Last week the Attorney General of the State of New York published a report about the integrity of several Cryptocurrency exchanges and the results weren’t very pretty. The report listed of a number of shortcomings in terms of internal controls against market abuse, conflicts of interest and customer protections. Some of the exchanges criticised the report heavily and sparked a war of words. Still the quarrel continues and regardless the side you’re taking, the report highlights some fundamental issues that go beyond the State of NY and affect the entire crypto industry.

When the Attorney General of the State of New York last week announced the results of the Virtual Markets Integrity Initiative, it kicked off a war of words with the cryptocurrency exchanges that have been subject to the Attorney General’s accusations of serious shortcomings. Described as a fact-finding inquiry into the policies and practices of platforms used by consumers to trade virtual or “crypto” currencies like bitcoin and ether, the report stressed several significant deficiencies in the setup and internal controls of these exchanges.

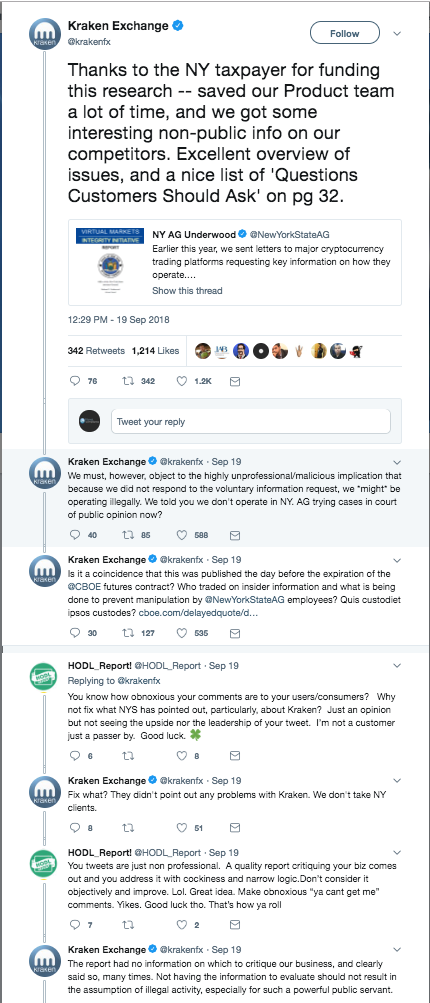

The dispute is still ongoing and at times seems to take a turn to the surreal if you read some of the comments in social media and industry forums. Beyond the arguments brought forward by both sides, there is an element that cannot be ignored and that indeed affects the integrity of the entire cryptocurrency. It ought to be dealt with before it becomes the subject of a massive scandal and as a result of such, but let’s not jump the gun and take one step after another.

What happened in New York?

BitLicence

The state of New York has been an interesting case for the crypto industry for a while. In 2015 it launched rules for virtual currency business activityas one of the first regulators trying to create a regulatory framework, which is commonly referred to as BitLicence and targeting also the performance of exchange services as a customer business. As a result a number of crypto start-ups including the Kraken exchange decided to close shop in NY State when it came into force and as of today only nine companies have been awarded a licence.

13 letters

Fast forward to April 2018 when the Attorney General’s office sent letters to thirteen major virtual currency trading platforms requesting key information on their operations, internal controls, and safeguards to protect customer assets. The letter was divided into eight sections consisting of 34 questions or requests to disclose information on six major topics, including (1) Ownership and Control, (2) Basic Operation and Fees, (3) Trading Policies and Procedures, (4) Outages and Other Suspensions of Trading, (5) Internal Controls, and (6) Privacy and Money Laundering. The Attorney General emphasised that it had in particular asked the platforms to describe their approach to combating suspicious trading and market manipulation; their policies on the operation of bots; their limitations on the use of and access to non-public trading information; and safeguards to protect customer funds from theft, fraud, and other risks. The virtual currency trading platforms that were sent the letter were: (1) Coinbase, Inc. (GDAX); (2) Gemini Trust Company; (3) bitFlyer USA, Inc.; (4) iFinex Inc. (Bitfinex); (5) Bitstamp USA Inc.; (6) Payward, Inc. (Kraken); (7) Bittrex, Inc.; (8) Circle Internet Financial Limited (Poloniex LLC); (9) Binance Limited; (10) Elite Way Developments LLP (Tidex.com); (11) Gate Technology Incorporated (Gate.io); (12) itBit Trust Company; and (13) Huobi Global Limited (Huobi.Pro).

While nine exchanges responded to the questionnaire and participated in the initiative, four didn’t as they claimed that they don’t allow trading from NY: Binance, Gate.io, Huobi and Kraken.

The outcome

The results of the report can be summarised into three key findings:

1. The Various Business Lines and Operational Roles of Trading Platforms Create Potential Conflicts of Interest.

Virtual asset trading platforms often engage in several lines of business that would be restricted or carefully monitored in a traditional trading environment. Platforms often serve (i) as venues of exchange, operating the platform on which buyers and sellers trade virtual and fiat currencies; (ii) in a role akin to a traditional broker-dealer, representing traders and executing trades on their behalf; (iii) as money-transmitters, transferring virtual and fiat currency and converting it from one form to another; (iv) as proprietary traders, buying and selling virtual currency for their own accounts, often on their own platforms; (v) as owners of large virtual currency holdings; and, in some cases, (vi) as issuers of a virtual currency listed on their own and other platforms, with a direct stake in its performance. Additionally, platform employees – who may have access to information about customer orders, new currency listings, and other nonpublic information – often hold virtual currency and trade on their own or competing platforms. Each role has a markedly different set of incentives, introducing substantial potential for conflicts between the interests of the platform, platform insiders, and platform customers.

2. Trading Platforms Have Yet to Implement Serious Efforts to Impede Abusive Trading Activity.

Though some virtual currency platforms have taken steps to police the fairness of their platforms and safeguard the integrity of their exchange, others have not. Platforms lack robust real-time and historical market surveillance capabilities, like those found in traditional trading venues, to identify and stop suspicious trading patterns. There is no mechanism for analyzing suspicious trading strategies across multiple platforms. Few platforms seriously restrict or even monitor the operation of “bots” or automated algorithmic trading on their venues. Indeed, certain trading platforms deny any responsibility for stopping traders from artificially affecting prices. Those factors, coupled with the concentration of virtual currency in the hands of a relatively small number of major traders, leave the platforms highly susceptible to abuse. Only a small number of platforms have taken meaningful steps to lessen those risks.

3. Protections for Customer Funds Are Often Limited or Illusory.

Generally accepted methods for auditing virtual assets do not exist, and trading platforms lack a consistent and transparent approach to independently auditing the virtual currency purportedly in their possession; several do not claim to do any independent auditing of their virtual currency holdings at all. That makes it difficult or impossible to confirm whether platforms are responsibly holding their customers’ virtual assets as claimed. Customers are highly exposed in the event of a hack or unauthorized withdrawal. While domestic or foreign deposit insurance may compensate customers for certain losses of stolen or misappropriated fiat currency, no similar compensation is available for virtual currency losses. There are serious questions about the scope and sufficiency of the commercial insurance that certain platforms purport to carry to cover virtual asset losses. Other platforms do not insure against virtual asset losses at all.

Together with the publication of the report, the Attorney General’s office also announced that it had referred three platforms – Binance, Gate.io, and Kraken – to the New York State Department of Financial Services for possibly operating unlawfully in New York.

The Fallout

The bigger picture

The bickering disregards that there seems to be some truth in the findings of the Attorney General’s report.

While it doesn’t accuse the exchanges of market abuse, the report underlines that the different platforms have yet to implement serious efforts to monitor and stop abusive or manipulative trading. There seems to be a general lack of monitoring activity within the industry that is normality for traditional trading platforms in other asset classes. The report also finds that there is a significant distortion towards professional, automated traders as opposed to retail customers, creating obvious advantages for those in exchanges for fees.

What makes matters worse is that the report’s conclusions are based on the information voluntarily provided by the exchanges, which leads to the assumption that the platforms itself do not consider this troublesome. This is underlined by a comment made by the CEO of Binance in light of the publication of the report:

It is alarming that the CEO of one of the world’s biggest crypto exchanges believes that the appropriate response to apparent wrongdoing is to that the other kids are worse. This view also fosters a worrying culture of conflicts of interest, which the report highlighted: While Coinbase insisted that it wasn’t one of the firms conducting proprietary trading, others did and account for a significant amount of total volumes, which gives a wrong impression of liquidity and could put traders at risk of illiquidity during times of price movement. Furthermore, various platforms allow their own employees to trade on their venue with differing efforts to ensure that those employees do not use non-public information to gain an advantage over other traders.

The insider trading allegations of Bitcoin Cash (BCH) on Coinbase in December last year are a perfect example for this problem: Prior to the launch of BCH trading on Coinbase and its pro-platform GDAX, its employees or people close to the company allegedly used the knowledge of the upcoming launch to buy Bitcoin Cash on other exchanges believing that this would drive the value up – as it did in the end. The story is currently subject of a class action lawsuit though Coinbase shared some information on the company’s internal trading and confidentiality policies following the incident that emphasized that a trading policy had been in place for some time at the company and that the policy prohibits employees and contractors from trading on “material non-public information”, such as when a new asset will be added to the platform. Its CEO made it also clear that “in addition to trading restrictions, it prohibits communication of material non-public information outside the company”, which includes friends and family. Armstrong also stressed that in the run-up of the announcement all Coinbase employees and contractors were explicitly prohibited from trading Bitcoin Cash and from disclosing the launch plans over a month ago with the trading restriction still in place. The internal investigation that was conducted by two U.S. law firms concluded that there’s no evidence of insider trading by the company’s employees. Considering that the announcement drove the value of Bitcoin Cash to an all-time of over $3,600, which was more than double than previous prices and seven times worth what is now, it is somewhat fishy though.

In addition to this, the report also pointed out that a few platforms issue their own virtual currencies or accept compensation in exchange for listing a virtual asset to trade, often without objective standards for listing particular virtual currencies, leaving serious questions about the elevation of particular virtual currencies over others on certain venues. Without proper controls the value of investing in an exchange’s token is put into serious doubt in the truest meaning of the word.

Again, the entire information used for the report and to come to this conclusion was provided by the exchanges, which points to a general lack of understanding of the issue.

If you go to the websites of Kraken, Binance or Gate.io, you will find it difficult to find a conflicts of interest policy like you would find on traditional exchanges and since they do not adhere to the same regulations, they don’t have to. It raises the questions though about potential conflicts of interest and how they are addressed amongst virtual currency exchanges.

If cryptocurrency exchanges really want to establish themselves as a serious alternative in global financial markets rather than being perceived loose cannons operating in a Wild West environment, they will have to get serious about establishing minimum standards that live up to what can be expected in terms of investor protection. Only then will cryptocurrencies be able to fulfil their potential but juvenile reactions in response to the discovery of noteworthy shortcomings show that influential members of the community have not realised this yet.