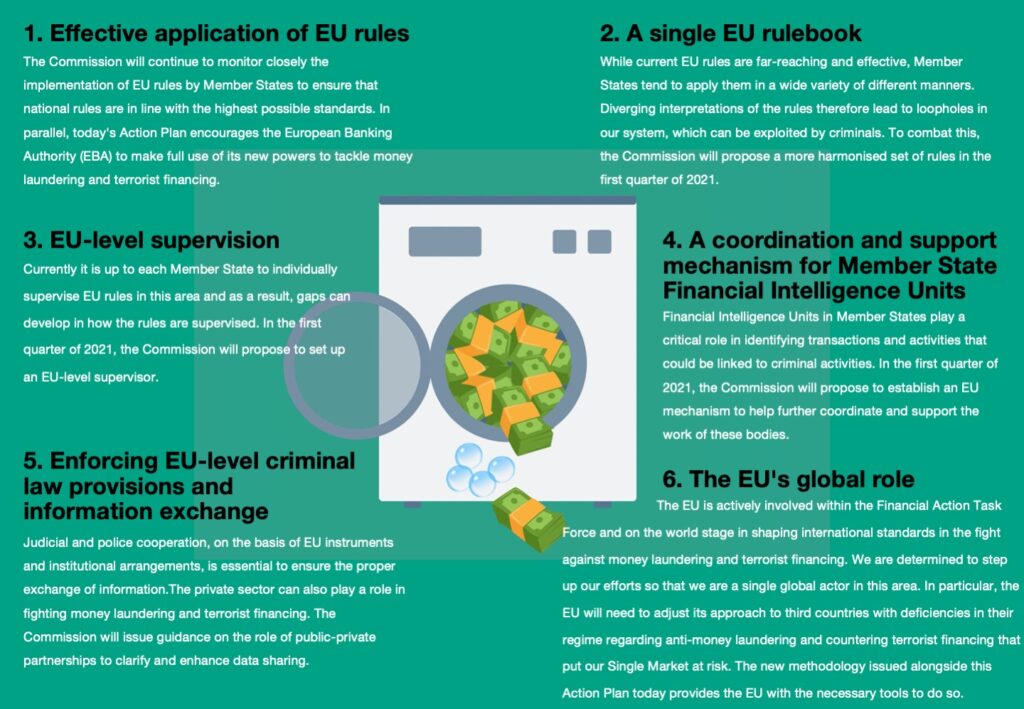

Well, the actual Action Plan is built on six pillars and each of them aims at improving the EU’s overall fight against money laundering and terrorist financing. At the same time, it is supposed to strengthen the EU’s global role in this area, harmonise EU rules and make them more effective as well as better supervised. And lastly, create better coordination between Member State authorities. The six pillars are:

Is the Commission AML Action Plan going to work though?

That, of course, is difficult to say and only time will pass a verdict on the Commission’s latest plan. It is certainly going to help and improve the existing structure. Take the Single EU Rulebook: harmonization of the rules is desperately needed in certain areas of AML regulation, for example, the framework for the eKYC process is incredibly fragmented across the 27 member states with no two jurisdictions being the same and different requirements from country to country. A harmonized framework with common standards would provide immediate relief for the FinTech sector that is heavily impacted by these rules.

At the same time, while financial regulation experts sometimes say that the EU is not seeking enough the dialogue with other jurisdictions, that cannot be said about the fight against money laundering and terrorism financing, at least if measured by the initiatives and communications with other governments and organisations.

The communication points to the EU’s work with the FATF, but the question is whether these efforts produce results that are effective and fast enough. Looking again at the example of cryptocurrencies and their use for laundering illicit funds, regulators have taken too long to respond to the threat, which resulted in major damage to the financial system and strengthened the position of drug lords and other criminals.

EU-level supervision and enforcement is another area that certainly needs solidification. Fines for AML deficiencies, sanctions violations and the like make up a large chunk of the enormous pile of compliance fines that have been handed out in the last decade. This is both evidence that there is strong demand for supervision – i.e. there is a constant flow of news regarding the shortcomings of financial institutions in this area – and enforcement in the sense that more needs to be done to drive down these failings.

Yet, will the Commission AML Action Plan work in that regard? Time will tell and the capabilities of crooks to find new ways to clean up their dirty money should never be underestimated. Still, it looks like a step in the right direction, but eventually we will have to wait and see whether it isn’t just an ambitious plan.